Source: New York Times

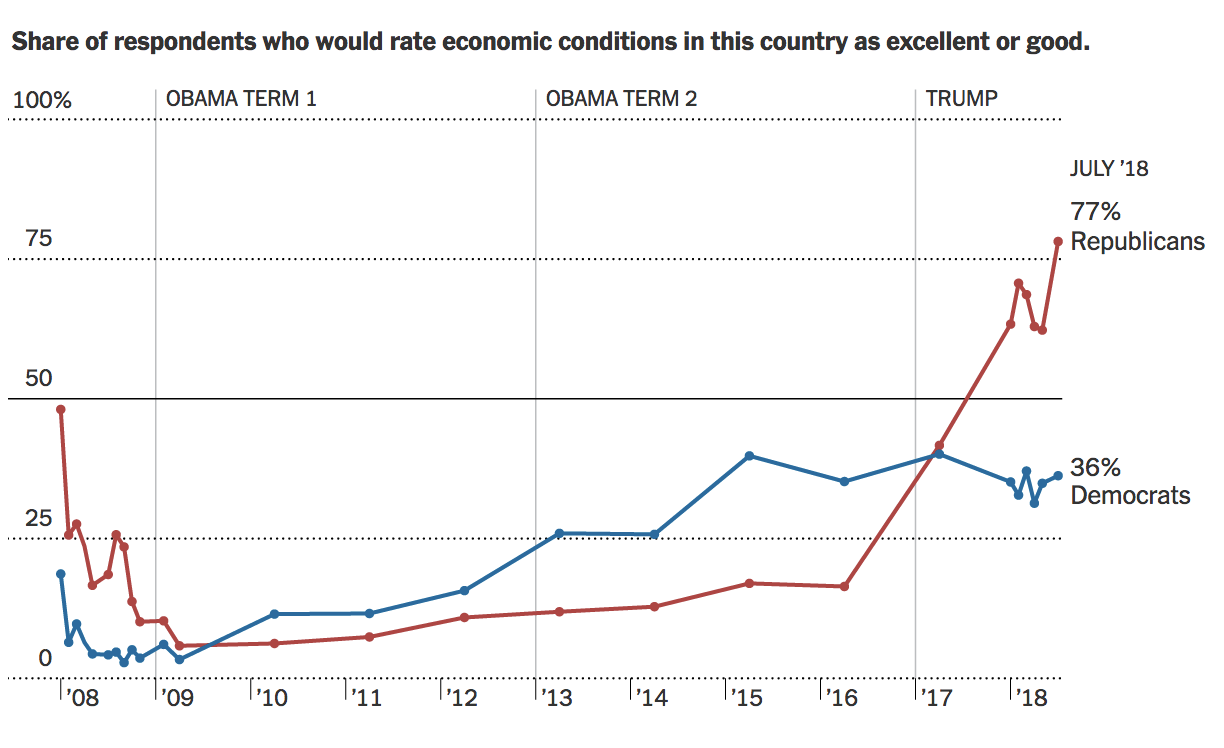

Surprise! Partisan politics confuses some peoples’ ability to make objective assessments of economic data:

“Americans’ perceptions of the economy’s prospects increasingly depend more on their political identity than statistics on output or stock markets. “

Is it a cognitive issue? Of course! Salesmanship? Maybe. Bias? Definitely. But why else would the change in POTUS affect anyone’s impression of the economy improving? Is it more likely forward expectations or tribalism?

Truth be told, it really does not matter.

What does matter is this simple bottom line: your biases affect how you see the world, which in turn affects how you think about, well, everything: politics, money, the economy, and of course, your investments.

You can do your best to not allow these elements into your investing strategies, but if you are human, it is all but inevitable that cognitive errors and biases eventually show up in your portfolios . . .

Previously:

Why Fake News Is So Harmful to Investors (October 23, 2017)

Markets Aren’t Kind to Alternative Facts (January 25, 2017)

Keep Politics Out of Your Investing Strategy (February 17, 2016)

Don’t Let Bias Corrupt Your Analysis (April 7, 2015)

See also:

Reminder: Land Does Not Vote (July 29, 2018)