From Torsten Sløk, Deutsche Bank Securities:

Source: Torsten Sløk, Deutsche Bank Research

From Torsten Sløk:

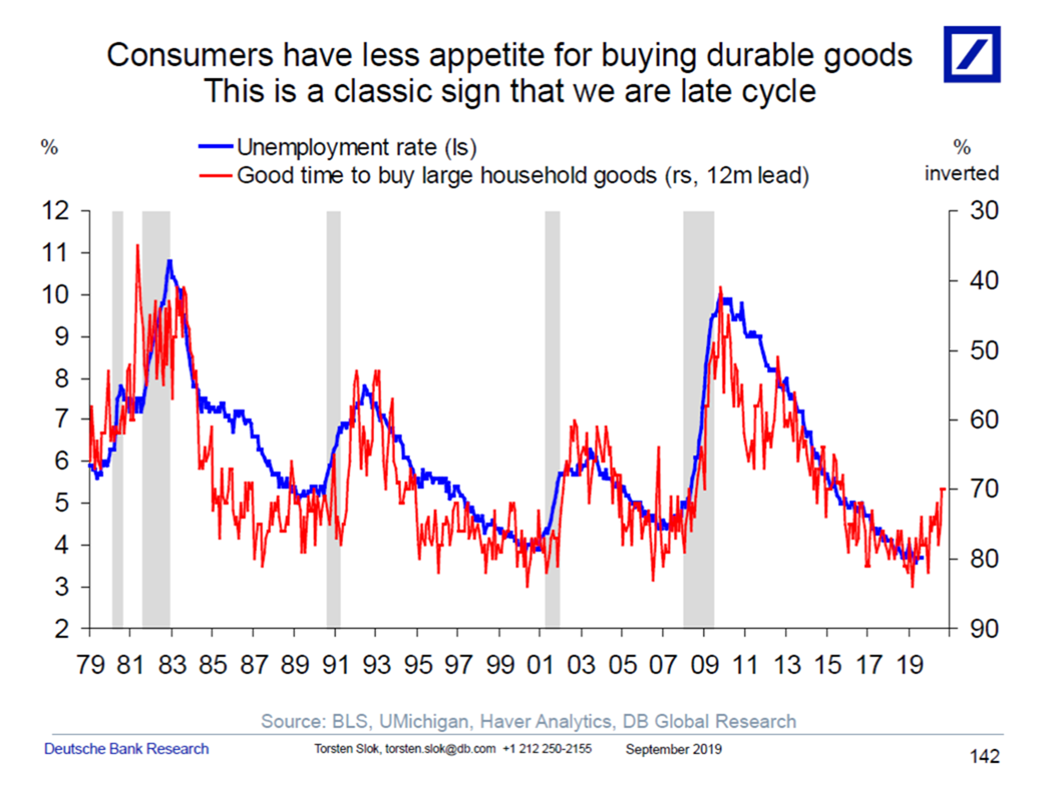

For the past year, we have seen a steady decline in US consumers’ interest in buying large household goods, i.e. washers, dryers, computers, TVs, furniture etc. This sentiment indicator has historically been a very good leading indicator of the business cycle, see chart below, where the blue line is the unemployment rate and the red line is the inverted percentage of consumers saying now is a good time to buy large household goods. Add to that the rising risk of job losses in manufacturing, and the downside risks to consumer spending look even more significant. The bottom line is that we expect the ongoing slowdown will continue.

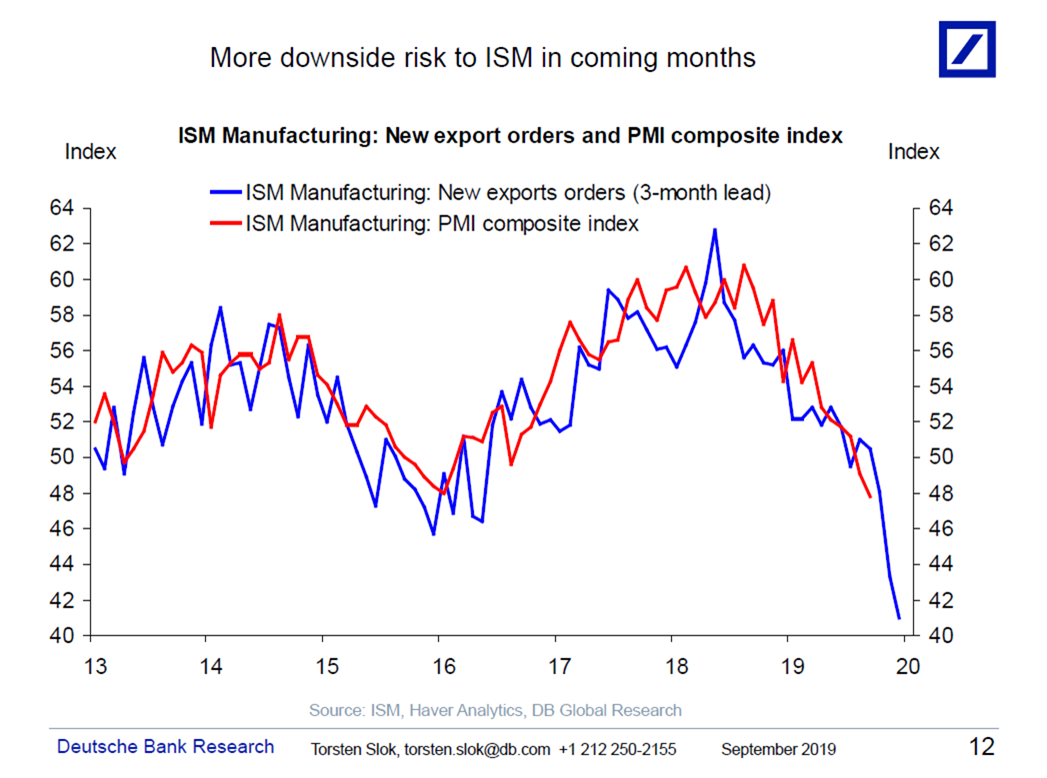

ISM at 47.8 is bad but new export orders at 41 is even worse, see chart below. There is no end in sight to this slowdown, the recession risk is real

Source: Torsten Sløk, Deutsche Bank Securities