Source: Credit Suisse

To hear an audio spoken word version of this post, click here.

How lucky was the year of your birth?

That is a question we do not usually spend much time thinking about. Yet it is one of the most consequential aspects of investing.

We often overlook the difference between skill and luck. We tend to overestimate our own skill, while underestimating the impact of random chance on a variety of outcomes, from our career to our portfolio performance. But one of the things that might have the greatest impact on how well you do as an investor is simply the year you were born – a thing that’s completely out of your control, and about as random as it can get.

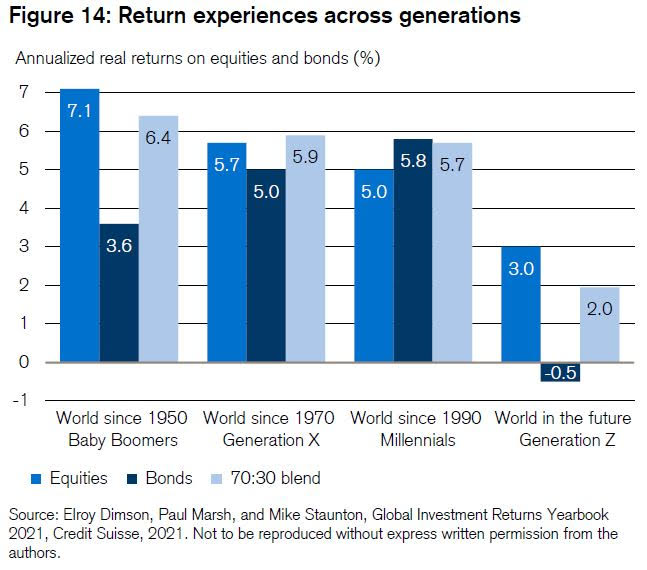

Consider the chart above from Credit Suisse: It shows investing returns relative to broad eras, broken up over 20 year increments. If you were fortunate enough to be born a Boomer, your equity returns are over 7% annualized. Gen Z? 3%. Gen X and Millennials 5.7 and 5.0 respectively. Compounded over a lifetime, those modest variances in annual returns yield massive differences in investment results.

There are similar impacts in spaces like real estate, also determined in large part by the year you shop for your first house. This is driven by many factors — marriage, children, school, career, etc. — but more than anything else, what drives those factors is the year you were born. My parents bought their second house in the 1970s; they had done well enough with the house they bought in the late 1960s that they could trade up from Teaneck, NJ to Plainview, NY (I did not want to move). Some 20+ years later, that 2nd home sold it for 10X what they paid. (Had mom waited another decade, it was closer to 30X). Those of you who bought a home in the mid-2000s, well, its almost 20 years later and, depending upon where you live, you may barely be back to break even.

I have heard real estate people claim their positive results are due to skillful analysis, an ability to understand RRE’s intrinsic worth relative to a variety of factors, including interest rates, GDP, inflation, market trends, etc. Some people can create alpha in real estate, equities, etc. but I think much of the strong returns we have been seeing lately is in no small part due to dumb luck. All of which goes to say that we need to be aware of how much of our success or apparent success is really the result of fortuitous timing beyond our conscious control.

I don’t relate to either the Boomers, who are mostly older than me, or the GenX-ers, who are mostly younger than me. I fall in the valley between them. While I was coming up in finance, the guys older than me had all made their fortunes during the bull market of the ’80s and ’90s, while I was in college and grad school. I missed much of the run up in the 1990s because I was a decade behind in my accumulation of skills and capital. At the time, I felt unlucky to have missed that run up.

It was only later in life I came to realize how many of those fortunes were lost in the 2000 Dotcom implosion. People freely brag about how much money they were making on the way up, but they tend to be more circumspect about how much money they are losing on the way down. Had I had a decent amount of risk capital to parlay into a small 1990s dotcom fortune, I can confidently say today I would have been part of that crash cohort: Temporarily flush with sudden riches, and then just as suddenly broke.

This is not false modesty but rather, a simply admission of how little I knew when I was starting out in this industry 25 years ago. Wisdom is hard to come by. Metacognition, recognizing when you are skillful or lucky is in itself an under-appreciated skill.

I have been fortunate to be dumb lucky for a while.

UPDATE: March 17, 2021

I meant to include this astonishing data point via Nick Maggiulli (but only linked it above):

“If you had invested from 1960-1980 and beaten the market by 5% each year, you would have made less money than if you had invested from 1980-2000 and underperformed the market by 5% a year When you were born > almost everything else.”

Compelling…

See also:

Patterned By Birth (The Irrelevant Investor, September 9, 2015)

Bad Investment Results? Your Birth Year May Be to Blame (Of Dollars and Data, May 9, 2017)

When You Were Born > Everything Else (The Irrelevant Investor, February 13, 2020)

Previously:

Never Confuse a Lucky Break With Smart Investing (April 1, 2019)

Investing is Not Gambling (and Vice Versa) (January 13, 2016)

Masters in Business: Michael Mauboussin on Untangling Skill and Luck (August 4, 2014)

Masters in Business Return of Michael Mauboussin (August 16, 2016)

click for audio