My mid-week morning train WFH reads:

• What Stays and What Goes in a Post-Covid-19 World Some pandemic-induced consumer behavior will prove sticky, but not all. With effective vaccines on the horizon, the most important question for investors is how much never goes back to the way it used to be. The answers will have major implications for swaths of the economy. Each affected industry has its own nuances to consider. (Wall Street Journal)

• We Begin Our Lives as Growth Stocks, But End Our Lives As Value Stocks What’s normal is lowering your expectations over time to the point where, as you head into old age, pleasant surprises will provide you with additional happiness. The high expectations of youth (growth) eventually get replaced by lower expectations and upside surprises as you age (value). (Of Dollars And Data)

• Mutual fund conversions to ETFs gather momentum: Moves by two US asset managers to convert some of their mutual funds into exchange traded funds could trigger a wave of copycat manoeuvres by rival houses, industry figures believe. Latest attempt by Dimensional could be start of ‘significant trend’ if move proves to be successful (Financial Times)

• Social media companies all starting to look the same: Tech platforms used to focus on ways to create wildly different products to attract audiences. Today, they all have similar features, and instead differentiate themselves with their philosophies, values and use cases. (Axios)

• How ABS Survived the March Wipeout and Staged a Comeback “They’re liquid and have predictable cash flows.” Asset-backed securities, the runt of fixed income, has had a little-noticed turnaround. Its position as a popular diversifying asset, with steady revenue streams and sturdy cash flows. Yields tend to be low— often not much better than Treasuries but the relative peace of mind ABS bring is welcome. (CIO)

• After Chaotic 4 Years, Wall St. Is Itching to Unfollow @realDonaldTrump President Trump turned his Twitter feed into a singular source of market volatility. Now, investors are looking forward to markets free of presidential tweets. (New York Times)

• Spotify Loves You. Will Everyone Else? How the streaming platform’s playlists became a market-shifting force in the music industry. “Lorem,” a Spotify playlist which launched early last year, has unexpectedly risen to become one of the most powerful opportunities for new artists to break through on the streaming platform, and in the wider music industry. (Hype Beast)

• Two Rural States With GOP Governors And Very Different COVID-19 Results South Dakota’s Governor loudly refused to impose any shutdowns or a statewide mask mandate; at 8000 infections per 100,000 people, SD’s infection rate is among the worst in the nation. Vermont’s Governor embraced safety measures, and has 500 infections per 100,000 people. That’s the lowest rate in the nation. (NPR)

• The Divide Between Political Parties Feels Big. Fortunately, It’s Smaller Than We Think. Democrats and Republicans do disagree with and dislike each other. But members of both parties overestimate the size of the partisan divide. The judgements that we make about what others believe can be very inaccurate. Misperceive the beliefs of those who belong to a different political party can have damaging consequences for democracy. (Behavioral Scientist)

• What is the Eisenhower Matrix? The Eisenhower Matrix, also referred to as Urgent-Important Matrix, helps you decide on and prioritize tasks by urgency and importance, sorting out less urgent and important tasks which you should either delegate or not do at all. (Eisenhower)

Be sure to check out our Masters in Business interview this weekend with Dennis Lynch, Head of Counterpoint Global at Morgan Stanley Investment Management, running $130 billion. Several of the funds Lynch runs have doubled YTD in 2020.

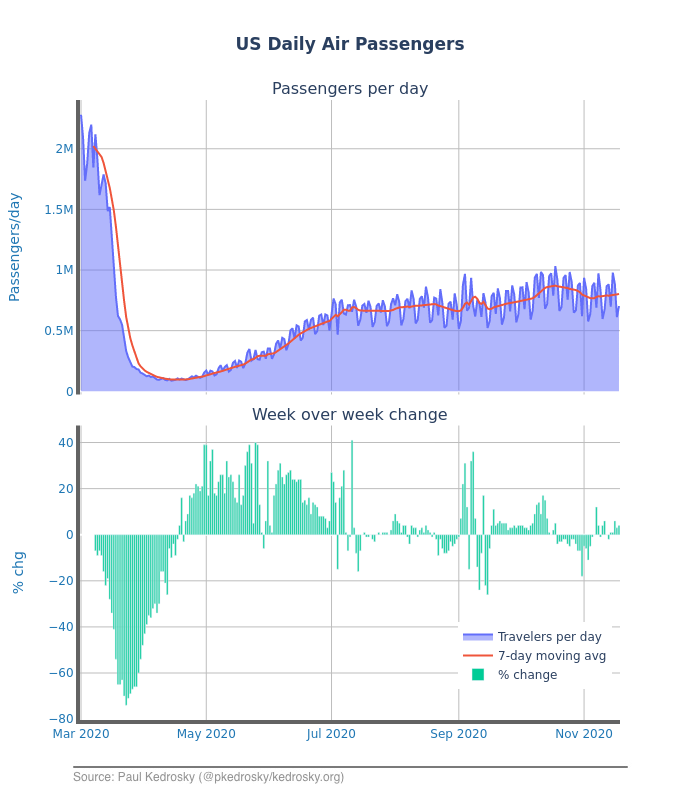

US Daily Air Passengers

Source: Paul Kedrosky

Sign up for our reads-only mailing list here.