Do you understand Bitcoin and Blockchain? I don’t mean abstractly, I mean specifically, do you grok it as a trader or investor?

If not — and I have huge gaps in my own understanding of it — then you will find the huge discussion out today from Bank of America Global Research enormously helpful. Its a killer long form research piece titled “Bitcoin’s dirty little secrets.” I found it to be more than a great primer — its filled with all of those fascinating data points about Crypto as a trading vehicle and asset class that I found insightful.

Its copyrighted, so I can’t/won’t post it, but I can share with you what I found to be the most interesting data points:

10 Surprising Facts About Bitcoin

1. Concentrated Ownership: About 95% of Bitcoin is controlled by just 2.4% of the accounts, and distribution is heavily skewed towards the largest accounts. By comparison, the latest Fed data suggests that the top 1% of Americans control about 30.4% of all household wealth in the US.

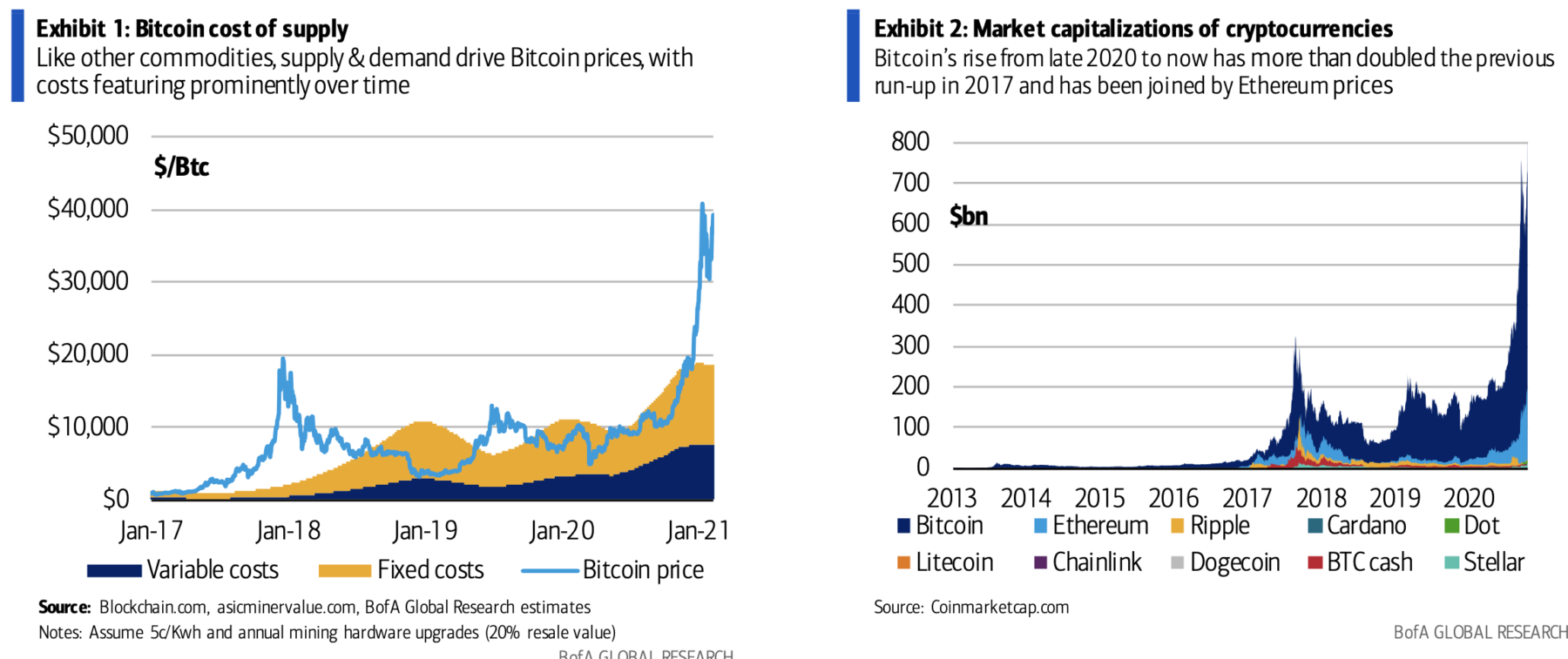

2. Volatile Prices: Bitcoin volatility is well above that of FX, gold, and even silver. Bitcoin volatility in 2021 is already the second highest in history year-to-date. Even after 10+ years of trading, Bitcoin has failed to develop some price stability. (Gini coefficient = .986 )

3. Dollar Denomination: ~80% of Bitcoin is exchanged in dollars (Exhibit 29), while other currencies like the EUR, the JPY, and the KRW account for 19%, .01%, and .43% of Bitcoin trading, respectively.

4. Correlation. Bitcoin no longer uncorrelated to other major risk assets. BAML finds the crypto-currency more positively correlates with equities and commodities, while it is neutral/slightly negatively correlated to haven assets such as the dollar and US treasuries. Note too that Bitcoin prices are closely correlated to Google searches.

5. Largest Hodler: Grayscale (GBTC) is now the largest public holder of Bitcoin. GBTC is an open-ended trust that provides exposure to Bitcoin, launched in Sep-13 and started trading OTC in May-15. AUM sits at $37bn, having increased more than 10x last year.

6. Steady Trading Volume: The number of daily Bitcoin transactions has averaged 287k in the past four years. Transactions have remained steady as prices rose. Surges in Bitcoin trading liquidity was perhaps one of the most important features of this emerging asset. Yet, much of the growth in crypto in recent years has not translated into increased Bitcoin liquidity.

7. Poor ESG Score: The E in Bitcoin is a major environmental disaster as Bitcoin prices are directly correlated to its energy consumption. The rising complexity that underpins Bitcoin is its biggest asset and the biggest flaw of the entire system. The energy consumption of the entire system have propelled Bitcoin’s CO2 emissions higher. (Half of China Bitcoin mining happens in coal-heavy Xinjiang province).

8. Bitcoin is a unique asset class: There is simply no other major asset that shares Bitcoin’s features due to its supply mechanics, ownership concentration, and historical performance. Ownership concentration is particularly severe. A small set of total accounts owns a massive portion of Bitcoin, leaving the asset vulnerable to sharp price swings on account of movements in these “whale” accounts.

9. Decentralized finance (DeFi): DeFi is the most fundamental challenge to modern finance that we’ve encountered. Modern finance works on the basis of there being trusted entities acting as central points for providing various services and filling various functions. DeFi is different, seeking to replace a range of centralized, regulated institutions with decentralized systems, typically based on the Ethereum blockchain.

10. Biggest Threat to Bitcoin: CBDCs: Central bank digital currencies (“CBDC”) would represent a major break with the status quo; in this, they are like cryptocurrencies. However, we think they are likely to differ technologically from cryptos, and are in part motivated by central banks’ wanting to defend their territory from cryptos and their relatives.

Its a fascinating read, worth your time to plow through all 50 pages…

Source:

Bitcoin’s dirty little secrets

Francisco Blanch, with Savita Subramanian, Philip Middleton, et. al.

BofA Global Research, 17 March 2021