Source: Bloomberg

Today’s must read column is by Sarah Ponczek of Bloomberg News: Epic S&P 500 Rally Is Powered by Assets You Can’t See or Touch discusses several consequential issues impacting investing today.

Begin with this observation:

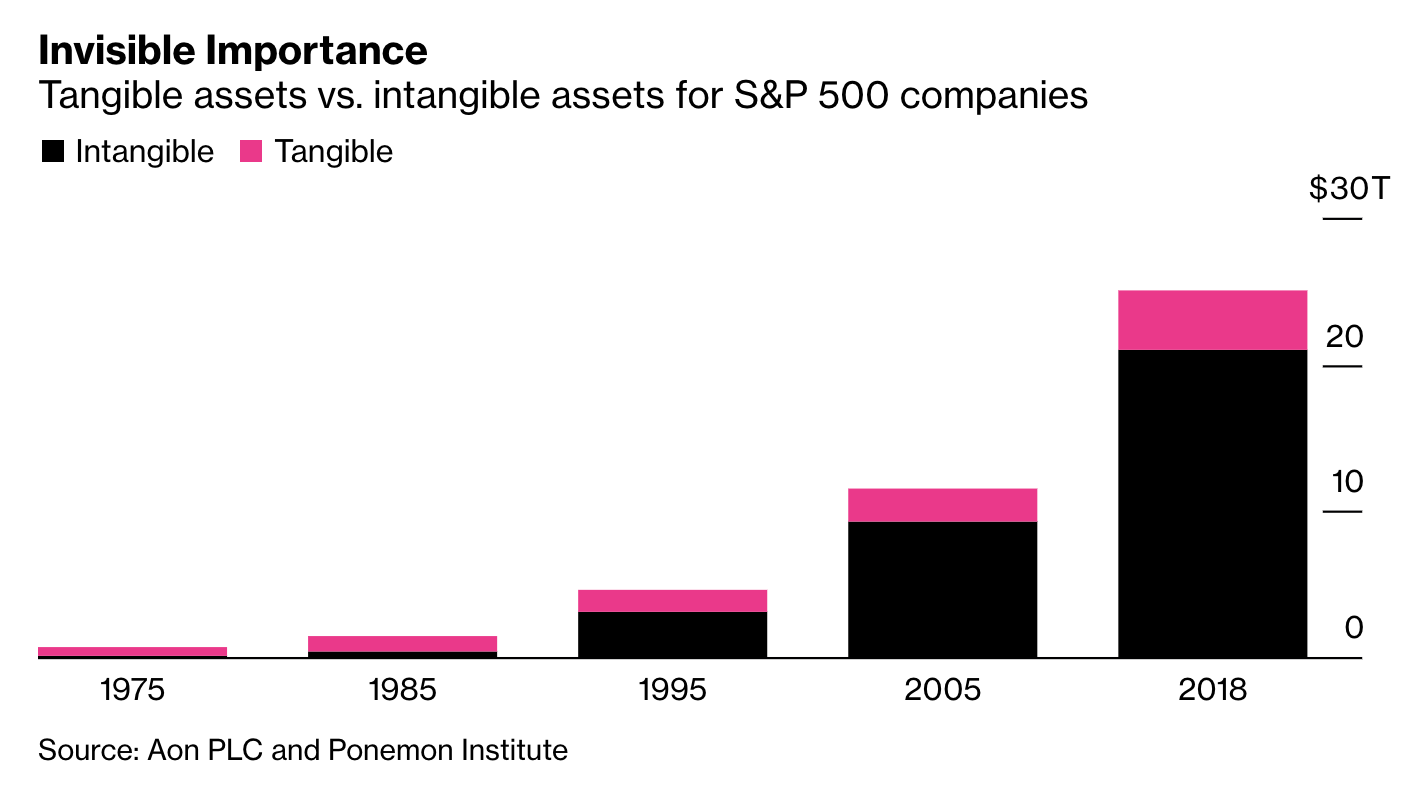

“Take all the physical assets owned by all the companies in the S&P 500, all the cars and office buildings and factories and merchandise, then sell them all at cost in one giant sale, and they would generate a net sum that doesn’t even come out to 20% of the index’s $28 trillion value . . . Back in 1985, before Silicon Valley came to dominate the ranks of America’s biggest companies, tangible assets tended to be closer to half the market’s value.”

What is left after you remove all of those physical assets? Intangibles, the things “you can’t see or count.”

Make a list of all intellectual property owned by these companies, and it includes: patents, algorithms, trademarks, software code, payment processing platforms, brands, logistical expertise, advertising platforms, user networks, ecosystems, supply chains, drug formulas, reputations, and good will.

The digital world is intangible.

The premium of the market relative to its hard assets is at a record: The S&P 500 trades at more than 12X its tangible book value. Detractors describe this as a bubble, similar to the dot-com boom & bust of the 1990s; Advocates note this is a reflection of a deep change in the way companies operate, a lasting trend that explains shifting valuations.

I find myself in the latter camp: The rise of P/E multiples over the past 30 years can in part be explained by these secular changes. Tech companies require less capital, less physical goods, and less labor to create intangible products. And, they have the benefit of scale, with practically zero additional cost for each new marginal unit produced. When we discuss valuations and multiples expanding, this is a key driver. (And yes, I am confirming my priors here).

At a certain point, big tech prices will completely decouple from reality, eventually leading to a crash. This happens every cycle. But the shift in hard versus soft assets, and the valuations we assign to them might be permanently changed.

Sources:

Epic S&P 500 Rally Is Powered by Assets You Can’t See or Touch

Sarah Ponczek

Bloomberg October 21, 2020

https://bloom.bg/35m89Xc

2019 Intangible Assets Financial Statement Impact Comparison Report

AON/Ponemon Institute

April 2019

https://aon.io/2TdDO7z