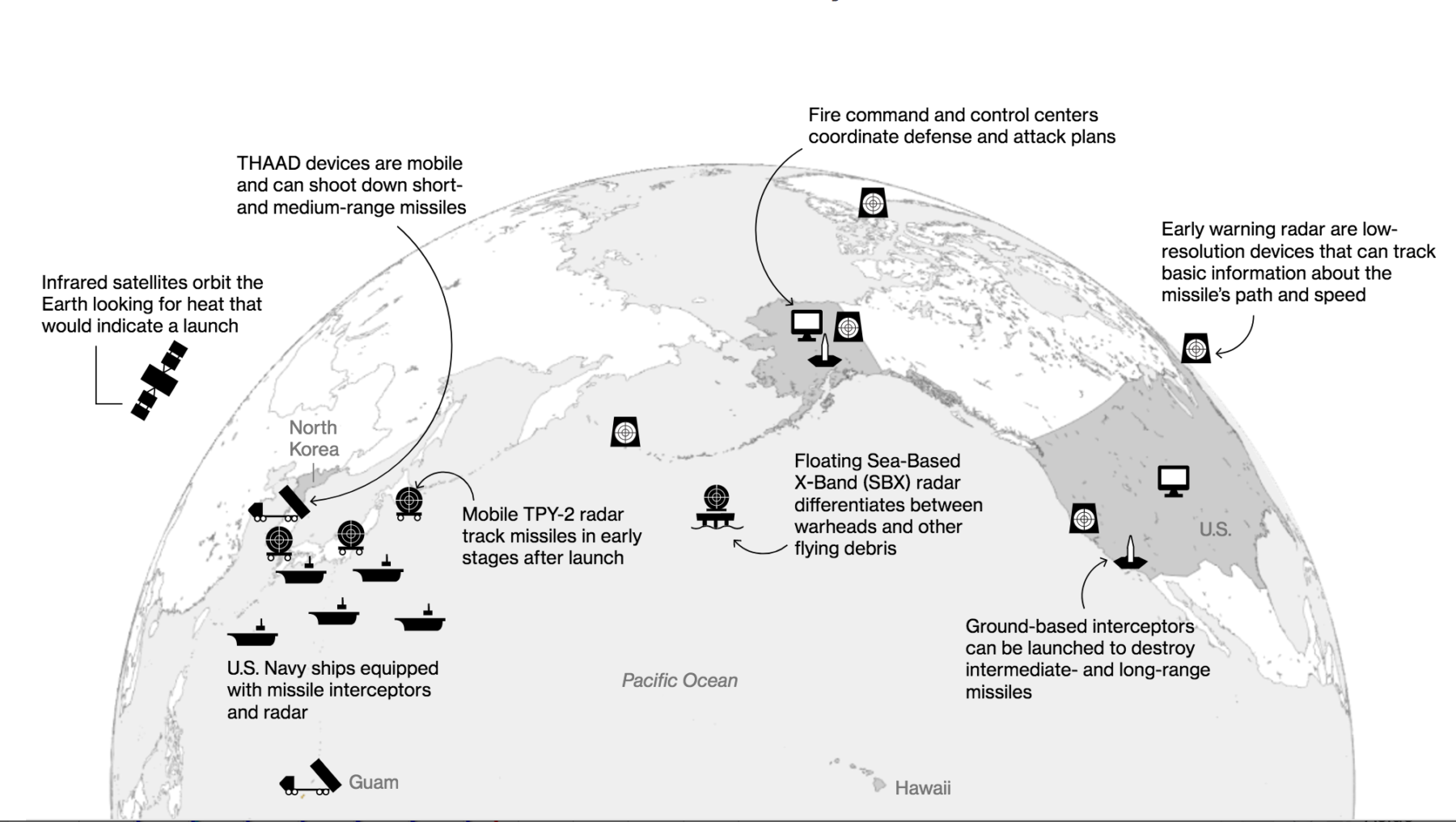

Source: Bloomberg

The question of how to invest under the threat of nuclear war keeps coming up from clients, the media, and others.

