Introductory Remarks by Governor Jerome H. Powell

The Federal Reserve Bank of New York November 02, 2017

At the Roundtable of the Alternative Reference Rates Committee NY Fed

Good morning. I am sorry that I am not able to be with you today at the FRBNY for this important meeting. I thought that I would begin by discussing the LIBOR related events that have brought us here, and then talk about the way forward.

LIBOR gained negative public attention when reports began to surface during the financial crisis that employees at some banks had attempted to manipulate the rate by altering the quotes they submitted for use in the calculation of LIBOR. A number of agencies, including the Commodity Futures Trading Commission (CFTC), the Department of Justice, and the U.K. Financial Conduct Authority (FCA), took the lead in investigating and prosecuting the cases of LIBOR manipulation that were uncovered. The Federal Reserve also joined in international efforts to strengthen LIBOR. Among other things, we joined the ICE Benchmark Administration’s (IBA’s) LIBOR Oversight Committee as an observer, and we also worked intensively with international authorities and IBA in developing and encouraging the reforms set out in IBA’s Roadmap for LIBOR.

But at the same time, as we and other authorities collected data on the transactions underlying banks’ submissions to LIBOR, we began to see that those transactions were relatively few and far between. As a result, many began to question whether LIBOR could be truly and permanently fixed. To be sure, much has been done to address the cases of attempted manipulation, and LIBOR has much stronger governance in place than it did before the crisis. The question instead was whether there were enough actual LIBOR transactions to form a stable basis for this critical rate.

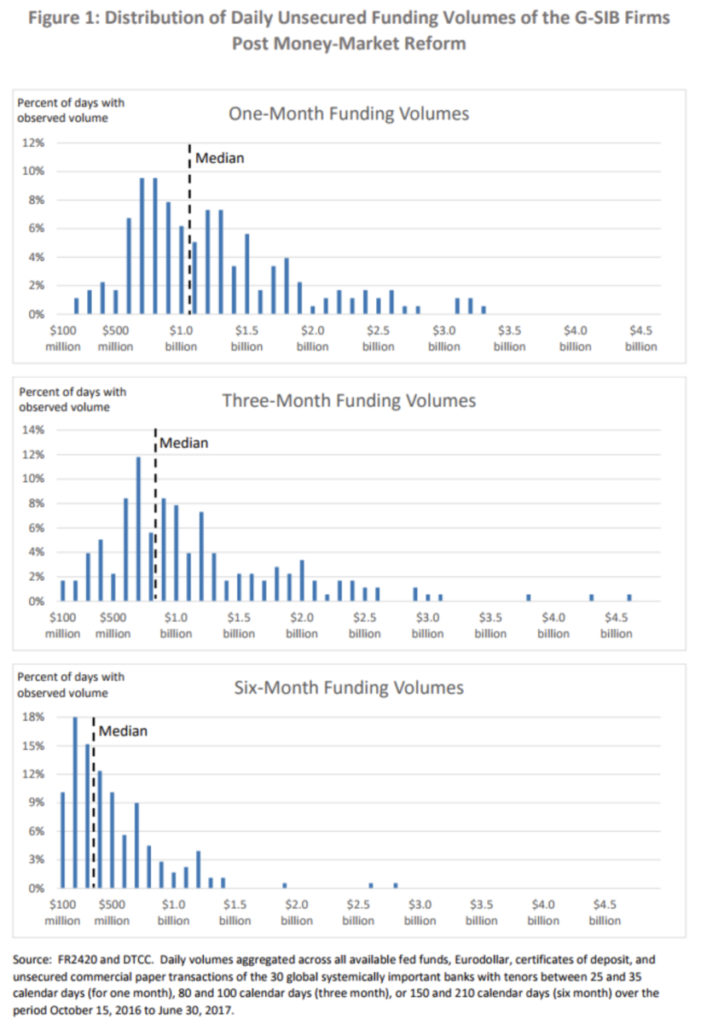

Since many of the pressures around LIBOR stem from the low level of underlying transactions, let me share some data regarding activity in U.S. dollar wholesale funding markets. Today, there are 17 banks that submit quotes in support of dollar LIBOR. Some have suggested requiring more banks to submit LIBOR data, but doing so would not materially improve the situation. The panels in Figure 1 show the distribution of daily aggregate wholesale dollar funding volumes for the 30 global systemically important banks (or GSIBs). The data here include all of the Eurodollar, federal funds, CD, and commercial paper transactions that the Federal Reserve has access to–the most complete picture of U.S. dollar unsecured funding that I am aware of. For one-month funding, shown in the top panel, the median daily volume of transactions by these banks since money-market reforms took effect last year was just over $1 billion. For three-month funding (the middle panel), the most heavily referenced LIBOR tenor, the median is less than $1 billion per day. On some days we see less than $100 million. If we compare this to the more than $100 trillion in outstanding volumes of U.S. dollar LIBOR contracts, it should be clear that the activity in this market is miniscule compared to the size of the contracts written on it.

