My Two-for-Tuesday morning train WFH reads:

• From Wall Street to Main Street, here’s what the economy looks like one year after the pandemic brought everything to a halt Wave after wave of stimulus spending coupled with unprecedented moves by the Federal Reserve to keep ultra-low-rate loans flowing to Wall Street and corporate America. Even if growth surges to a red-hot 6%, many parts of the economy will still end the year deep in the pandemic hole they fell into last spring. (Bloomberg) but see 17 Reasons to Let the Economic Optimism Begin A reporter who has tracked decades of gloomy trends sees things lining up for roaring growth. (New York Times)

• From Bowie Bonds to Pipe: Financing Recurring Revenue The idea that a predictable set of cash flows can be traded for cash proved alluring. A special financial structure called a whole business securitization emerged to channel sticky cash flow streams to investors. Today, it is used by companies which generate steady streams of income without the tangible assets that would provide the backbone for more conventional securitizations. (Net Interest)

• Why Bond Investors (and Wise Men) Got Inflation Wrong Recent history has tended to mock the financial worrywarts, and for understandable reasons. (Bloomberg) see also Stop Stressing About Inflation Inflation is periodic, driven by specific events; Deflation is consistent, the background state of the modern economy. (TBP)

• The billionaire boom Elon Musk, Jeff Bezos, Mark Zuckerberg and six other tech titans made more than $360 billion during the pandemic, which may finally shatter the myth of the benevolent billionaire (Washington Post)

• The Pandemic Ignited a Housing Boom—but It’s Different From the Last One Residential home sales are hitting peaks last seen in 2006, just before the bubble burst, but this time mortgages are stricter, down payments are higher, and a tight supply is supporting prices (Wall Street Journal) see also The Housing Boom That Never Ends Already Wiped Out All the Short-Sellers Real estate dominates Canada’s economy to an alarming degree (Bloomberg)

• Twitter is reinventing itself Building an experience within Twitter can be a layer of fabric that lets people talk with their voice; There’s some mechanics inspired from other startups that are doing this. Fundamentally, the way Twitter builds Spaces will look and feel very different than how some other platform tackle it. Therein lies the challenge and the opportunity for building a great product. (The Verge)

• Why Do Some People Hate Cathie Wood? Her investors are not completely inelastic, but it’s going to take a lot longer for the love affair to end than her haters believe. I don’t know if that’s months or quarters, but I’m sure it’s not days or weeks. (Irrelevant Investor) see also No Room on the ARK? As the firm skyrockets up the industry league table, investors should be asking whether the kind of performance that has landed ARK on its current perch is sustainable—especially as capacity concerns mount. (Morningstar)

• The Coronavirus Killed the Gospel of Small Government Markets crashed, unemployment soared, and America remembered that the economy serves society, not the other way around. (New York Times)

• Metakovan, the mystery Beeple art buyer, and his NFT/DeFi scheme After the barest amount of digging, I am going to hazard a guess that the mystery Beeple buyer is Vignesh Sundaresan, a crypto entrepreneur who has been in the crypto landscape for about seven years. (Amy Castor) but see From Crypto Art to Trading Cards, Investment Manias Abound Each market frenzy seems crazier than the last. But all have the same roots. Mini-bubbles across a wide variety of esoteric categories, making once-obscure acronyms like SPACs and NFTs practically as ubiquitous as the S&P. (New York Times)

• Syria Ten Years Later: Blood and Blame Obama officials—some now in the Biden administration—are unwilling to admit their mistakes, even after years of humanitarian disasters and strategic blunders. (The Bulwark)

Be sure to check out our Masters in Business interview this past weekend with Jeff Immelt, former CEO of General Electric from 2001 to 2017. He joined GE in 1982, in its plastics, appliances, and healthcare division, and led GE’s Medical Systems division from 1997 to 2000. His new book is: Hot Seat: What I Learned Leading a Great American Company.

