It is bottom of the ninth inning for unicorn madness.

All that capital chasing too few quality deals leads to valuations getting stretched, sometimes to the point of madness. While lots of money makes it easier for promising start-ups to get funded, it also ends up flowing to lesser ideas, less prepared entrepreneurs, and weaker start ups.

The issue of so much cash does raise some interesting questions:

Is there a limit as to how much the venture industry can scale up in size? How big can VC get?

What about VC firms — can they keep growing or is there a natural ceiling?

What about speed of capital deployment? Is there a pace that acts as a natural break on investments (does this not scale too?)

What about concentration? Can any one firm hold an outsized influence on the industry?

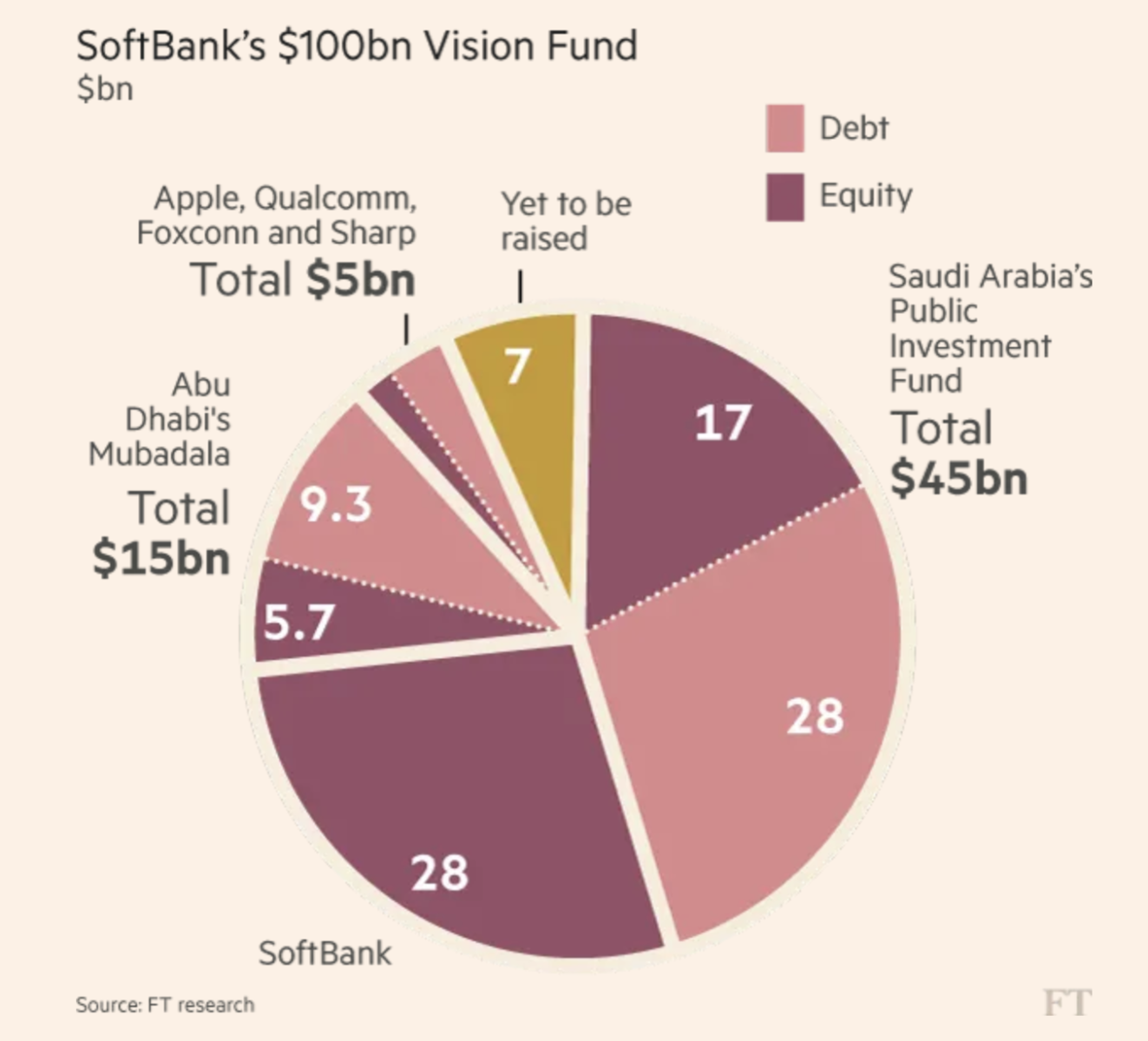

All of which leads us to the ginormous Softbank Vision fund, the choices it makes when deploying its capital. Is it better off making lots of small bets, spreading risk across numerous early stage companies? Or, can it achieve good returns with fewer, larger bets? And, should they be focused on early, mod or late stage investments?

I’ve been thinking about this for a few weeks now, and I’ll scribble some thoughts down on this topic later today…

Investors in Softbank Vision Fund

Source: FT