Very interesting article in the WSJ about Vanguard’s new CEO, Tim Buckley:

Vanguard’s new chief executive has a challenge his three predecessors didn’t: How to how to grow a firm that is already the world’s second largest investment manager.

When Tim Buckley started at Vanguard in 1991, the firm managed $77 billion and attracted $15 billion in new cash that year. It had 2,600 employees in one Malvern, Pa. office and was trying to grow with an unusual ownership structure—it is owned by its customers—and ultralow fees.

More than two decades later, the firm now has $5 trillion in assets under management and 17,000 employees across 18 offices. It is the largest U.S. mutual fund and exchange-traded fund provider by assets and the second largest money manager in the world after BlackRock . . . Mr. Buckley’s challenge will be to balance investments in technology to improve the customer experience and grow assets with expense controls that keep fund fees low.

Vanguard has largely built itself by offering some of the lowest-cost funds in the asset management industry. Today, that success means rivals are increasingly trying to match or best the firm on fees to nab assets.

Fascinating stuff — go check out the full column.

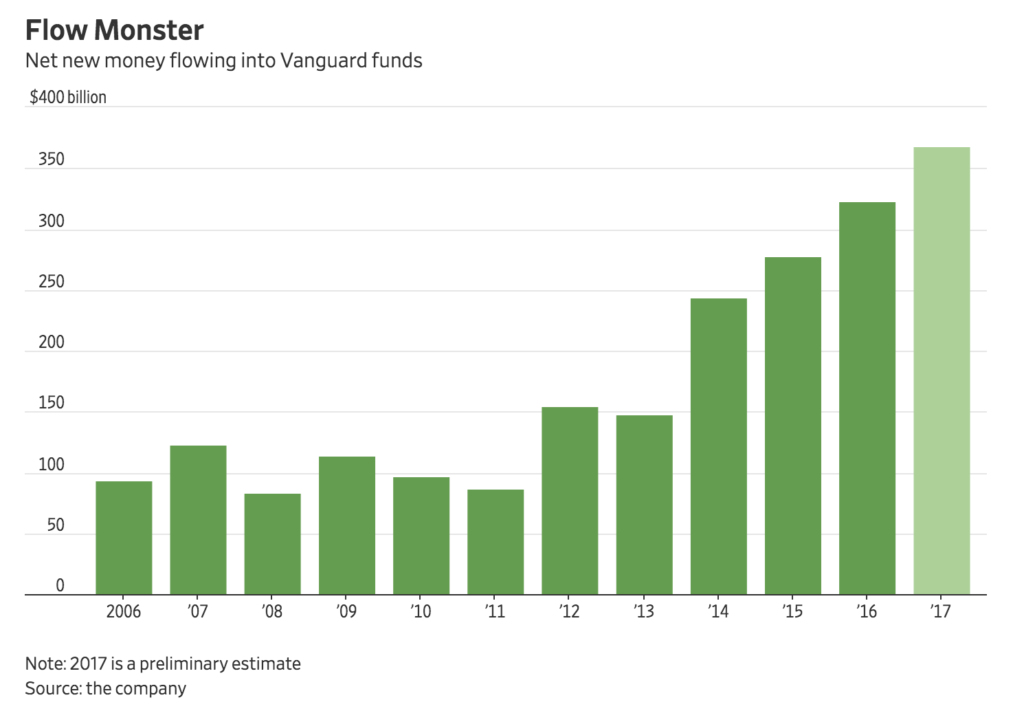

Money flowing into Vanguard’s mutual and exchange-traded funds is envy of industry

Source: WSJ

Previously:

Vanguard’s Tim Buckley: The Complete Interview (August 1, 2017)

Source:

The Challenge for Vanguard’s New CEO: Keep a Behemoth Growing

Sarah Krouse

WSJ, Jan. 4, 2018

http://on.wsj.com/2lTnuZz