Before we get into the specifics of this fraud, some reminders:

(1) The IRS will never call you to initiate an examination or audit. If you receive a call from someone supposedly from the IRS out of the blue, just hang up.

(2) The IRS does not use automated robocalls to demand tax payments or to suspend your Social Security number – hang up and block the number if you receive a robocall from someone saying they are the IRS

(3) The IRS does not communicate via email – never open an attachment or click on a link from an unknown or suspicious source claiming to represent the IRS

Now, about the above letter:

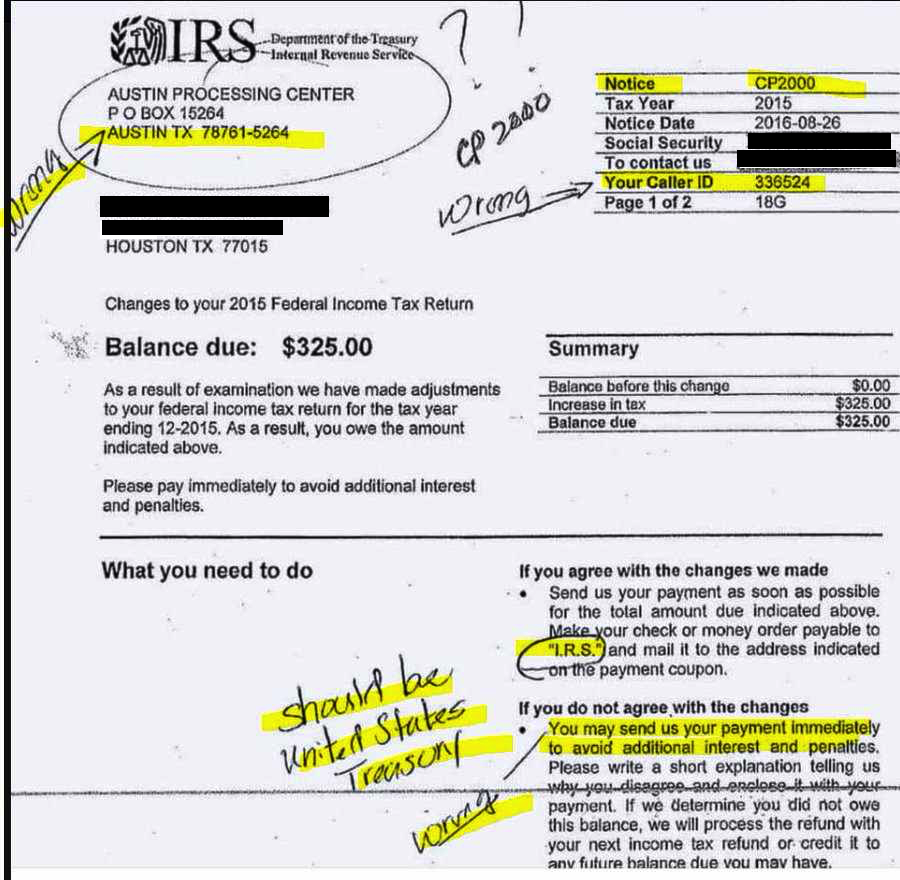

I was alarmed this week when a friend shared a seemingly innocent-looking CP2000 notice from the Internal Revenue Service in Austin. The CP2000 is how the IRS notifies taxpayers of a change to their tax account. The letter concerned a prior-year income tax change in the amount of $325.00. It contained the IRS logo in the upper left addressed from the “Austin Processing Center,” and a quick search confirmed that Internal Revenue does run a legitimate payment processing center in Austin, Texas.

To your average John Q. Taxpayer, it probably looks like the real thing. Here’s a three-page example of the letter from 2016:

http://online.wsj.com/public/resources/documents/Exampleofscamletter.pdf

Trouble is the letter is a complete fake. A fraud. It represents a continued evolution of many IRS-related scams that are increasingly sophisticated in time.

The “tells” for someone who has seen and reviewed actual CP2000 notices (example here) are subtle but revealing. The biggest single red flag on the letter is that payment is requested payable to “I. R. S.” – which is dead wrong. All – 100% – of your payments are made to the “United States Treasury” for federal income tax purposes, never to the IRS or I. R. S. (which can stand for Irving R. Smith or some other use of the acronym).

Next, the customer service number is wrong, as well. The IRS operates out of the easily-memorized 800-829-1040. The scam letter contains a different 800 number not affiliated with the Department of the Treasury or Internal Revenue Service.

The payment address is also a red flag. The official payment processing center for Austin, Texas does not use a post office box at all – it is an entirely separate zip code. An internet search of the fraudulent IRS Austin post office box listed results in several pages of warnings from the tax community to get the word out that this address is fake.

Yet to the untrained eye, these distinctions are subtle. If you do receive a letter that appears to be legitimate, there is no harm in double-checking – take your time before you mail a payment off to make sure the request is real. Calling the IRS customer service number is an adventure in excessive hold times, so requesting a tax transcript for the year in question – online or via mail – is an easy way to cross-check the request letter against the official IRS database. If the proposed change does not appear on your tax record, it may be a fake request. Transcripts are usually mailed to your last-filed address within 5 to 10 business days which is plenty of time to review and respond to an actual notice. Here’s how:

https://www.irs.gov/individuals/get-transcript

Next, here’s the official IRS response to the original 2016 letter scam:

https://www.irs.gov/newsroom/irs-and-security-summit-partners-warn-of-fake-tax-bill-emails

~~~

Bill Sweet is a Tax-planning expert and certified financial planner, and CFO of Ritholtz Wealth Management (Bill’s personal story is here).