Source: Torsten Sløk, Ph.D., Deutsche Bank Securities

Last month, we looked at how the top 1% of wage earners in the USA — they garnered wage gains of 158% since 1979.

The bottom 90%? A bit more modest gains — of 23.9%.

But that is just income. Let’s consider wealth created by the stock market.

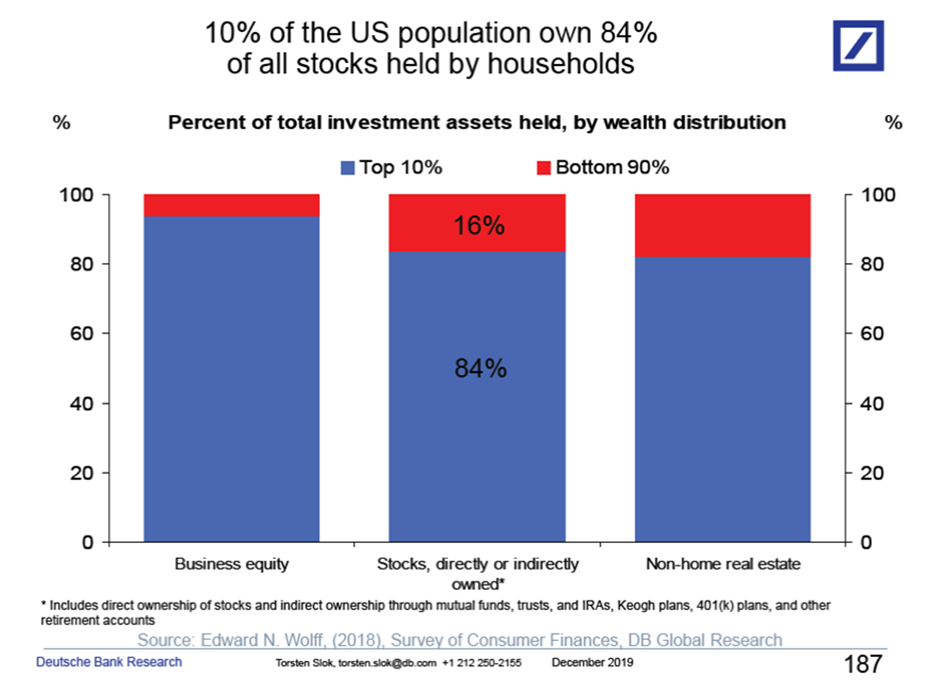

According to Torsten Sløk of Deutsche Bank, the distribution is quite astounding: 84% of stocks in the USA are owned by the Top 10% of households.

While half of the US population own equities directly or indirectly (i.e. in pension accounts), it is only a modest share: The bottom 90% of households owns only 16% of all equities. Note the bottom 50% own practically none at all.

If you choose to focus on the stock market as a measure of how well the US economy is doing, you are missing a huge part of the picture. This is especially true for gig economy workers, younger workers, areas outside of the wealthy coasts and cities, and workers displace by technology and globalization.

Its great that the stock market is up and at record highs; but that is only half the story. Or, to be more precise, about 10% of the recovery story.

Previously:

Top 1%: Wages up 158% since 1979. (December 20, 2019)

The Bifurcated Economic Recovery Continues (June 5, 2019)

The Robust, No Good, Excellent, Terrible Recovery (October 3, 2018)

How Is Your Personal Economic Recovery Going? (May 23, 2015)

The Bifurcated Recovery in Jobs (November 12, 2013)

See Also:

Overview: Post-Credit Crisis Recovery