My morning train WFH reads:

• The Fed Loves Main Street as Much as Wall Street This Time (Bloomberg)

• Grocery delivery was supposed to be the ultimate lifeline. But it’s falling short. (Washington Post)

• Morningstar: Mainstream Investors Might Get Access to Alts, But They Won’t Get Alpha (Institutional Investor)

• Pass the salt: The minute details that helped Germany build virus defenses (Reuters)

• The crisis has brought the economy to a near halt, leaving millions of people out of work. The unprecedented intervention averted a full-scale meltdown – for now. (The Guardian) see also Why We’re Angry: “17 million people just lost their jobs — they understand they’re the ones getting screwed.” (Irrelevant Investor)

• The Yeast Supply Chain Can’t Just Activate Itself (Slate)

• This epidemiologist proved 10,000 steps is a lie (Popular Science)

• Why Did The World Shut Down For COVID-19 But Not Ebola, SARS Or Swine Flu? (FiveThirtyEight)

• Inside the Totally Unlikely, Totally Predictable Rise of Joe Biden (Vanity Fair)

• Now’s the Time to Branch Out Into More Interesting Indoor Plants (Bloomberg)

Be sure to check out our Masters in Business interview this weekend with James Montier, member of GMO’s Asset allocation team and author of numerous investing books, including The Little Book of Behavioral Investing: How not to be your own worst enemy.

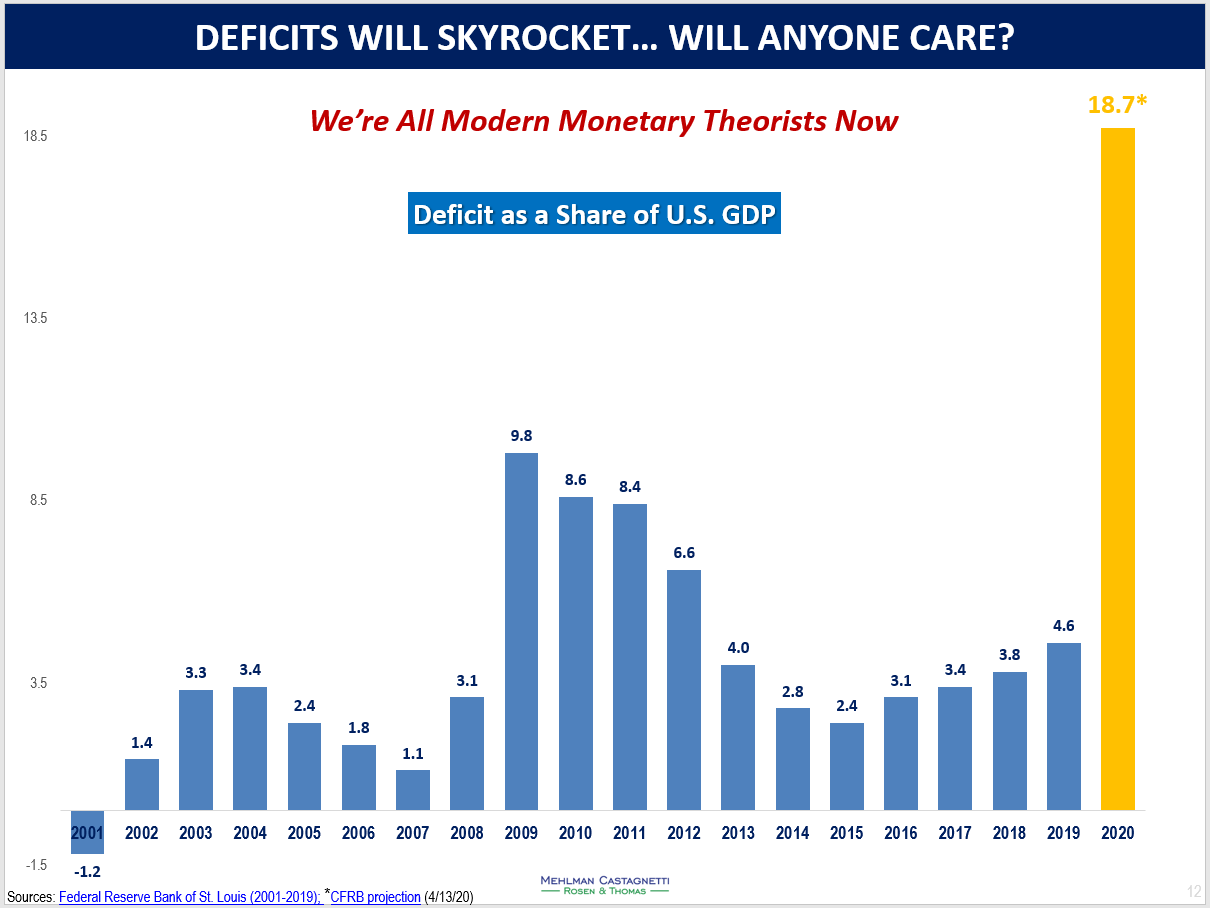

Deficits will skyrocket … Will anyone care?

Source: Bruce Mehlman

Sign up for our reads-only mailing list here.