This week was the one year anniversary of the March 23, 2020 market lows.

These sorts of things always lead to a media spasm of coverage, followed by my annoyance of the same. I am working on a piece that pushes back on some of the hot takes that were filled with usual lack of context and foolish street myths.

One thing especially worth noticing is the tendency to treat buyers and sellers as a monolithic blocks.

They are not.

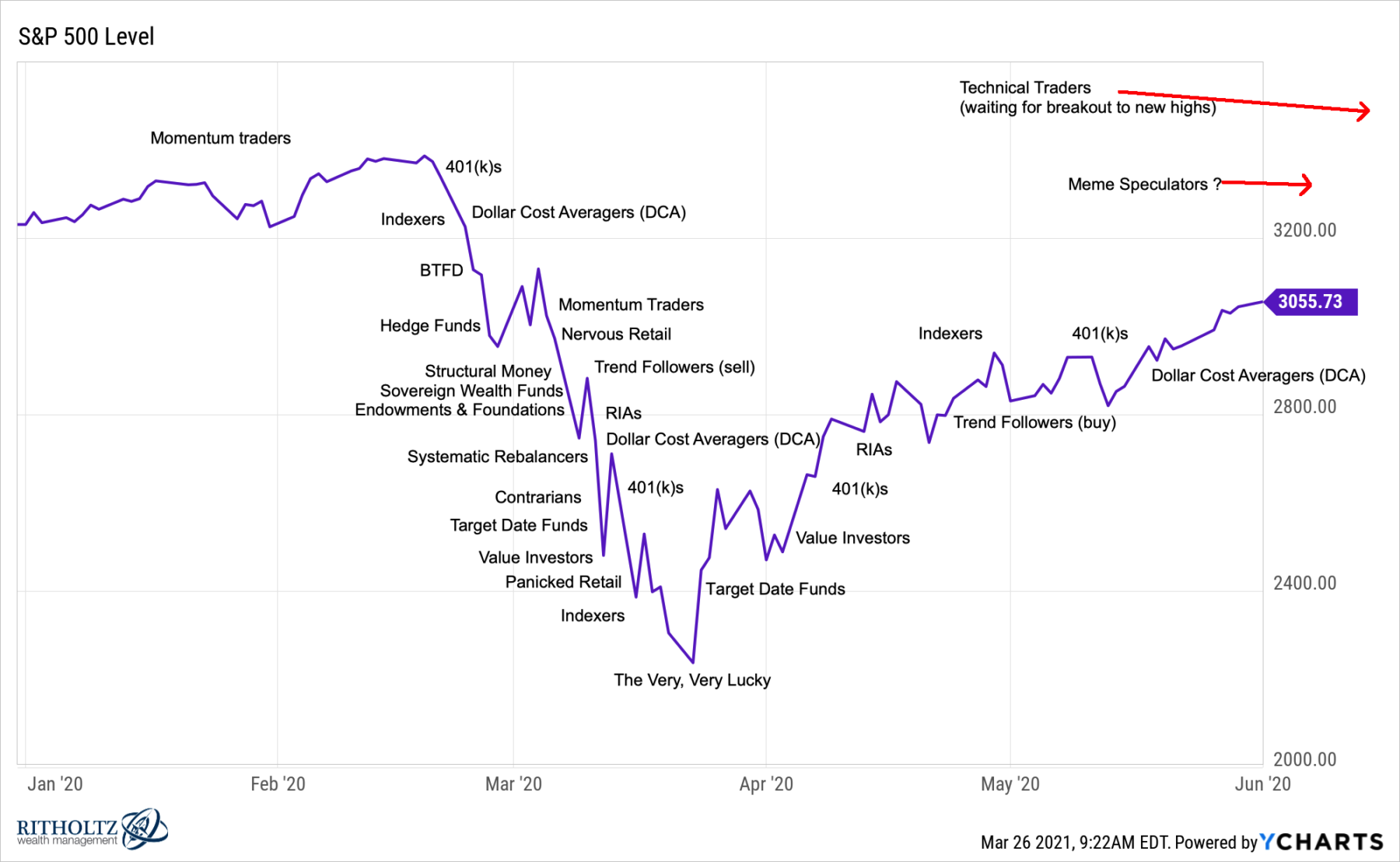

I am only spitballing here, but based on my experiences and some decidedly anecdotal information, different kinds of buyers and sellers come out at different times. I think it might look like some variation of the chart above.

More on this next week . . .

Buyers & Sellers

Trend/Momentum traders On sustained moves higher

401(k)s

Panicked Hedge Funds

Contrarians

Target Date Funds

The Very Lucky Lows

Structural Money*

Value Investors

Trend/Momentum traders On sustained moves lower

GARP Buyers

Passive Indexers, DCA

401(k)s

Technical traders New breakout highs

Active Stock Pickers

Meme Speculators ?

________________________

* Sovereign Wealth Funds, Market Makers, Prop Desks, Endowments & Foundations.