Interesting way to look at actively managed funds:

“As investment strategies go, funds whose managers try to beat the market by picking winning stocks or other assets have fallen out of favor in the U.S. in recent years. Over the past 10 years, more than half a trillion dollars has flowed out of actively managed U.S. stock funds and into passively managed U.S. index funds. Average returns for the active funds during this period lagged behind those of index funds tracking the same asset class.

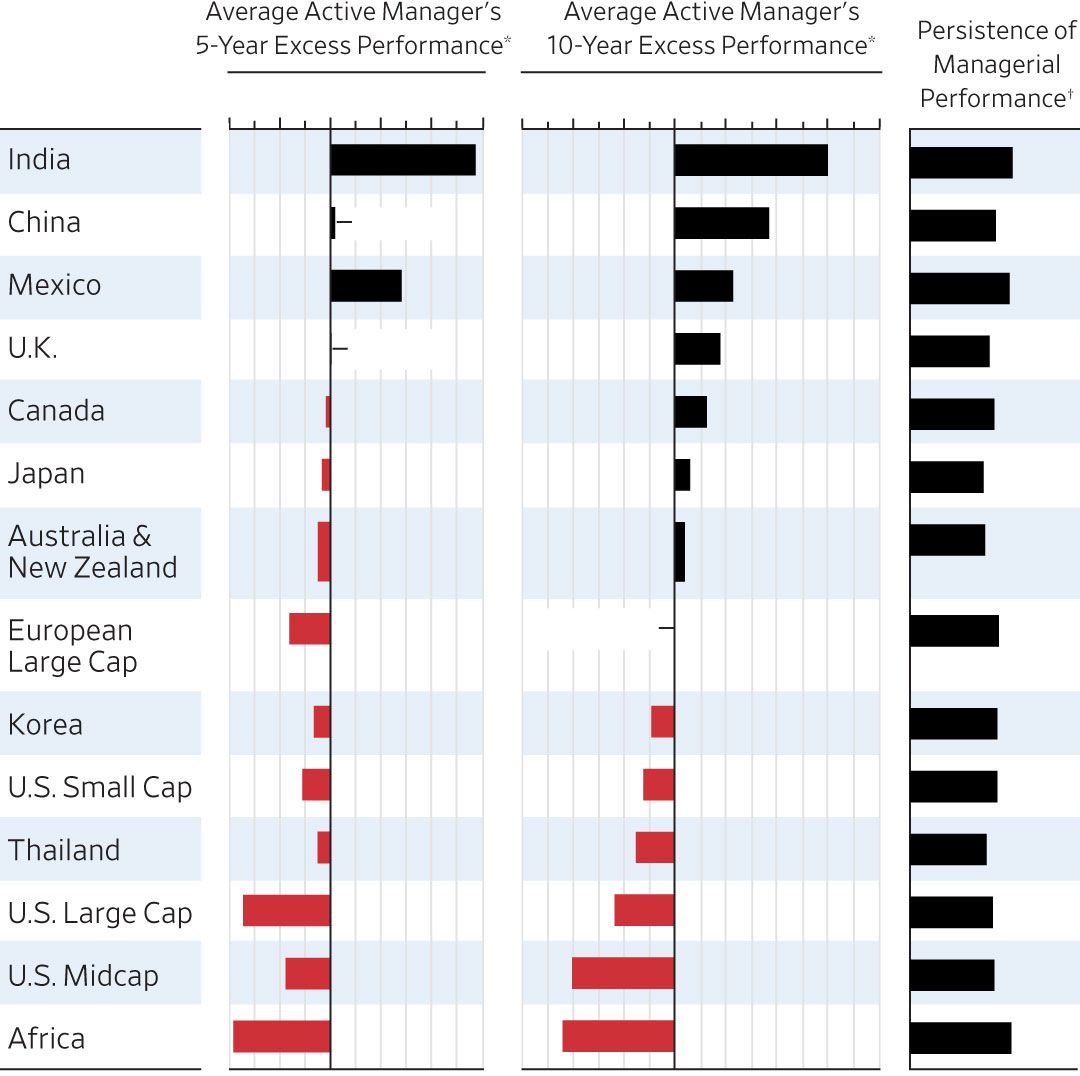

Yet, there are pockets around the world where average returns for actively managed funds are exceeding those of their passive peers, and these results may be surprising to some…

To draw some comparisons, we looked at publicly listed, open-end equity mutual funds around the world over 10 years where Morningstar Inc. is tracking at least 200 funds dedicated to a particular region or country. An interesting picture emerges when comparing actively and passively managed funds.”

Where Active Management Still Dominates

Source: WSJ