This week, we speak with Doug Braunstein, founder and managing partner at Hudson Executive Capital, which has underwritten several successful SPAC offerings, with $1.6B in AUM. Previously, he was Chief Financial Officer at JPMorgan Chase, where he worked directly with Jamie Dimon as a member of JPMorgan’s Executive Committee. He also served as head of JPMorgan’s Americas Investment Banking and Global M&A.

Braunstein tries to take a “private equity” approach to public companies. He explains why the SPAC structure works so well for mid-sized firms versus the traditional initial public offerings (See HECCU/TALK merger). The specifics are better known in advance (unlike in an IPO), and its faster and more flexible. The disclosures are better as well, including revenue and profit projections. This could allow for the ability to be patient and invest longer term.

Hudson Executive Capital has a substantial stake in Deutsche Bank since 2018; the bank has suffered from a number of scandals, trading losses, and self-inflicted wounds. DB now has new management, and is in the early stages of a turnaround. Its one of the few banks considered a “national champion,” with the potential to grow tremendously from its current $24 billion market cap.

He also discusses why JPM Chase’s “fortress balance sheet” allowed the firm to take advantage of numerous opportunities during the financial crisis of 2008-09. They acquired Bear Stearns and Washington Mutual cheaply — was each having a temporary liquidity crisis; they also passed on Lehman Brothers which was having a more serious solvency issue; they also helped with the workout of AIG. Braunstein called being CFO of JPM Chase a “remarkable privilege” and an “awesome responsibility.”

A list of his favorite books are here; A transcript of our conversation is available here.

You can stream and download our full conversation, including the podcast extras on iTunes, Spotify, Stitcher, Google, Bloomberg, and Acast. All of our earlier podcasts on your favorite pod hosts can be found here.

Be sure to check out our Masters in Business next week with Jean Hynes, incoming CEO of Wellington Management. The firm has over $1 trillion client assets under management. Hynes also runs the $51B Vanguard Healthcare Fund – the country’s largest health care fund.

Doug Braunstein Favorite Books

Team of Rivals: The Political Genius of Abraham Lincoln by Doris Kearns Goodwin

Moneyball: The Art of Winning an Unfair Game by Michael Lewis

Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System–and Themselves by Andrew Ross Sorkin

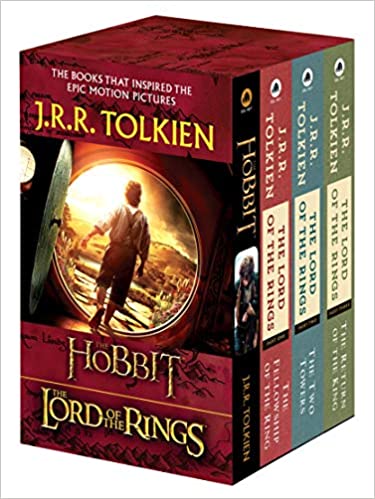

The Hobbit and The Lord of the Rings by J.R.R. Tolkien

Books Barry Mentioned

The Premonition: A Pandemic Story by Michael Lewis