In our view, it would not be feasible to produce a robust, transaction-based rate constructed from the activity in wholesale unsecured funding markets. A transactions-based rate from this market would be fairly easy to manipulate given such a thin level of activity, and the rate itself would likely be quite volatile. Thus, LIBOR seems consigned to rely primarily on some form of expert judgment rather than direct transactions.

As we discussed these issues with the officials in the United Kingdom who oversee and regulate LIBOR, we also became aware that they were receiving a steady stream of requests, and sometimes demands, from banks seeking to leave the LIBOR panels. The use of expert judgment in submissions allows LIBOR to be published every day, but many banks are now understandably uncomfortable with being asked to provide judgment about something that they do very little of. In his July speech, Andrew Bailey discussed the efforts of the FCA to keep these banks on the panels. Market participants should understand that the official sector has done everything it can to stabilize and strengthen LIBOR. Without the intervention of U.K. authorities, LIBOR would be in a weaker state today.

But that balancing act has grown increasingly difficult. As time has passed, some banks have grown more resistant to public-sector entreaties to remain on the panels. As you know, one bank left the U.S. dollar panel last year. At the same time, we have had to confront the fact that, if banks could not be persuaded to voluntarily remain on panels, then the legal powers to compel them to do so were limited. Under European Union benchmark regulations, which LIBOR will soon be subject to, authorities can only compel submissions to a critical benchmark for a period of two years. Given this time limit, brokering a voluntary agreement with the submitting banks to stay on for a longer period was the last, best choice that authorities had available to guarantee some further period of stability for LIBOR. CFTC Chairman Chris Giancarlo and I have publicly supported the FCA’s efforts to secure an agreement with the submitting banks to stay on through the end of 2021, and we have encouraged the U.S. banks that submit to LIBOR to cooperate with FCA’s effort.

Of course, LIBOR may remain viable well past 2021, but we do not think that market participants can safely assume that it will. Users of LIBOR must now take in to account the risk that it may not always be published. While the public’s understanding of this risk has increased significantly since Andrew Bailey’s speech, the official sector has been concerned about it for some years, as reflected for example in our public comments and in the annual reports of the Financial Stability Oversight Council. Given our understanding of the risks to LIBOR, the Federal Reserve convened the Alternative Reference Rates Committee (or ARRC) in 2014 in cooperation with the Treasury Department and CFTC. Consistent with recommendations from the Financial Stability Board (FSB), we charged the ARRC with identifying a robust alternative to U.S. dollar LIBOR and with developing a plan to encourage its use in some derivatives and other transactions as appropriate.

The ARRC has accomplished the things that we asked of it. I want to thank the members for their work and also to extend my special thanks to Sandie O’Connor as the chair of the ARRC. Sandie will discuss the ARRC’s work shortly, but I’ll make a few points.

First, I’d note that, like most market participants, the ARRC members initially had a difficult time conceiving of any kind of transition from LIBOR. As is the case for all of you, a transition will be a complicated task for the broker-dealers and other members of the ARRC, and will involve significant costs. Over time, however, I think the ARRC members have developed a greater understanding of the risks to LIBOR and now see that, despite those complications and costs, a transition may prove necessary. I also think that, having had time to consider the transition plans that Sandie will talk about, ARRC members have become more comfortable with the idea that a transition is feasible, even if the necessity of achieving it is regrettable.

