Source: Financial Times via @NateGeraci

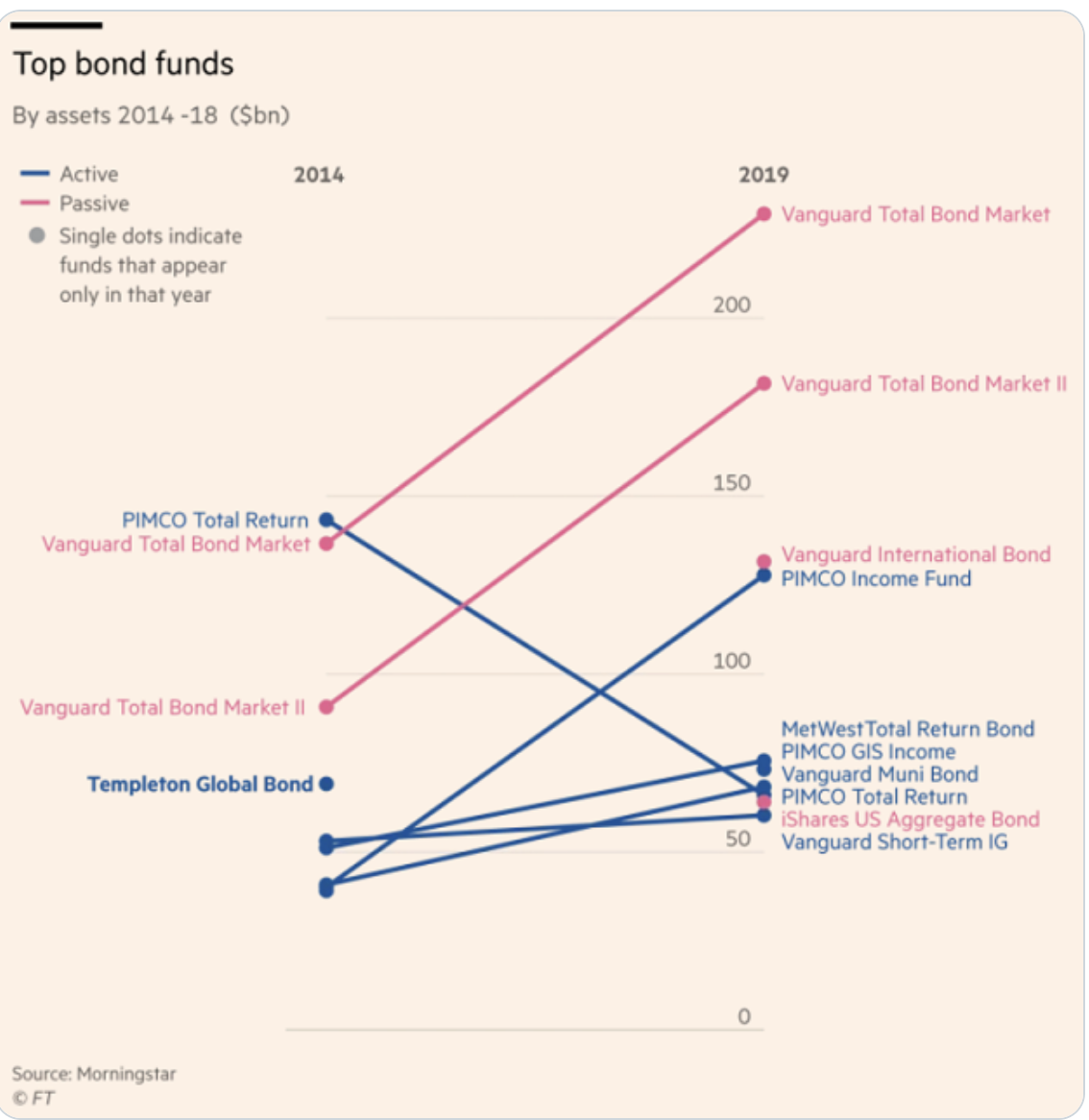

Talk about burying the lede: In a longish Financial Times piece about Franklin Templeton’s star bond fund manager Michael Hasenstab, a graphic mentioned in passing some of the changes in bond fund league tables since 2014.

Over that period, Vanguard became the home of the world’s 3 largest bond funds, and 5 of the top 10 bond funds. (Hat tip to @NateGeraci who spotted this).

The top 3 bond funds by assets are Vanguard Total Bond Market (VBMFX), with $232 billion in assets; Total Bond Market II Index Fund Investor Shares (VTBIX) with $185 billion in assets; Total International Bond Index Fund (VTABX) with $135 billion in assets. Vanguard also has Intermediate-Term Tax-Exempt Fund Investor Shares (VWITX) with $70 billion in assets; Short-Term Investment-Grade Fund Investor Shares (VFSTX) with $60 billion in assets.

The other 5 funds in the top 10 include 2 PIMCO funds, a Met West, Franklin Templeton and an iShares fund.

The likely drivers of Vanguard’s gains are twofold: In general, investors have been migrating towards fee-based fiduciary advisors and away from commission based brokers. Practitioners who are also fiduciary advisors typically move investor holdings towards low cost, passive funds. Vanguard dominates the list of bond funds in this space. The combination of more passive investors (see all funds by assets) and more households moving towards fiduciary advisors are both accruing to more assets for Vanguard.

The “Vanguard Effect” — the company’s influence on other funds to lower their fees to be competitive — will likely to continue driving fees lower in the fixed income space, despite the modest yield.

Previous Related Discussions: