Very few companies have pricing power at the moment

Source: Torsten Sløk, Deutsche Bank Securities

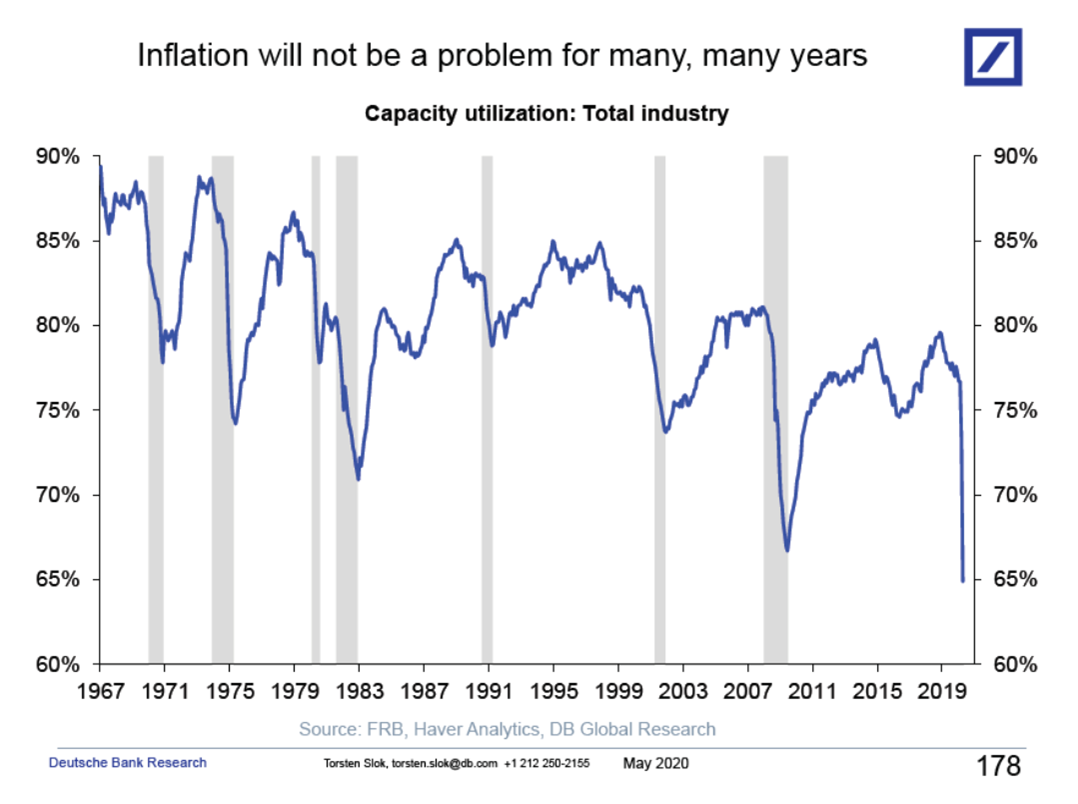

Today’s episode of confirming my priors comes to us via Torsten Sløk. His chart shows Industrial Capacity Utilization. The key takeaway is that unless you are making N95 masks or Purell, you have no pricing power whatsoever.

Consumers are hunkered down, and what purchases they are making is being done mostly over the internet, where price comparisons are easy.

As a lazy Amazon shopper, I was surprised by this: The lockdown has me more price aware then normal, and so I have been using Google Shopping to compare prices. Scrabble Deluxe set (B&N), Hummingbird Feeder (PerkyPet), Dog Treats (Chewy), Swiffer refills (Target) and other items that were cheaper, and occasionally much cheaper, than at Amazon. Ironically several of these sites use Amazon to process the payments, so Uncle Jeff still gets his cut.

Question: What will this mean for $AMZN post-lockdown?

But back to the chart above: It is highly doubtful we will have much inflation to contend with for a long time. The sequence of events that must happen for that to occur is a very low probability, and random outcomes leading to higher prices beyond a few items in short supply. But it is a highly doubtful scenario. If & when that occurs, we also should see plenty of advance notice.

In the meantime, Unemployment, food, and lack of rent payments are a much, much bigger issue than fear of inflation from the same people who have been fearing inflation for 3 decades.

Update: May 2021

After 14 months of lockdowns, we have vaccines and are re-opening! We are seeing lots of spot shortages, rising wages, and price pressures. I am in the transitory camp, but that “low probability sequence of events” has occurred. Prices are rising, and I am writing about this “reset.”

Previously:

Return of the Inflationistas (May 14, 2020)

Longest Period in History Without an Increase in Minimum Wage (August 1, 2019)

Wildly Wrong About Interest Rates, Jobs & Inflation (June 11, 2019)