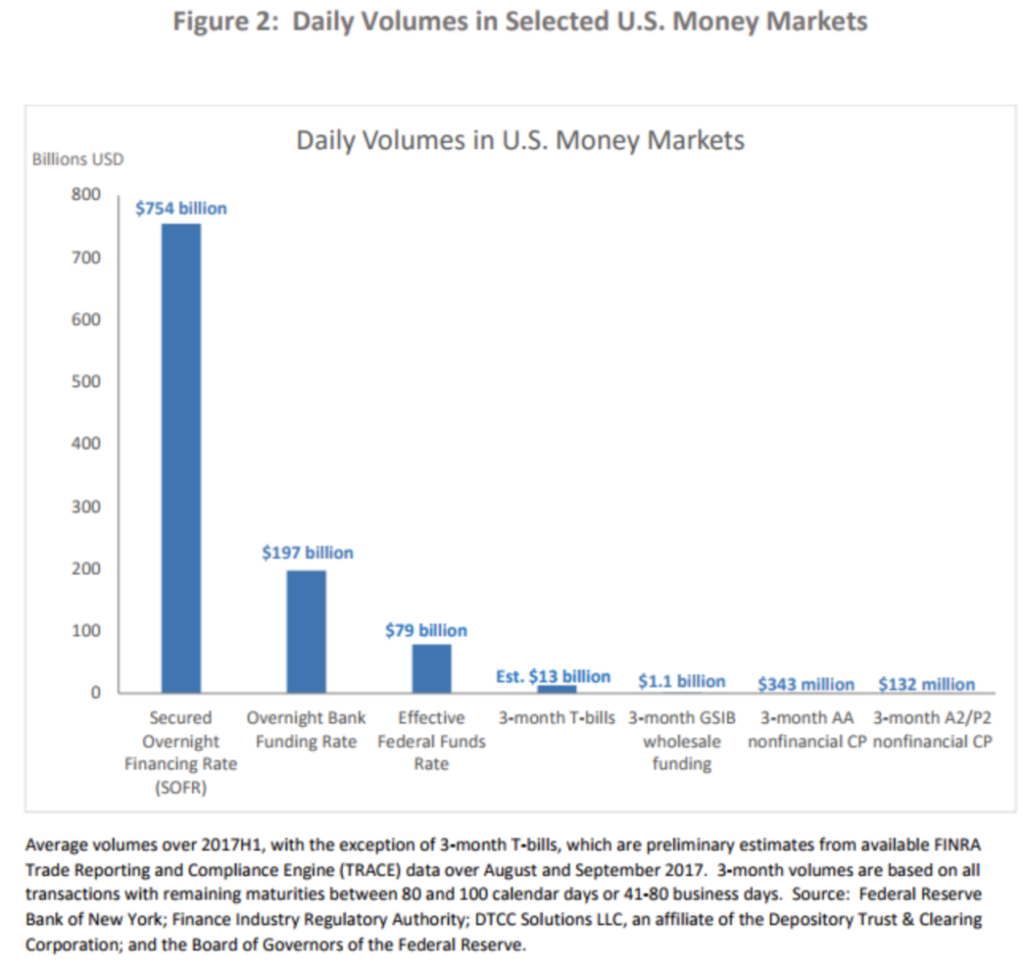

Second, it is clear that any rate the ARRC selected as a potential alternative needed to be highly robust. There would be no point in selecting a rate that might find itself quickly in the same kinds of conditions that LIBOR is in now. In our view, the ARRC has chosen the most robust rate available. In general, only overnight unsecured or secured funding markets appeared to have enough underlying transactions to produce a robust rate. The overnight Treasury repo market is the largest and most active market in any tenor of U.S. rates markets. Figure 2 illustrates the point: the transactions underlying the Secured Overnight Financing Rate (SOFR), at about $700 billion per day or more, are much larger than the volumes in overnight unsecured markets, even much larger than estimates of the volume in Treasury bills, and they dwarf the volumes in other term markets. The alternative reference rate needs to be able to stand the weight of having trillions of dollars written on it, and the ARRC has definitely met this standard in choosing SOFR.

Third, we charged the ARRC with devising plans for a voluntary transition that encouraged the use of their recommended rate where appropriate. We have never told anyone that they cannot use LIBOR. The ARRC did consider whether other cash products could move from LIBOR to the rates it evaluated, but their paced transition plan has focused on derivatives because that is where the largest gross exposures to LIBOR are, and because it may be easier for many derivatives transactions to move away from LIBOR to a new rate.

Now, however, market participants have realized that they may need to more seriously consider transitioning other products away from LIBOR, and the ARRC has expanded its work to help ensure that this can be done in a coordinated way that avoids unnecessary disruptions. Sandie will discuss plans to eventually create a term reference rate, which may help to smooth any transition. That term reference rate would have to be built by first developing futures and OIS markets that reference SOFR. It will likely never be as robust as SOFR itself, and so derivatives transactions will almost certainly need to be based on the overnight rate, but a term reference rate could conceivably be used in some loan or other contracts that currently reference LIBOR.

All of the work that we will talk about today will help, but we have to acknowledge that the transition will be complicated. Unfortunately, as I have discussed, we cannot guarantee that it won’t be necessary. The most complicated aspects involve the legacy contracts that reference LIBOR, many of which do not have strong language in place if LIBOR were to stop publication. The FSB has been working with the International Swaps and Derivatives Association (or ISDA) to devise better language for derivatives, and ISDA’s Scott O’Malia and Katherine Tew Darras will discuss that work later this morning. As people now consider the risks around LIBOR for other types of contracts, they will need to go through their documentation to understand what the fallback language is and how it can be improved. We will also discuss those issues today. This is important work, both for the parties to these contracts and for our financial stability. While there may be no perfect contract language or fallback, good risk management requires that we work together to find language and fallbacks that are robust and that limit unintended valuation changes.

So, while much work has been done, there is more still to do. I have been heartened in seeing that many market participants are already confronting these issues. For some, Andrew Bailey’s speech was a difficult wake-up call. But the efforts we have undertaken with the ARRC show what is possible when the official sector works collectively with market participants. If market participants are willing to continue to work together, then we can safely achieve the transitions needed to create a better and more robust system that will help to ensure our ongoing financial stability.