@TBPInvictus here:

What inning are we in in this economic cycle? Sixth? Eighth? Are we going to go into extra innings? This parlor game consumes an inordinate amount of time among those of us who try to divine business cycles (a hobby for me, not a profession).

Herewith a few indicators.

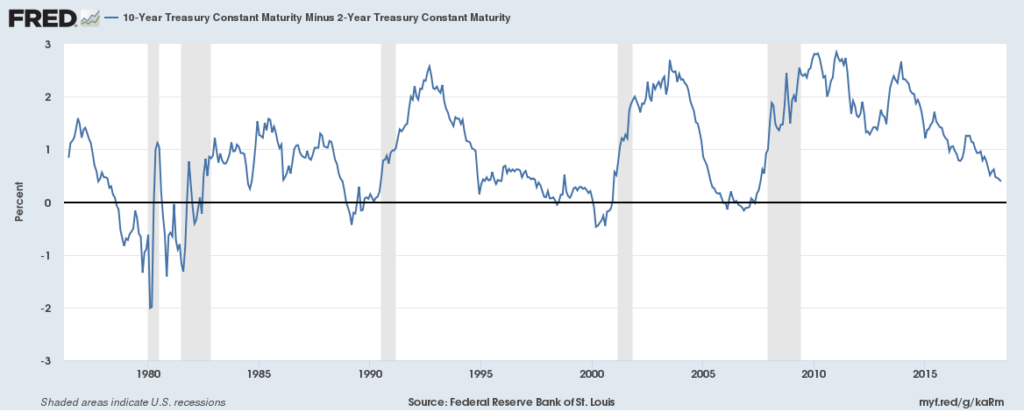

First up, the tried and true yield curve – the 2/10 treasury spread. Invert the yield curve and recession is sure to follow. We’re not there yet, but the spread has been narrowing for quite some time and we’re getting close. We’re at about 40bps currently, give or take.

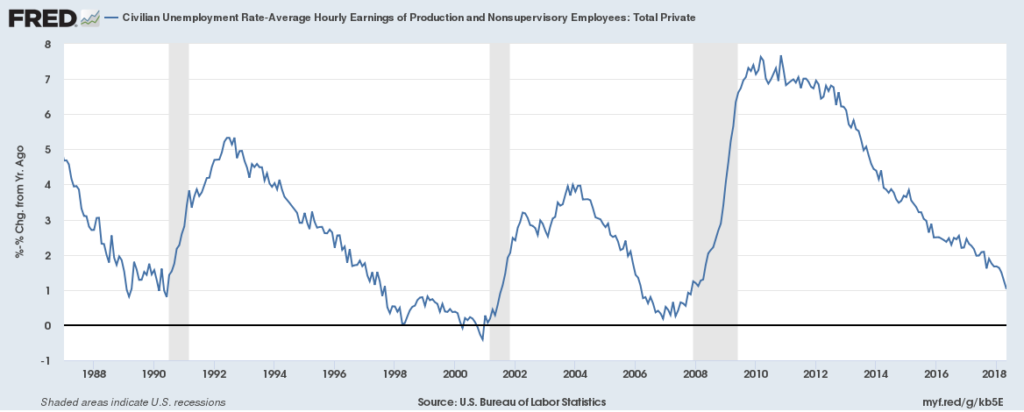

Next up, a somewhat unique look at the labor market and earnings in one chart, courtesy of yours truly with a nifty homemade chart.

When the unemployment rate drops and the labor market tightens, wages should – and typically do – rise. That process has been slightly off in this cycle (wages have not accelerated as much or as quickly as might have been expected), which remains a puzzle or mystery (whichever you’d like to call it).

What we see below is the Unemployment Rate minus the Year-Over-Year Percent Change in Average Hourly Earnings. What’s clear is that when this metric troughs, a recession soon follows. While the trough was very near or just under zero in the previous two recessions, it was around 1 prior to the 1990 recession, and we’re in that vicinity now, though no telling if the next move will be higher or lower. I’d also note the false alarm in 1998, short-lived though it was. Any way you slice it, this metric is likely getting close to being a yellow flag.

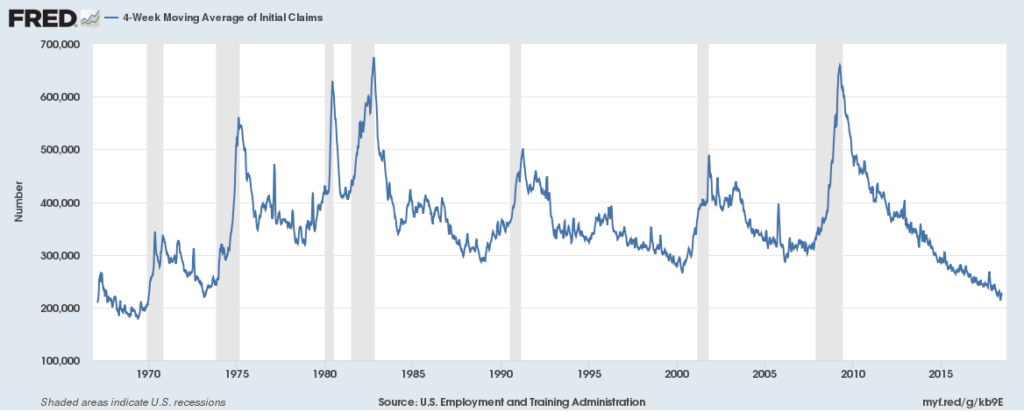

Below is a very simple, straightforward variant, a subset, of unemployment – those unemployed for 15 weeks and over. The “15 weeks and over” provides some early warning, which is why I prefer it. When this level troughs and starts to lift, a recession is in the offing, and the record here is damn near spotless, with few head fakes.

Some favorites from Twitter:

Bottom line: There’s nothing visible in any of the data I follow closely that suggests the next recession is staring us in the face. That said, there are enough signs out there to suggest it could be a late ’19 or 2020 eventuality. Other factors, though, like what appears to be an escalating trade war situation with many allies, could easily change our trajectory. Stay tuned.