Source: Barclays

Diving into some data on Hedge Funds, I happened across some research by Barclays. This was the noteworthy paragraph:

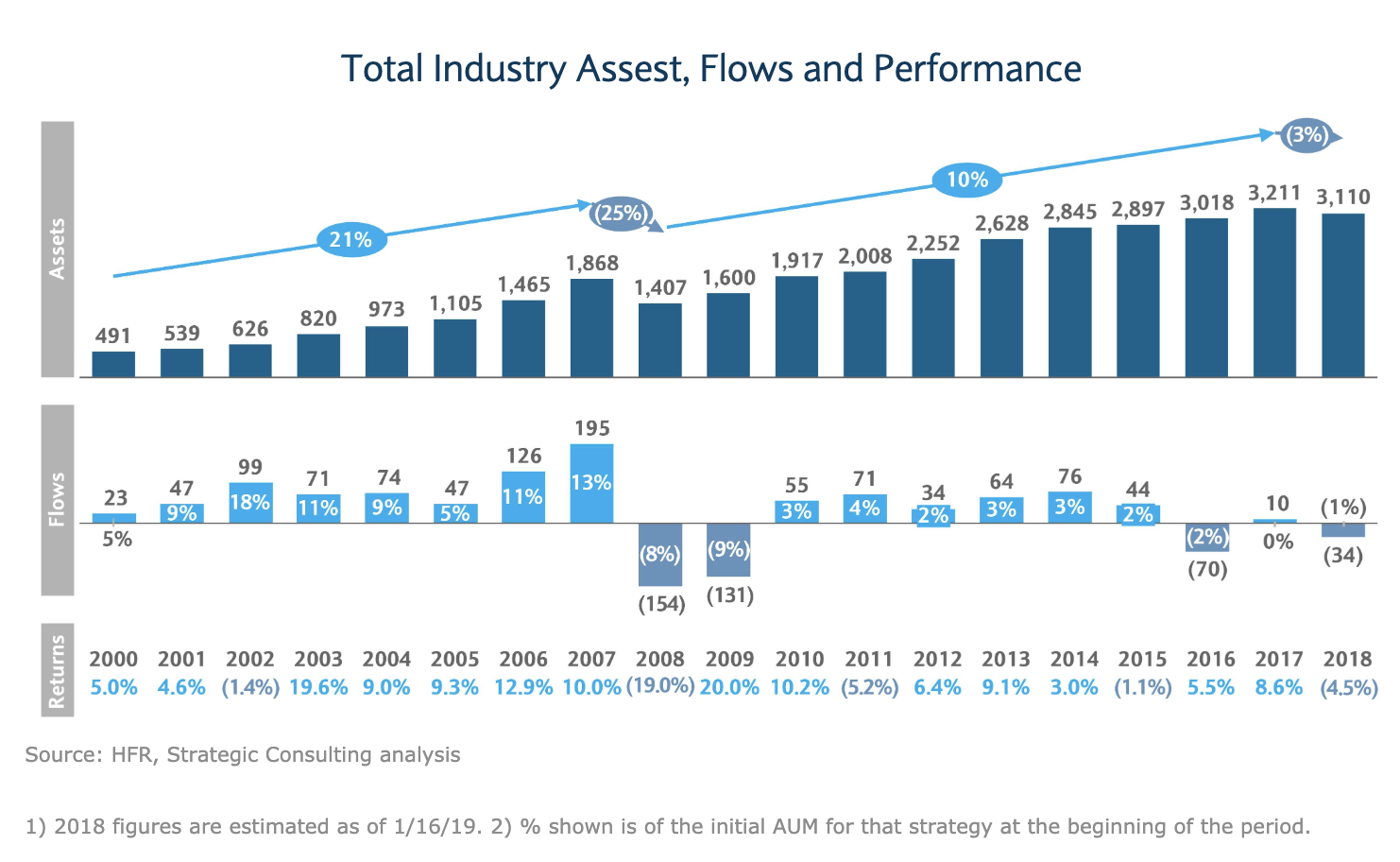

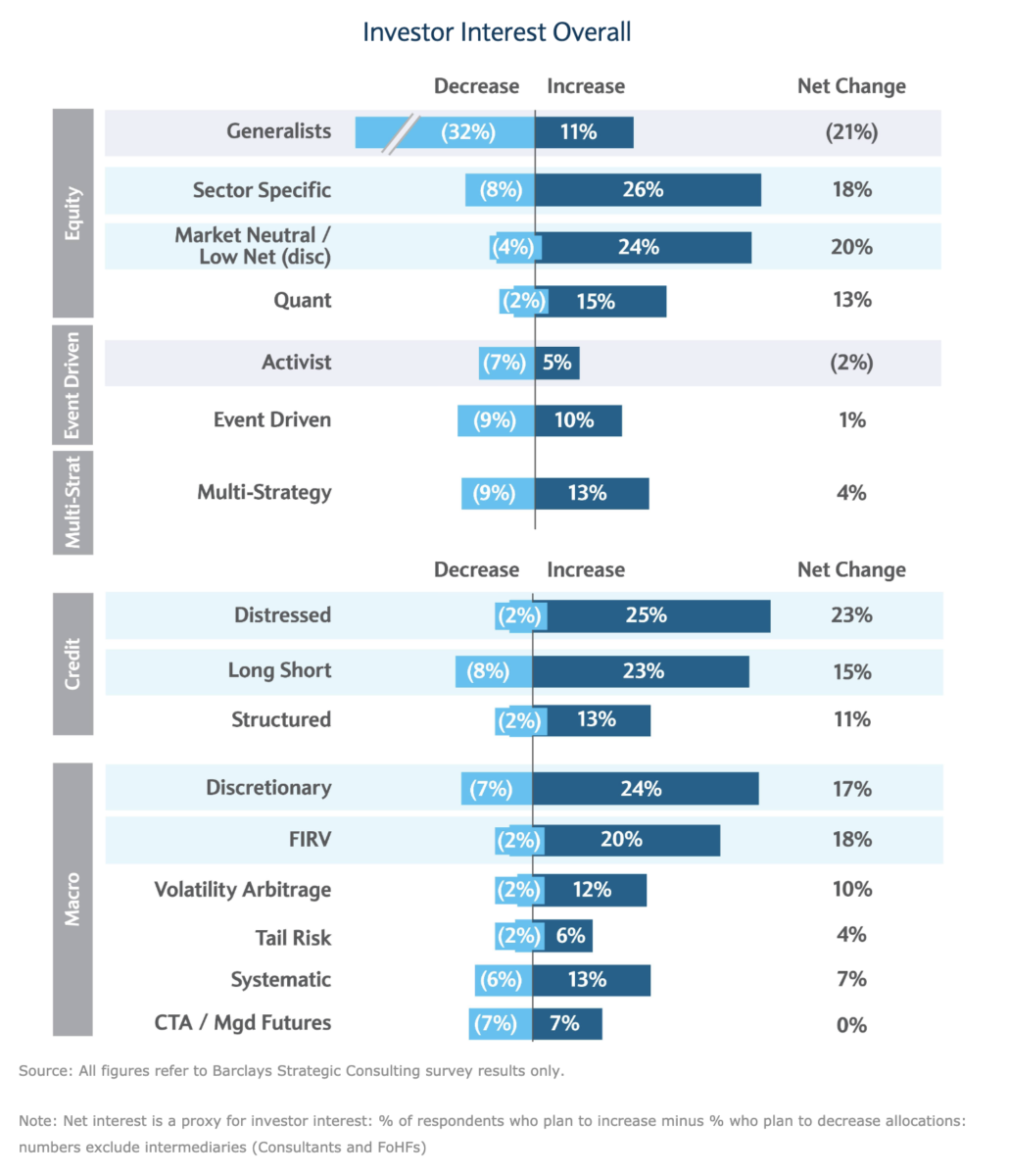

“Investors remain committed to hedge funds despite the recent poor performance. For 2019 we expect to see a significant amount of reallocations, roughly $350 billion of ‘money in motion’ from investors’ reallocations across strategies and managers. However, on a net basis, we are projecting outflows from the industry of $20-50 billion.”

I find it fascinating how hedge funds have performed since the Great Financial Crisis: For the two decades prior, hedge funds had significantly outperformed their benchmarks over. AUM had risen to $1.4 trillion in total assets by 2008. That great run ended post-financial crisis. By 2015, assets doubled to nearly ~$3 trillion. But the performance, for reasons still being debated, faltered.

Hedge funds have seen 6 continuous quarters of capital outflows. This is unprecedented — greater than even the outflows during the GFC.

One alternatives losses are another’s gains, and the outflows from HFs mostly seem to be going to private equity.

More on this later in the week…

Sources:

Crossing currents: 2019 Global hedge fund industry outlook

Barclays, 28 Feb 2019

http://bit.ly/2NBmR51

Hedge fund industry sees 6th consecutive quarter of outflows

HedgeWeek, 24/10/2019

ttp://bit.ly/33FR4Wc

Source: Barclays