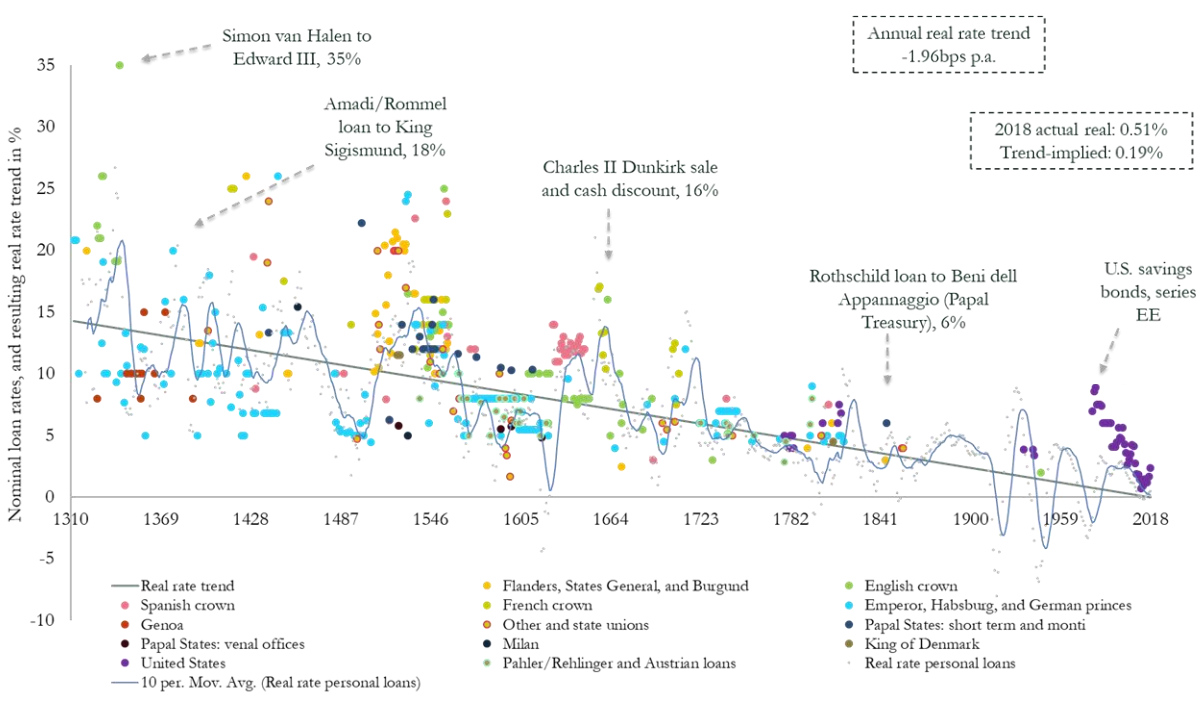

Source: Paul Schmelzing, visiting scholar at the Bank of England (BOE), via Visual Capitalist

When economists use the phrase “Lower for longer” this is not what they usually are referring to. Instead, they tend to think of the continued accommodative stance of central banks around the world. It hints at the still fragile state of the global economy post GFC.

But stepping back — w a a a y back — to look at the big picture, we see that the overall trend for interest rates (since record-keeping began in earnest) has been down. Its noisy and volatile, but it has been unmistakably downwards.

Consider: Global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) over the past eight centuries. The data is based upon 78% of advanced country GDP.

The big question this provokes: “Why have real rates had a negative historical slope spanning back to the 1300s?”

I have seen numerous explanations: Productivity gains, deflation, labor arbitrage, widespread credit availability, too much capital, technological innovations, fall of city states/rise of superpowers, decreased frictions, globalization, fall of landed gentry, decreased poverty, rising global middle class, etc.

No one of these is especially convincing; perhaps it is some combination of factors that is driving rates lower for 8 centuries.