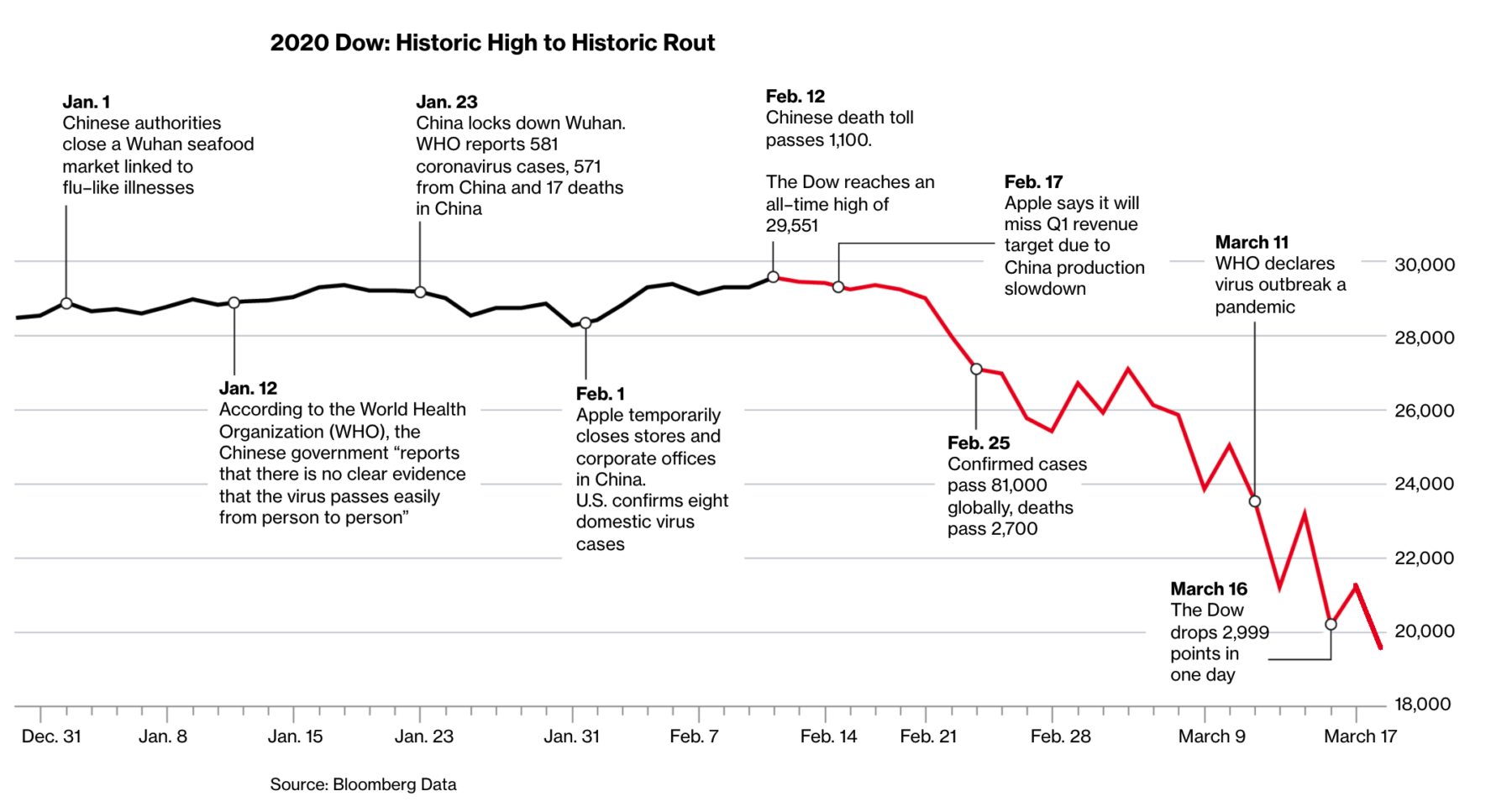

What the Dow’s 28% (Update 32%) Crash Tells Us About the Economy

Source: Bloomberg (Note: I added line breaking Dow $20k to reflect 3/18 trading)

Short answer: Recession.

Longer answer: Decades ago, the Dow Industrials was used as a shorthand substitute for the broad market. It shouldn’t be — its not very representative and is dollar price weighted. Broader indices like the Wilshire 5000 (now about 3400 stocks) or the S&P500 present a better frame of reference.

