My mid-week morning train WFH reads:

• Howard Marks: 2020 In Review We are left to contemplate the jaw-dropping list of extremes compiled during this turbulent year: We had a health emergency, an ailing economy, the most generous capital market of all time, and strong stocks and bond markets. This seemingly anomalous relationship between the pandemic and recession on one hand and the strong capital and stock markets on the other can be explained by the Fed’s and the U.S. Treasury’s aggressive actions. (Oaktree Capital)

• Economies can survive a stock market crash If a correction is due to higher rates and stronger growth, it would not matter much — except to investors (Financial Times)

• Chamath Palihapitiya Weighs Lessons from a ‘Tough Week’ With his deals seeing double-digit declines, the venture capital star encourages fellow investors not to be afraid of making changes. (CIO)

• The Tactics People Are Using to Get Their Money Out of China Finding ways around the rules is something of a national pastime. (Bloomberg)

• Empathetic Robots Are Killing Off the World’s Call-Center Industry That’s a growing threat to the Philippines, where outsourcing accounts for 9% of the economy (Businessweek)

• Why Would Anyone Open a Restaurant in a Pandemic? Those that did may be better off, their owners say, because they could meet the moment’s restrictions and cravings from the very start. (New York Times)

• Wikipedia Is Finally Asking Big Tech to Pay Up The Big Four all lean on the encyclopedia at no cost. With the launch of Wikimedia Enterprise, the volunteer project will change that—and possibly itself too. (Wired)

• Massive Facebook study on users’ doubt in vaccines finds a small group appears to play a big role in pushing the skepticism Internal study finds a QAnon connection and that content that doesn’t break the rules may be causing ‘substantial’ harm (Washington Post)

• Not tonight, darling: how the world lost its libido – and how it can get it back After a year of lockdowns, home schooling, social distancing and stress, sex drives are suffering – among both couples and single people. Can we do anything about it – or do we just have to wait till the end of the pandemic? (The Guardian)

• What an interesting life: Steven Spurrier & the Judgment of Paris I don’t usually reads obituaries, but this one detailing how Steven Spurrier upended the wine world by comparing California and French wines in a blind tasting with all French judges (“Judgment of Paris”) is fascinating. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Bill Gurley, the legendary venture capital investor at Benchmark. His investments include GrubHub, Nextdoor, OpenTable, Zillow and of course, Uber. He is a member of the Board of Trustees of the Santa Fe Institute, and is widely considered one of most influential dealmakers in technology. He was named TechCrunch’s VC of the Year in 2016.

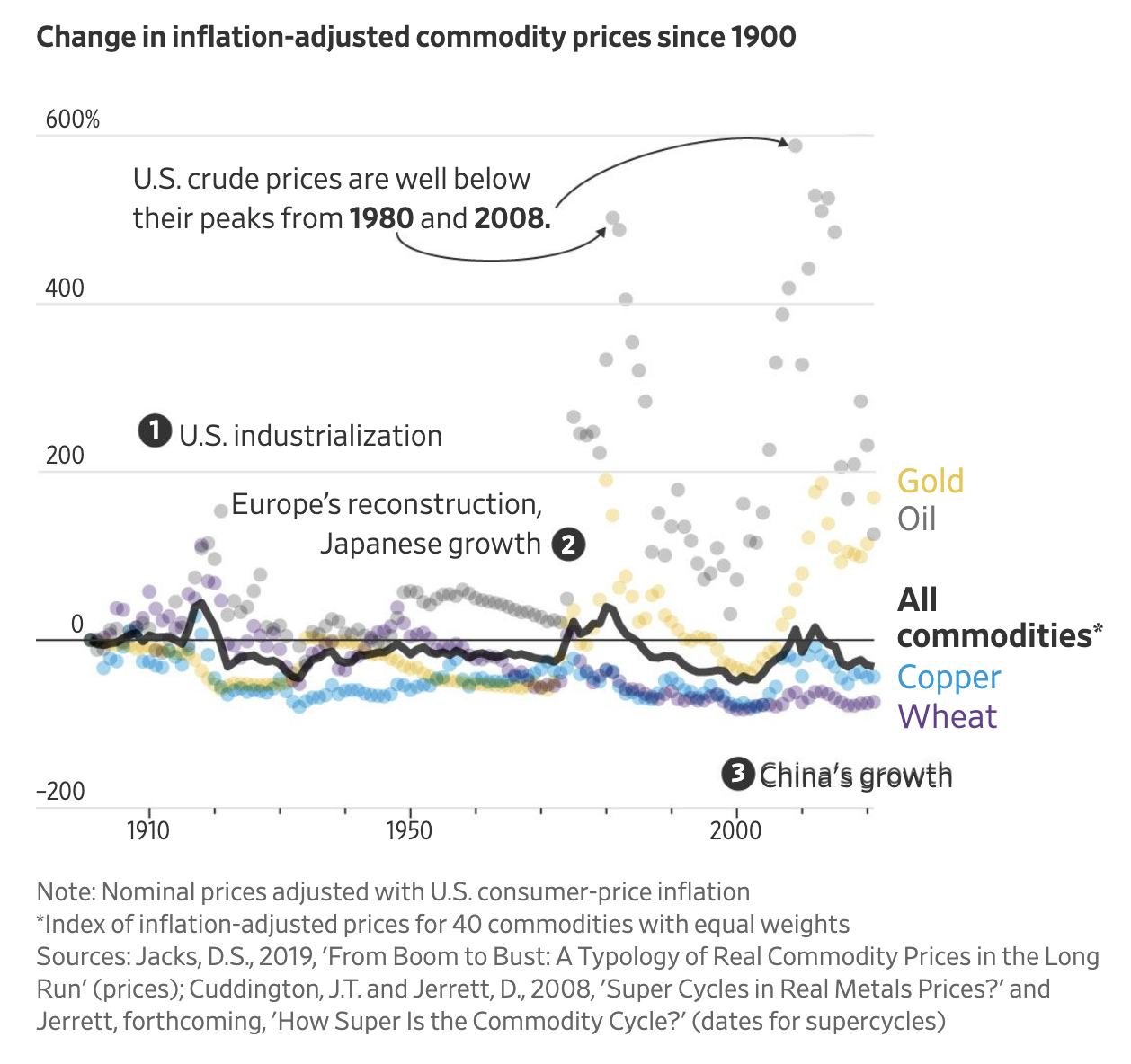

Commodities Supercycle Looks Like a Stretch

Source: Wall Street Journal

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.