The weekend is here! Pour yourself a mug of Tucson Coffee Roasters Monsoon coffee, grab a seat by the fire, and get ready for our longer form weekend reads:

• The Essex Boys: How Nine Traders Hit a Gusher With Negative Oil “They had balls of steel. It was quite unbelievable to see.” Among the many previously unthinkable moments of 2020, one of the strangest occurred on April 20, when the price of crude oil fell below zero. Over the course of a few hours, a guy called Cuddles and eight of his pals from the freewheeling world of London’s commodities markets rode oil’s crash to a $660 million profit. (Businessweek)

• How One of the Reddest States Became the Nation’s Hottest Weed Market Oklahoma entered the world of legal cannabis late, but its hands-off approach launched a boom and a new nickname: ‘Toke-lahoma.’ Voters in the staunchly conservative state had authorized a medical marijuana program and sales were just beginning. They immediately saw the potential for the fledgling market. With no limits on marijuana business licenses, scant restrictions on who can obtain a medical card, and cheap land, energy and building materials, Oklahoma could become a free-market weed utopia. (Politico)

• From Elon Musk to Jeff Bezos: 2020’s Top Climate Grifters Amid the life-threateningly urgent climate crisis, it’s bad enough to pollute the planet with greenhouse gases. But to add insult to injury, some of the people and firms responsible for that pollution have tried to dress themselves up as climate heroes. You know the type: the ones who spent 2020 hiding behind gentle, Earth-friendly language to hide their Earth-destroying agendas. These are some of the biggest climate grifters of 2020. (Gizmodo)

• How Compass Became the Bane of Real Estate “They’re a disruptor by capital, not innovation. It’s amazing it’s gotten this far. They’re a brokerage that doesn’t offer anything different; they’re just better at selling an idea.” The high-tech real estate startup boasts SoftBank backing, a $1.6 billion war chest, and plenty of skeptics. Now it’s cashing in on the pandemic real estate boom. But with the SoftBank backing and massive valuation, there have been no shortage of Compass comparisons to WeWork. Compass has acquired more than a dozen brokerages, expanding from 37 to 122 markets in 2018, seducing brokers with unsustainably high commissions. A real estate executive in New York City who doesn’t compete with the firm says the startup’s greatest strength isn’t technology — but good old-fashioned brute force. (Marker)

• Institutional Investor of the Year: BlackRock’s Larry Fink In a year marked by a global pandemic, racial justice protests, and a climate reckoning, Fink was the undisputed industry leader — and the obvious choice for this inaugural honor. (Institutional Investor)

• The Gadfly of American Plutocracy Far from a marginal outsider, a new biography contends, Thorstein Veblen was the most important economic thinker of the Gilded Age. His critiques of capitalism and economic theory speak to our own era of economic injustice. Living through economic convulsion and class conflict unlike any other in U.S. history, he often preferred to retreat into the long view of an evolutionary perspective that reduced the present to a little speck in the passage of millennia. (Boston Review)

• Social Strikes Back Until recently, it was commonly accepted that “social” was done. The market had been fully saturated, the thinking went, dominated by the holy trinity of Facebook, Twitter, and Instagram. Turns out, rumors of social’s demise have been greatly exaggerated. Not only are we seeing the rise of innovative new social networks—from the earshare of Clubhouse to the seamless interactivity of cloud gaming—but having a social component has become a powerful acquisition and retention tool for every consumer product, across education, shopping, fitness, food, entertainment, and more. (Andreessen Horowitz)

• It can be hard to hear your mum thinks the Earth is flat. But saving a loved one from conspiracy theories is possible It was on their weekly video call that she first noticed the flat Earth poster in her mother’s house. She let her mum talk about her theories and occasionally asked probing questions, but otherwise didn’t engage. She didn’t know it at the time, but the flat Earth poster was the first sign her mother was drifting away from her friends and family. Over the next two years she seemed increasingly unable to talk about anything else — not just flat Earth theory, but chemtrails, 9/11 truth, the “Plandemic,” and arguing the Holocaust never happened. The final straw came when she was peddling anti-vaccination conspiracies while tutoring Kasey’s grandchildren. (ABC News)

• You can buy a robot to keep your lonely grandparents company. Should you? Even before Covid-19 came around, robots like were being introduced in nursing homes and other settings where lonely people are in need of companionship — especially in aging societies like Japan, Denmark, and Italy. Now, the pandemic has provided the ultimate use case for them. Retirement communities and senior services departments in New York, Florida, Alabama, Pennsylvania, and several other states have begun buying robots for older adults. As many seniors face down the winter holidays alone, it may be tempting to give them a companion robot as a gift. (Vox)

• 64 Reasons To Celebrate Paul McCartney After all these years, he’s still underrated. In 1956, when Paul McCartney was 14, he sat down at his Dad’s piano and tried to come up with his own song. For years he had been breathing in songs from radio and TV and movies and family singalongs. Folk songs, show-tunes, pop hits, jazz standards, music hall numbers. He’d heard his dad play a tune of his own, a party piece, and now he thought he would have a crack at it himself. Why not? He soon got quite good at it. His early efforts included a jaunty number, written when he was 16, called “When I’m Sixty-Four.” (Ian Leslie)

Be sure to check out our Masters in Business interview this weekend with Mike Swell, head of Global Fixed Income at Goldman Sachs Asset Management (GSAM). Swell is responsible for co-leading the global team of portfolio managers that oversee more than $700 billion in multi-sector bond portfolios.

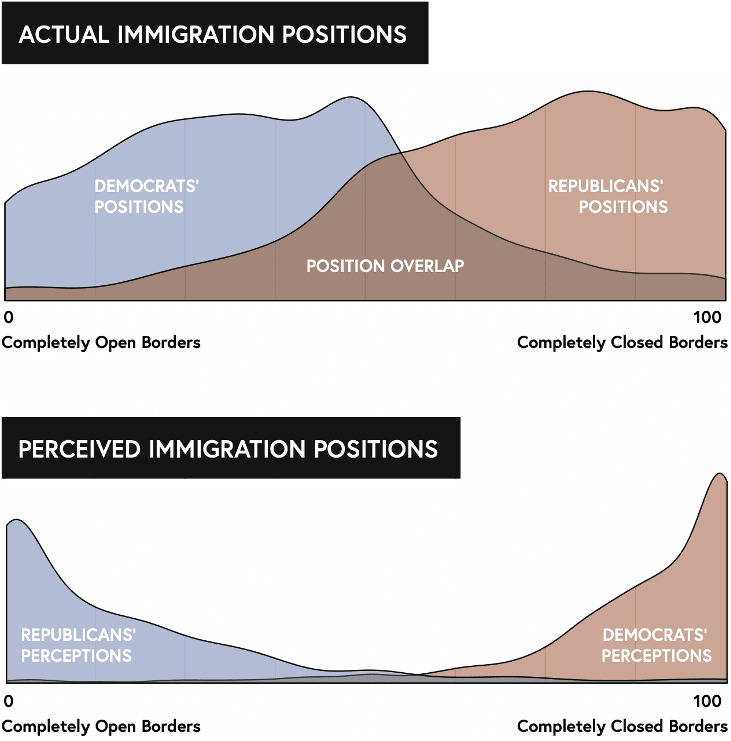

The Divide Between Political Parties Feels Big. Fortunately, It’s Smaller Than We Think.

Source: Behavioral Scientist

Sign up for our reads-only mailing list here.