Regardless, it is is still a big psychological reference, as the media + therefor the public notice it. Hence,t he drop form near 30,000 to just under 20,000 is noteworthy.

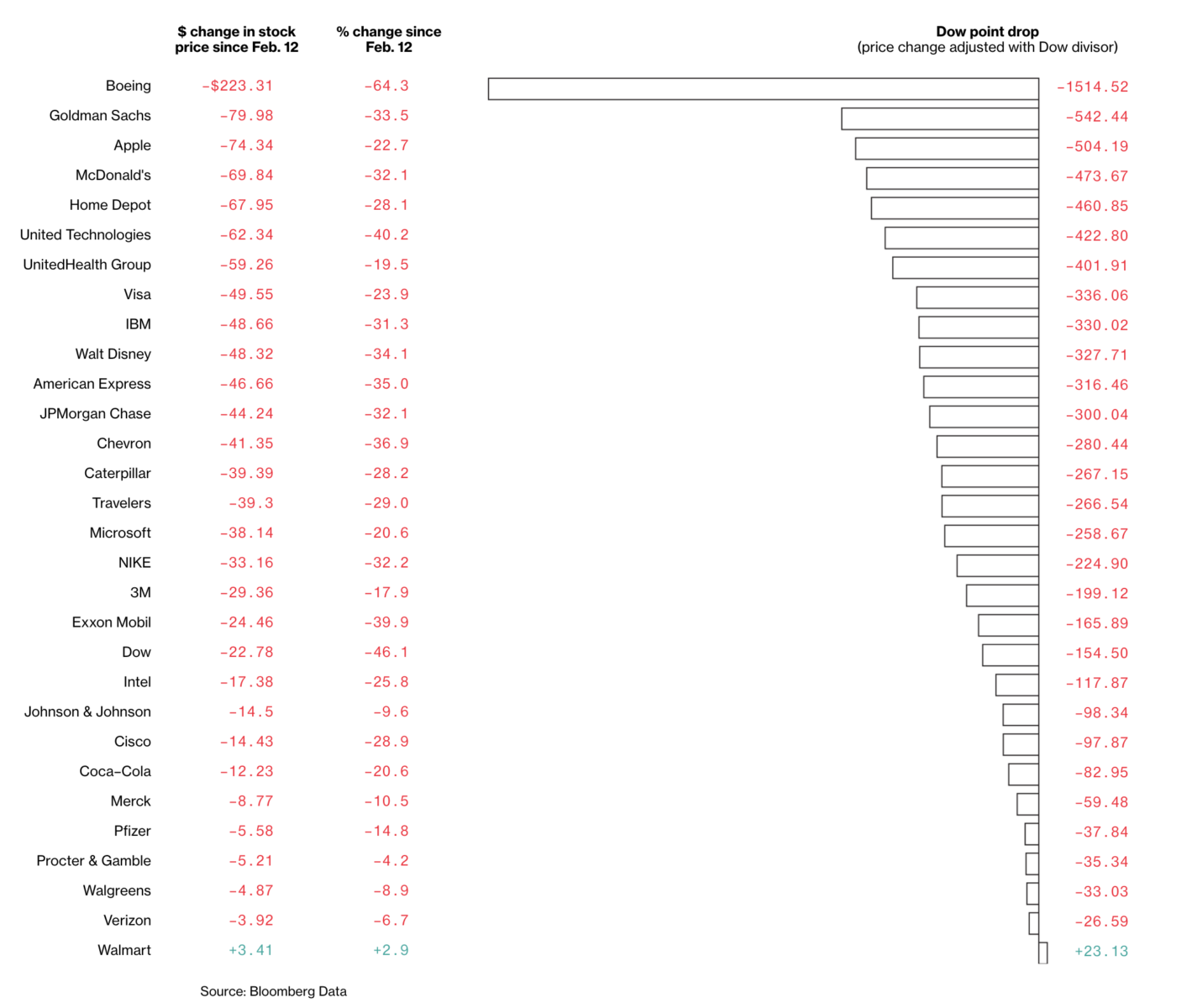

This Bloomberg discussion also breaks down the percentage drop by Industry Sectors, as well as the individual companies from best to worst performing.

Percentage Drop by Industry Sectors, Best to Worst Performing

Source: Bloomberg