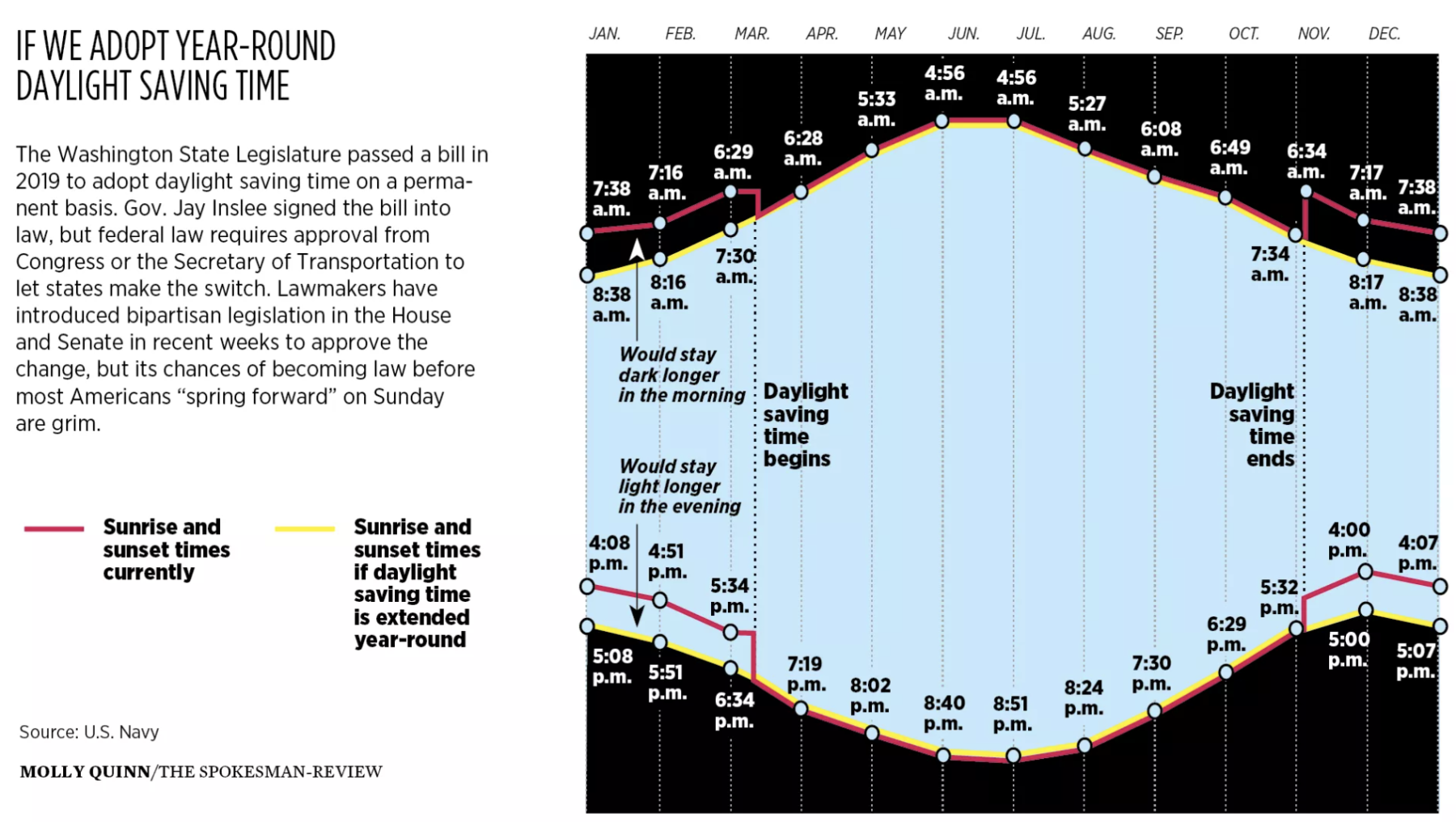

With bipartisan support in Congress for permanent daylight saving time, could this weekend’s time change be the last?

Source: Spokesman Review

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.