The Financial Crisis Killed Hedge-Fund Performance

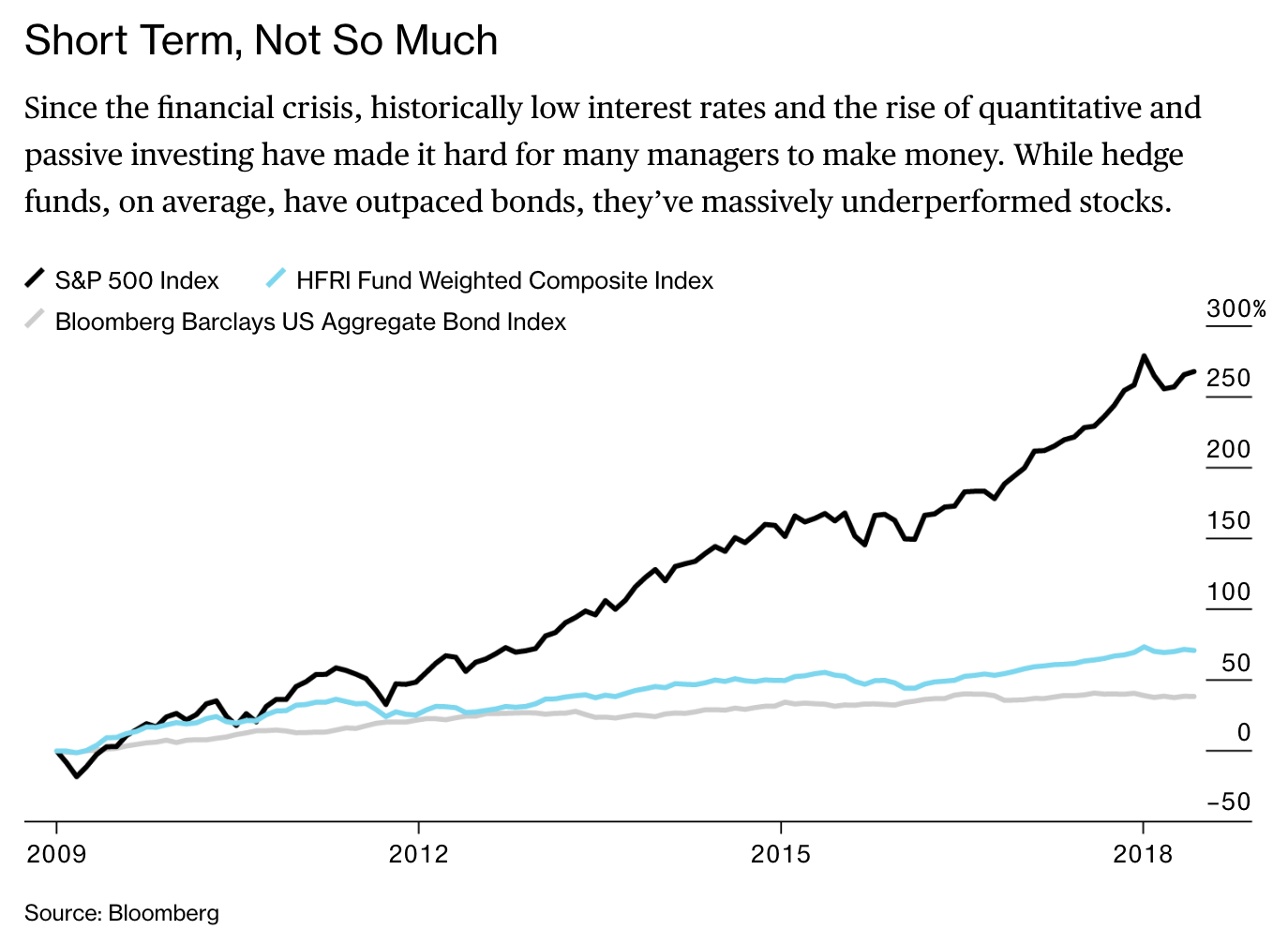

The industry never came back from the “Great Reset,” the huge sell-off during the first quarter of 2009.

