I am fascinated by the idea of trying to engineer illiquid collectibles — art, cars, even down payments — into liquid, investable assets.

We have discussed this previously in terms of survivorship bias and collectible cars, but the latest variations via artworks are very interesting engineering problems.

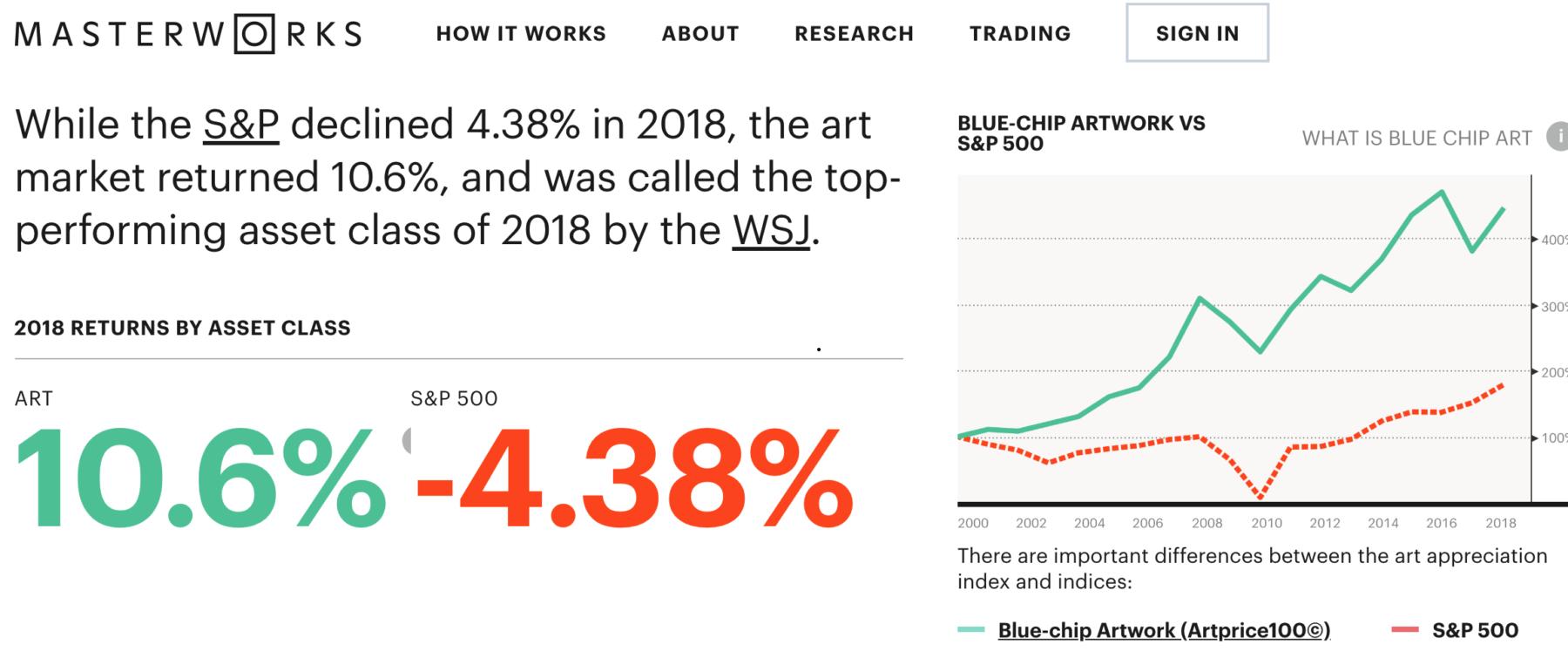

Take for example Masterworks, a site that seeks to “hold each painting for a three to five-year period to allow it to appreciate in value, but it will be continuously offered for sale. At any time, a collector can make an offer to buy a painting that you’ve invested in, and if the painting is sold, your share of the net proceeds, if any, will be distributed to you.”

I am not sure if this an investment or a marketing strategy, but it intrigues me (And no, I cannot imagine ever putting a penny of client money into this).

Consider the down payment co-investing strategies like Unison. They “go in on the down payment with you” covering as much as 95%; they become your partner, and when you sell that house, they share in the gains.

Or Edly, which is a broad Income Share Agreements — they fund college tuition in exchange for students paying a fixed percentage of their salary instead of student loans.

These strategies seem to be ways to take what might have been a straight up private equity approach and turn it into a broader platform. They are all, for better or worse, pure financial engineering approaches to solving specific financial problems: College affordability, lack of down payments, partial auto ownership, illiquid art investments. I don’t have a firm opinion yet of these are good or bad things — I bring all of my prior biases and suspicions tp the issue — but they certainly are intriguing.

I need to write more about them to figure out what I think. It is worth exploring in greater details.

Previously:

Survivorship Bias (& Compounding) in The Art World (May 22, 2019)

Survivorship Bias on Wheels (August 14, 2018)

Do $100 Million Apartments Mean We Are in a Bubble? (June 2, 2016)

See also:

The Finer Things in Life Weren’t Good Investments in 2019 (WSJ)

Art Guarantees Dip 18% in 2019 Amid Slowing Art Market (Penta)

Art is not an investment, part 872 (Reuters)

Parking an Investment in Your Garage (NYT)

Want to Own a Warhol? Now, You Can Buy a Piece of One (NYT)

Sotheby’s Wine Sales Top $100 Million for Second Consecutive Year (Barron’s)

At last, you can become a shareholder in a Birkin bag or a Lamborghini. (Fast Company)