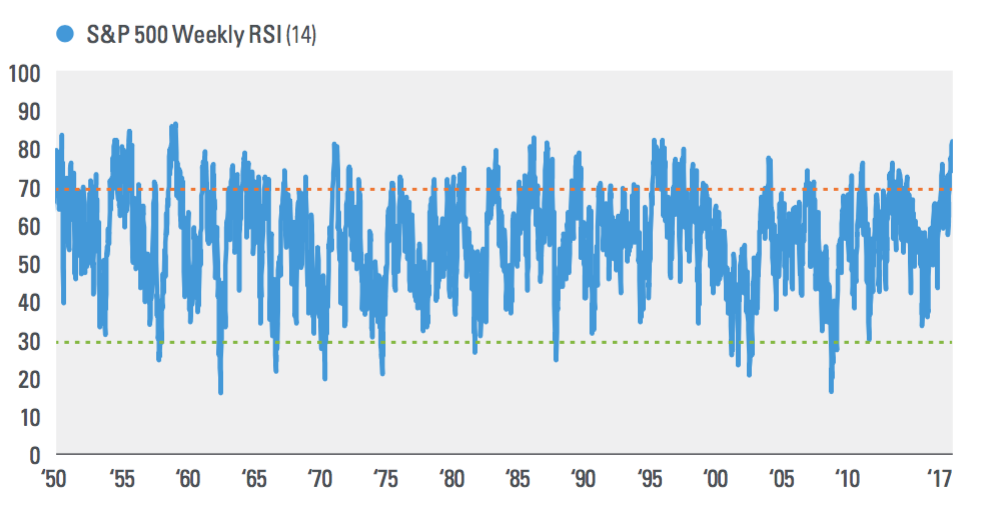

Interesting chart from John Lynch Chief Investment Strategist and Ryan Detrick, CMT Senior Market Strategist, LPL Financial discussing why overbought markets can actually be bullish. Indeed, they remind us of an old trading aphorism the most bullish thing a market can do is get overbought and stay that way.

But, they also back it up wth some data: “Sure enough, when the S&P 500 weekly RSI has gotten over the historically super overbought level of 80 (like recently), the returns have been better over the longer term.”

Here is the RSI chart:

THE S&P 500 IS THE MOST OVERBOUGHT IN 22 YEARS

Source: LPL Research, Bloomberg

And the S&P500 subsequent market performance to being overbought

BEING OVERBOUGHT ISN’T A BAD THING

Source: LPL Research, Bloomberg