Bloomberg, September 17, 2018

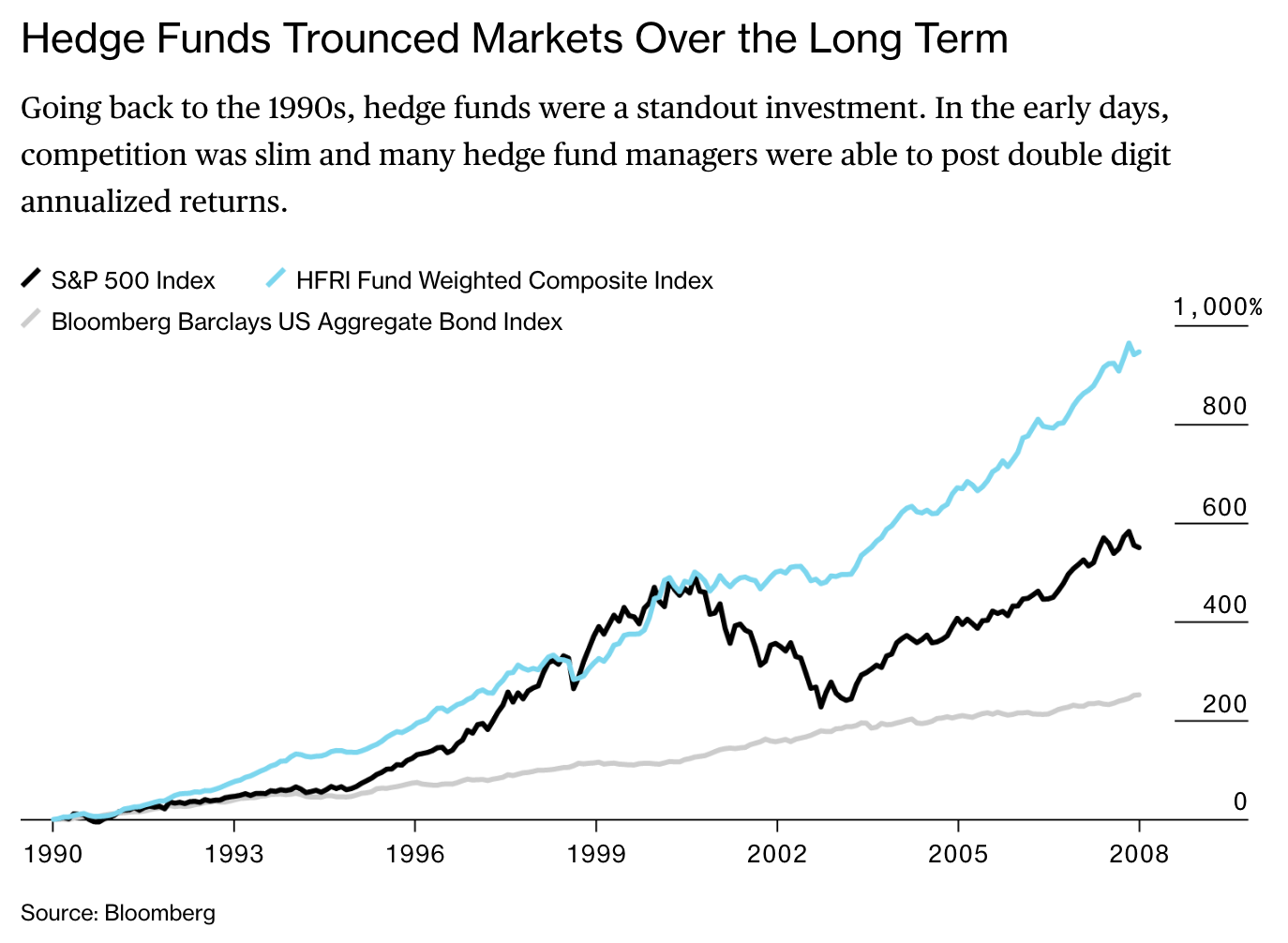

I mentioned last week I was perplexed by the idea that Hedge Funds, who as a group had generated reasonable (but expensive) out performance pre-crisis (see charts below), suddenly lost their mojo.

Why?

There are a few credible theories:

1. Dilution

1b. Fat head, long tail

2. Size is an issue

3. Size removes incentives

4. Groupthink

5. Recency effect/bad timing

Finally, my own theory is the GFC operated as “the Great Reset.”

You can read all about it here…

Source: Bloomberg

~~~

I originally published this at Bloomberg, September 17, 2018. All of my Bloomberg columns can be found here and here.