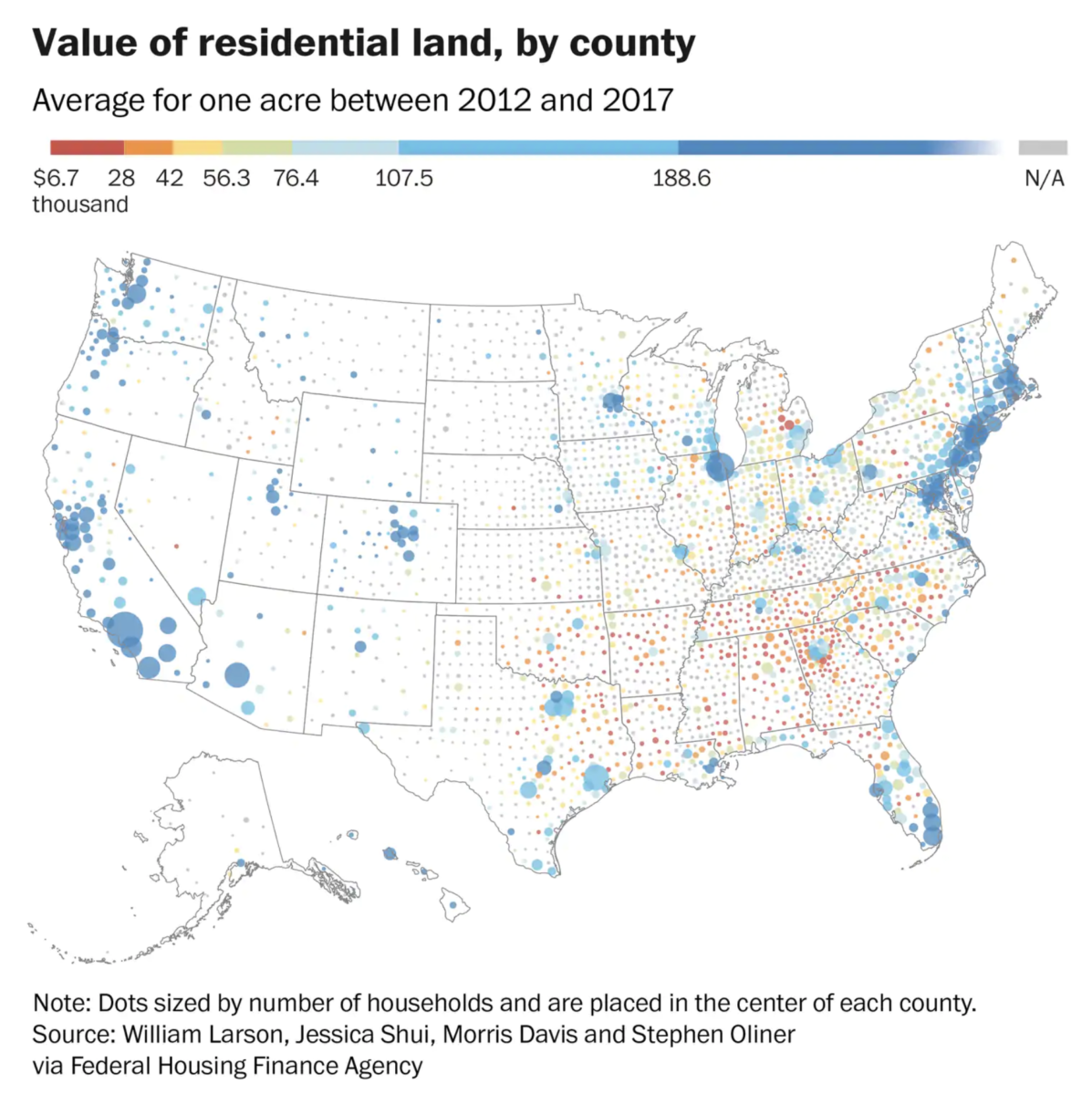

Very interesting data set showing the value of land, minus the structures built on it, across the country:

“The analysis provides an unprecedented view into one of the nation’s largest stores of wealth: the dirt upon which homes are built. It was a tremendous technical undertaking to strip away the value of structures and measure only the cost of land at the neighborhood level. The economists’ full analytical program took more than a week to run.

It also hints at where a housing bubble could appear: “Previous research shows that very large increases in land prices helped predict subsequent house price busts during the financial crisis,” Larson said.

The team relied on appraisals of single-family homes submitted between 2012 and 2018 to Fannie Mae and Freddie Mac, the giant, government-sponsored enterprises which securitized and guaranteed almost half of all mortgages in 2017. The researchers could only calculate accurate land values if the home on top of the land was a decade old or less, and therefore hadn’t depreciated significantly.”

The chart is intriguing:

Detailed data show the value of land under homes across the country

Source: Washington Post

Sources:

The Price of Residential Land for Counties, ZIP codes, and Census Tracts in the United States

by William Larson (FHFA), Jessica Shui (FHFA), Morris Davis (Rutgers), Stephen Oliner (AEI)

Working Paper 19-01 FHFA, 1/2/2019

Detailed data show the value of land under homes across the country

Andrew Van Dam

Washington Post, January 23 2019