My end of week morning train WFH reads:

• Reverse Wealth Transfer on Steroids Stop scrolling, stop gaming, stop trading, stop making memes. Stop collecting things that don’t function and will, with the passage of just a year or two, become completely laughable. Nobody’s going to want to buy any of this stuff from you because they’re going to make 70 billion versions of everything you’re buying now. It’s artists today, but eventually it will be corporations. They will sell you limited edition ziploc bags filled with air if you demonstrate a willingness to buy it from them. (Reformed Broker)

• Goldman CEO’s Year of Empty Offices, Island Getaways and Strife The Goldman Sachs Gulfstream descended into the sun-kissed Bahamas that Friday with a familiar passenger aboard: David Solomon. Known for working relentlessly and for an abrasive style, which has rubbed raw at times during the virus outbreak as he’s shown annoyance with a scattered workforce. (Bloomberg)

• Marvel’s Most Superhuman Feat Was Saving Itself In 1996, Marvel filed for bankruptcy. Its business was in shambles. That wasn’t the first time in the company’s history that it stumbled hard—but each time it’s reemerged, stronger than before, like that supervillain you think you’ve defeated who suddenly reappears in the final battle. How is Marvel so resilient? Seems like its real superpower is making comebacks. (Slate)

• Hacksilver. Over the last month or two I’ve been following an interesting archaeological debate over the discovery of coinage. Silver served as the main measure of value, the means of payment and credit, and as an indirect form of exchange in Near Eastern economies from the mid-3rd millennium onward (Moneyness)

• Big Names Like a Once-Obscure Investment: The SPAC “I can’t believe we haven’t seen a Kim Kardashian SPAC yet.” (New York Times) see also The Celebrities From Serena Williams to A-Rod Fueling the SPAC Boom A list of the biggest names in sports and entertainment are behind the recent rise in blank-check companies (Wall Street Journal)

• America’s Covid Swab Supply Depends on Two Cousins Who Hate Each Other The pandemic brought the business opportunity of a lifetime to Puritan Medical Products of Guilford, Maine. But even a $250 million infusion from the U.S. government has done little to quell an epic family feud. (BusinessWeek)

• Cars Have Your Location. This Spy Firm Wants to Sell It to the U.S. Military 15 billion car locations. Nearly any country on Earth. ‘The Ulysses Group’ is pitching a powerful surveillance technology to the U.S. government. (Vice)

• 5 phrases to use to improve your emotional intelligence and relationships at work Phrases like “tell me more” and “thanks for understanding” shift the focus from yourself to others. (Business Insider)

• The engineers building ridiculous dart blasters that Nerf won’t touch Out of Darts is at the forefront of a cottage industry selling original blasters and parts that can leave the official Nerf brand (owned by giant Hasbro) in the dust. It’s almost something of an arms race, where the Nerf internet community one-ups each other by making their toy blasters shoot more foam faster, farther, and more accurately, whether to show off or to perform that much better in an actual game of Nerf. (The Verge)

• Dua Lipa’s Master Class in Pop Ubiquity Right around the pandemic’s true kickoff moment in the United States, the British pop star released her second album, “Future Nostalgia,” a polished trip through several eras of dance music: disco’s groovy pulse, new wave’s punchy synths, the brash colors of the 1980s New York club-kid house music that Madonna spent her early years so cannily borrowing from. “Future Nostalgia” offered a soundtrack to precisely the type of wild night that had gone extinct by the time the record actually reached listeners. (New York Times interactive)

Be sure to check out our Masters in Business interview this weekend with Bill Gurley, the legendary venture capital investor at Benchmark. His investments include GrubHub, Nextdoor, OpenTable, Zillow and of course, Uber. He is a member of the Board of Trustees of the Santa Fe Institute, and is widely considered one of most influential dealmakers in technology. He was named TechCrunch’s VC of the Year in 2016.

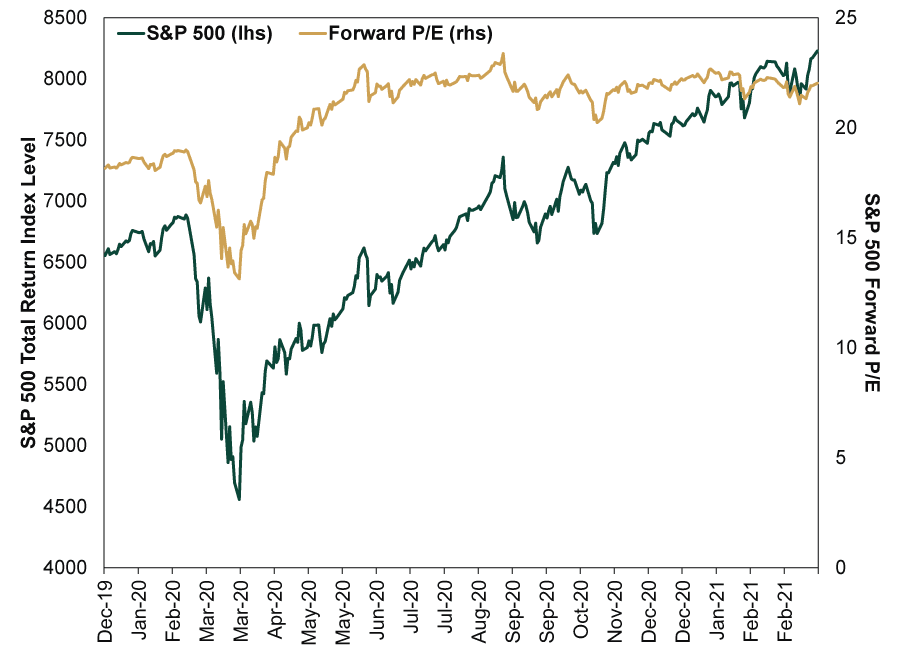

Stocks not overvalued? Its the E (not P) that’s driving P/Es these days

Source: Fisher Investments

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.