Source: Bruce Mehlman

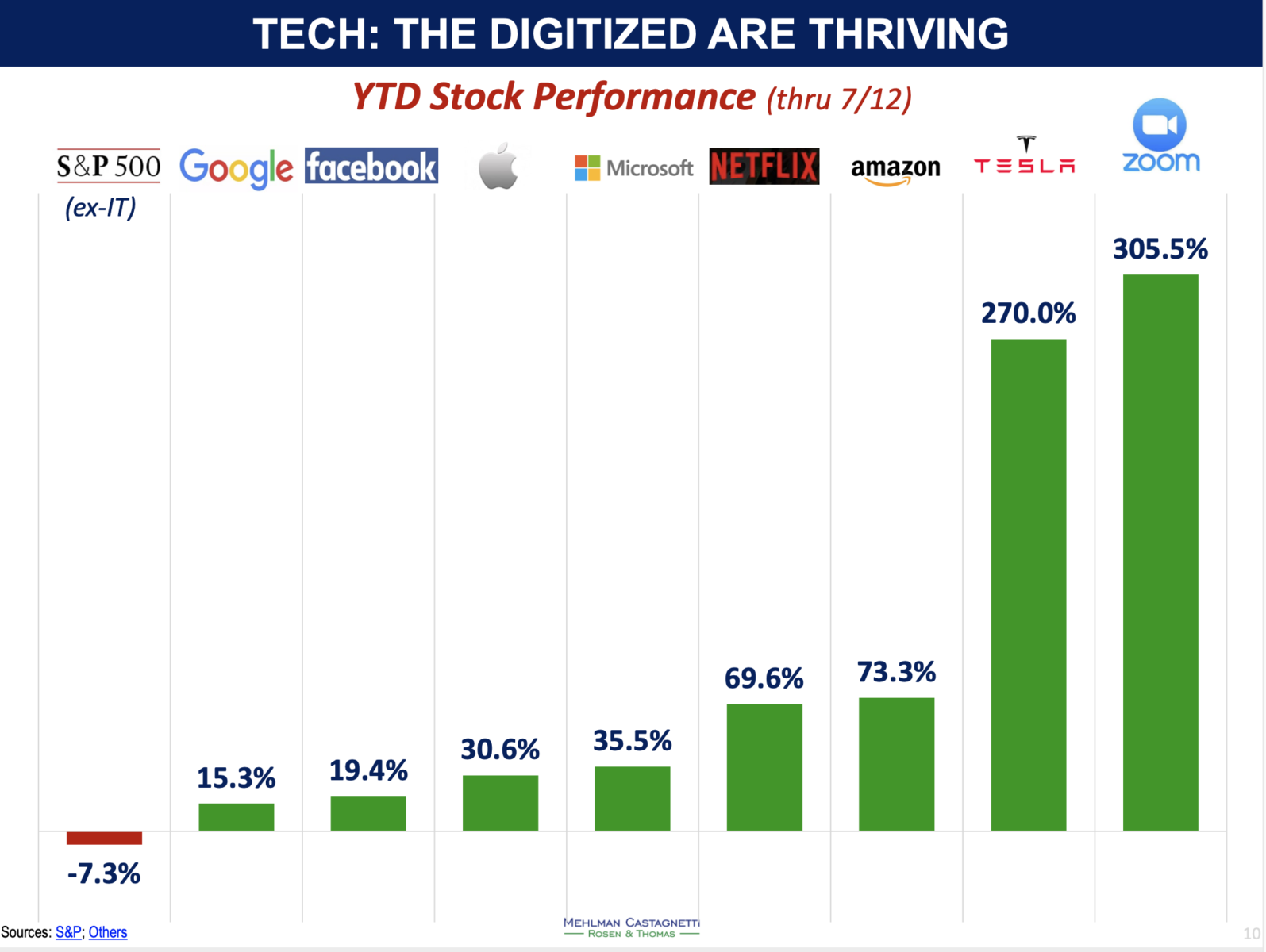

Its big tech FAANMG week here at TBP, with yet another variation of what we have been discussing regarding the domination of large cap technology.

While Zoom is surely profiting from the WFH phenomena, it is the other, larger and more influential stocks that have captured my attention.

Tesla is its own unique creature, a cult stock with a charismatic leader and a unique product vastly superior to its competitors in numerous ways. It is very reminiscent of 1990s Apple, after Steve Jobs returned as the prodigal son. As we noted previously:

“Tesla has forced the rest of the automotive industry to go along with it. Other carmakers, perhaps having learned a lesson from watching Apple and Amazon destroy competitors, have switched rather than fight. Instead of ceding the electric-vehicle market to the Silicon Valley-based interloper, they have responded aggressively to the e-threat. Every major automaker has aggressively embraced electrification of their fleets. Tesla has already changed the entire industry.”

Jim Reid of Deutsche Bank points out that $TSLA is its own unique creature:

“Tesla’s market cap ($287bn) has grown to over a third of the combined market cap of the US, EU and Japanese auto indices. Since March, Tesla has added just over 8 Fords or 27 Renaults. In fact, Tesla is over 3 times the size of the “S&P 500 Automobiles and Parts” sector, even though it’s not a member or in the S&P 500 (it would be the 15th largest).”

While Tesla is definitely bubblicious, you cannot say the same thing about the rest of the Tech sector. FAANMG is not the same as the 1990s tech boom. These companies are driven by revenues and profits, not clicks and eyeballs. I suspect those who believe this is a parallel bubble to the dotcom boom and bust will be sorely disappointed.

Previously:

Winning by Changing the Rules of Business (March 14, 2018)

What is Driving Markets? (July 10, 2020)

BBRG: Big Tech Drives the Stock Market Without Much U.S. Help (July 13, 2020)

FAANMG Stock Prices Reflect Global, Not US, Recovery (July 17, 2020)