Thinking about investing around an unthinkable outcome is quite a challenge: Do you consider Defense names (big inflows after), Infrastructure engineering firms (big needs following), manufacturers or sellers (CVS, Amazon, etc.) of potassium iodide (preventative)? None of those are remotely satisfying. Then there is the usual Gold; Volatility Calls; S&P 500 Puts, etc.

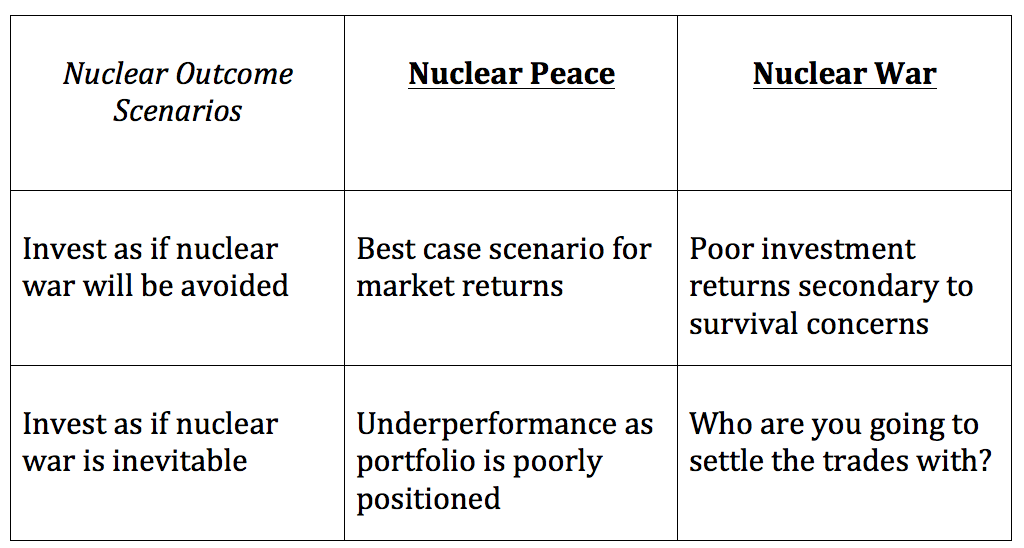

The actual short answer is somewhat counter-intuitive: Ignore the possibility of nuclear war. Don’t pretend it doesn’t exist, but consider various outcomes if you are right and if you are wrong in each outcome/posture combo in the matrix below:

Various Nuclear Scenario Outcomes

Source: Ritholtz Wealth Management

Its astounding that this is even a thing in 2017, decades after the fall of the Soviet Union and the rise of greatly improving global cooperation.

The best approach is to assume there will be no apocalypse; the longer answer is detailed at If You Are Reading This, the World Has Not Ended.

Predicting the end of the world has always been a losing bet; on the off chance that one day, the bet pays off, the issue is what good will it do to have made that bet? Over dinner not too long ago, Art Cashin of UBS, who has a half century of NYSE floor experience, related the story of something that happened during the Cuban Missile Crisis:

“Everyone was on edge as the U.S. and Soviet Union approached the brink. One day, word began to spread that Russia had launched its nukes, which would arrive in 11 minutes. A trooper to the end, Cashin ran around the exchange floor trying to sell short, but was unable to do so. The 11 minutes passed, but nuclear annihilation never came. Soon after, Cashin reported to his boss. He told him what occurred, and was told that in the future, upon learning of the end of the world, the proper trade is to go long, not short.

He asked his boss, Why go long if the world is ending? “It never does end,” his boss told him, and even if it does, “who are you going to settle the trade with?”

There in lays the rub of trying to manage around a nuclear threats. There are no good outcomes, other than avoiding nuclear conflict.