The weekend is here! Pour yourself a mug of Brooklyn Roasting Company 3D coffee, grab a seat by the fire, and get ready for our longer form weekend reads:

• Bill Gates Has a Master Plan for Battling Climate Change The co-founder of Microsoft became obsessed with developing clean tech through his philanthropic work. With a new book, ‘How to Avoid a Climate Disaster,’ and a cadre of billionaire partners, he now has an action plan for ending the world’s carbon dependency. (Wall Street Journal)

• The Man Who Abandoned Value When Arne Alsin wrote about investing in disruptive companies two years ago, one commentator called it “one of the dumbest articles ever written.” After a 274 percent year, Alsin isn’t the one who looks dumb. (Institutional Investor)

• At 93, She Waged War on JPMorgan—and Her Own Grandsons Beverley Schottenstein said two grandsons who managed her money at JPMorgan forged documents, ran up commissions with inappropriate trading and made her miss tens of millions of dollars in gains. So she decided to teach them all a lesson. (Bloomberg Wealth)

• ‘Digital tulip’ or new asset class? Bitcoin’s bid to go mainstream The cryptocurrency’s embrace by Elon Musk and America’s oldest bank suggests it is starting to win institutional acceptance. (Financial Times)

• The Profile Dossier: Charlie Munger, the Master of Mental Models To avoid ignorance and stupidity, Munger is famous for knitting together ideas from a variety of disciplines to create what he calls a “latticework of mental models.” Mental models refer to the frameworks that help us simplify and understand the world. They also help us clarify our thinking and make better decisions. (The Profile)

• Anti-Vaxxers Misuse Federal Data to Falsely Claim COVID Vaccines Are Dangerous VAERS, a database of reports of vaccine side effects, is being abused by people trying to sow fear. It’s not the first time. (Vice)

• Waze Founder/CEO: Why did I leave Google or, why did I stay so long? Difficulties of breaching the gap between an Israeli and a US company, a startup and a corporation, and the Israeli culture of immediacy and corporate political correctness. (PayGo)

• Portrait of a Clubhouse skeptic the platform has also been permeated by the kind of hustle-culture brain rot that emerges from any platform that mixes social media and professionalism (Here’s looking at you, LinkedIn) (Medialyte) But see Clubhouse’s Inevitability Clubhouse, meanwhile, Silicon Valley’s hottest consumer startup, feels like the opposite case: in retrospect its emergence feels like it was inevitable — if anything, the question is what took so long for audio to follow the same path as text, images, and video. (Stratechery)

• The Long Hack: How China Exploited a U.S. Tech Supplier For years, U.S. investigators found tampering in products made by Super Micro Computer Inc. The company says it was never told. Neither was the public. (Bloomberg)

• A Quite Possibly Wonderful Summer Families will gather. Restaurants will reopen. People will travel. The pandemic may feel like it’s behind us—even if it’s not. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Doug Braunstein, former Chief Financial Officer at JPMorgan Chase. Braunstein is founder and managing partner at Hudson Executive Capital, which has underwritten several successful SPAC offerings, with $1.6B in AUM. Braunstein worked directly with Jamie Dimon as CFO and a member of JPMorgan’s Executive Committee. He served as head of JPMorgan’s Americas Investment Banking and Global M&A.

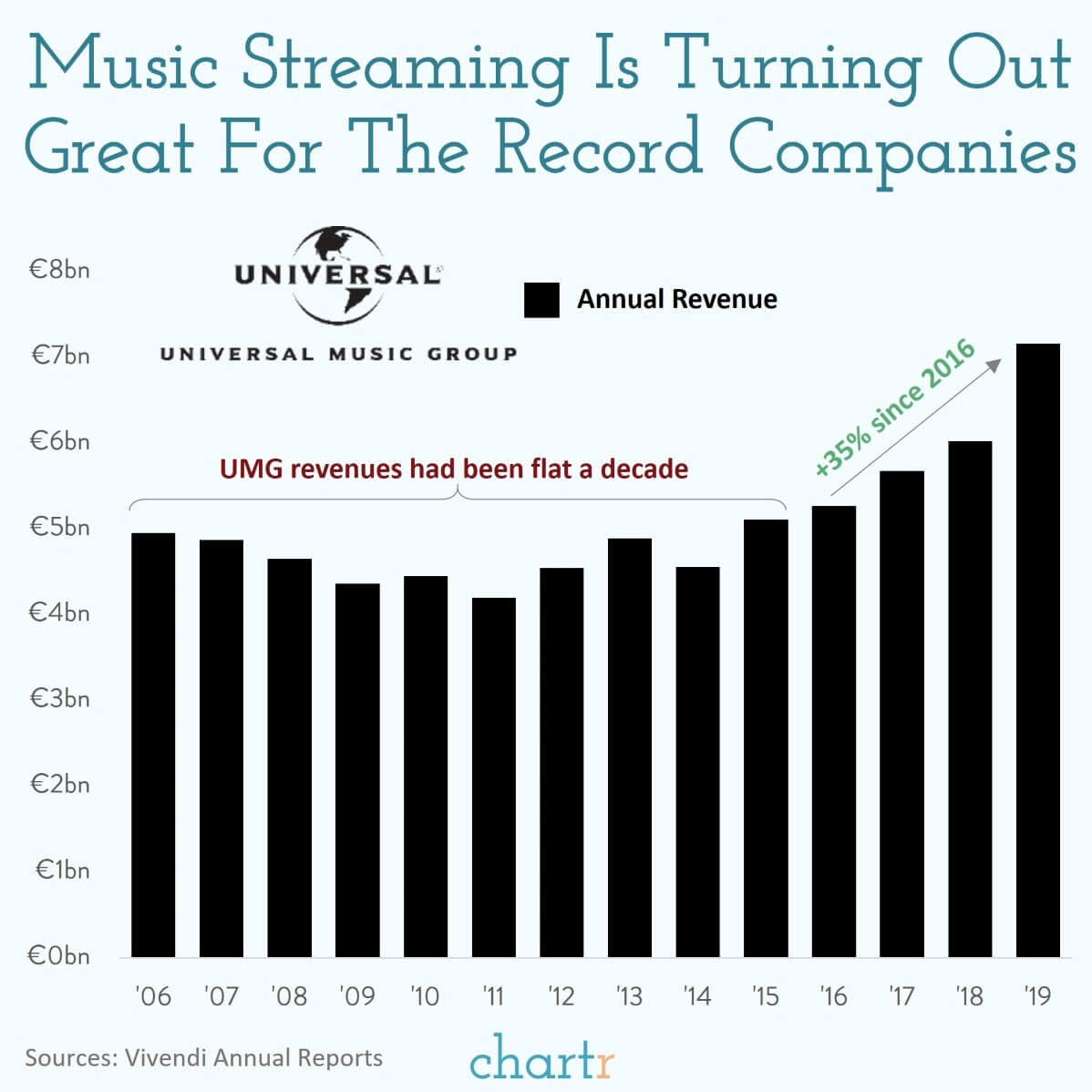

French conglomerate Vivendi is spinning out UMG at a €30bn valuation

Source: Chartr

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.