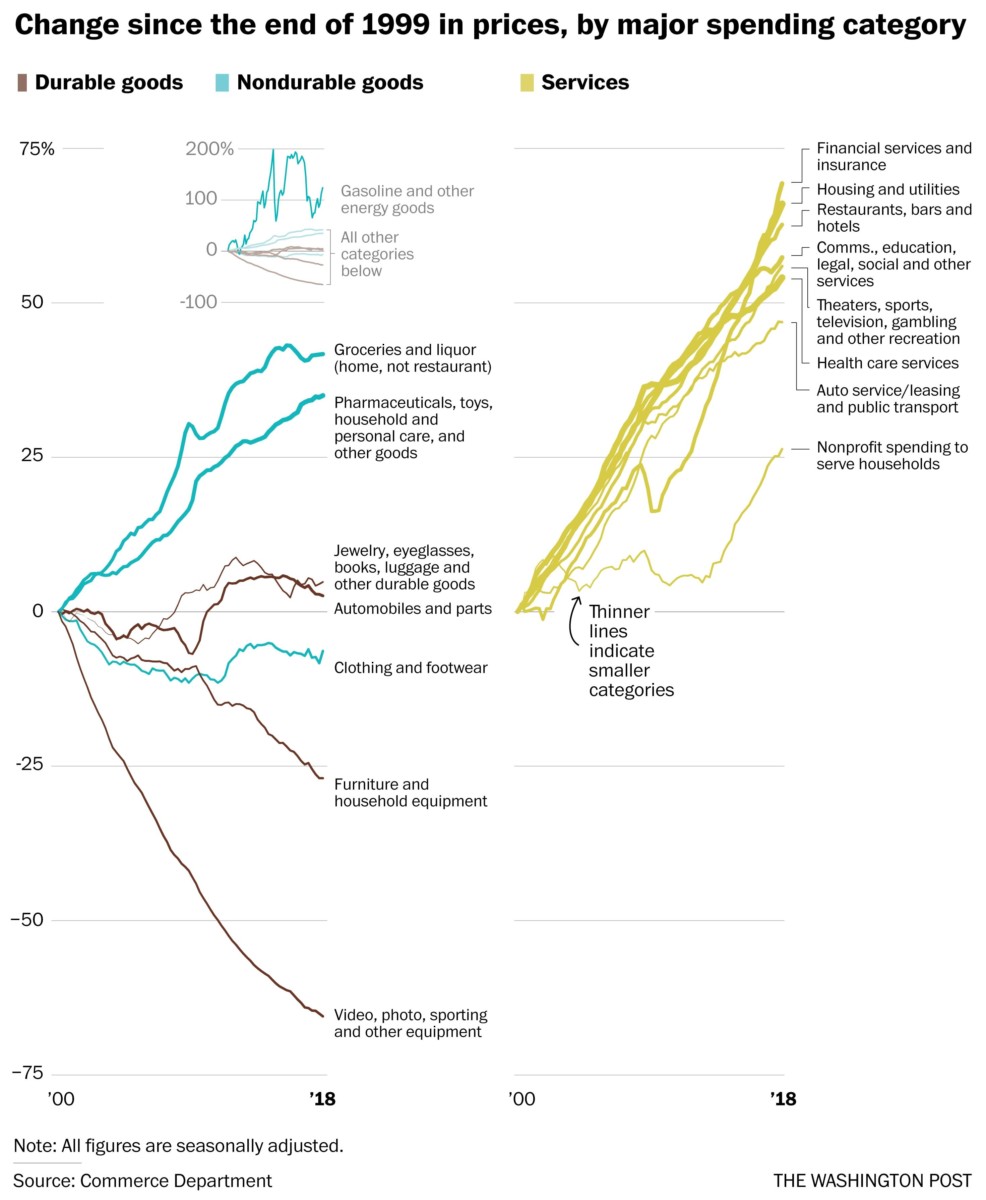

Short answer, according to WaPo: hit harder than people think it will:

“These categories show a similar trend. Most durable goods (brown lines) have become cheaper since the end of 1999. Durable goods are typically used for three years or more, such as furniture, cameras and automobiles. As a category, they are more likely to be traded across borders — and thus the most likely to get pricier should a trade war escalate.

Some nondurable goods (teal lines), such as toys and clothing, are also easy to manufacture cheaply abroad and ship to the U.S. It’s no coincidence that they are among those with the lowest price increases.

Most services (red lines), such as restaurants and health care, are challenging to import and haven’t seen the type of competition that would keep prices low.

We can also go one step farther and calculate just how much each category has contributed to the annual inflation rates watched by the Fed. Durable goods — many of them cheap imports — have been the only category that helped slow price growth. There are a few exceptions, such as the periods in 2009 and 2015–2016 when volatile oil prices sent the prices of nondurables into free-fall.”

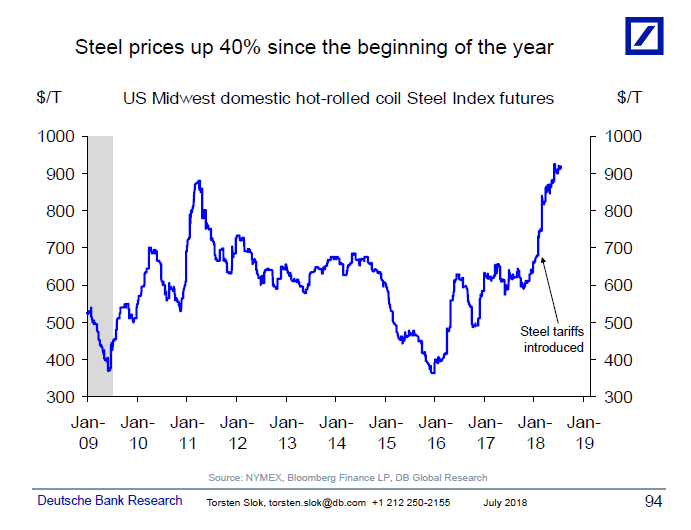

This chart shows that the tariffs are starting to bite . . .

See the full column for the details . . .

Source: Washington Post

Steel prices have gone up after the trade war broke out

Source: Torsten Sløk, Deutsche Bank Securities