The weekend is here! Pour yourself a mug of French Mocha coffee, grab a seat on the massage chair, and get ready for our longer form weekend reads:

• How Robinhood Made Trading Easy—and Maybe Even Too Hard to Resist The app popularized zero-commission brokerage, eventually forcing its major competitors to follow, and introduced millions of millennials and Gen Zers to the market. It’s also attracted critics, including U.S. lawmakers and a state securities regulator, who say Robinhood makes investing very real money feel too much like a game and encourages frequent trading by its novice users. Is the app that brought zero-commission trades and a mobile-first design to millions of investors too good at what it does? (Bloomberg) see also The 4 Types of Robinhood Traders It’s important to remember not every Robinhood trader is the same. This new hoard of active investors isn’t all YOLO-ing their entire paychecks or stimulus payments. I see 4 different types of Robinhood traders. (A Wealth of Common Sense)

• The Rage of Carson Block He began by criticizing China, but his caustic gaze has landed everywhere, as he has taken on companies in Europe and the U.S. as well. He has opinions on everything from ESG to SPACs: “There’s so much dog shit there, a cynical predatory play on retail investors.” Prime brokers refused to do business with him, while feeding billions to Bill Hwang. Who’s laughing now? (Institutional Investor)

• Posen: The Price of Nostalgia: America’s Self-Defeating Economic Retreat What the U.S. economy needs now is greater exposure to pressure from abroad, not protectionist barriers or attempts to rescue specific industries in specific places. Instead of demonizing the changes brought about by international competition, the U.S. government needs to enact domestic policies that credibly enable workers to believe in a future that is not tied to their local employment prospects. The safety net should be broader and apply to people regardless of whether they have a job and no matter where they live. It is the self-deluding withdrawal from the international economy over the last 20 years that has failed American workers, not globalization itself. (Foreign Affairs)

• JetBlue’s Founder Is Preparing to Launch a New Airline in a Global Pandemic In the present environment, comfort with upheaval is an asset. It would be wrong to call the airline industry stable, with its rich history of bankruptcies, takeovers, and ruinous price wars—but it’s very hard to break into. David Neeleman has made his career and fortune doing just that. “After deregulation, the failure rate of new airlines has been in the mid-90s or up. Most people have done one new entrant—and failed. A few have maybe tried another one. David has been involved in four successful startups. It’s unmatched.” (Businessweek)

• Why Cryptocurrency Is A Giant Fraud Much of the cryptocurrency pitch is worse than fishy. It’s downright fraudulent, promising people benefits that they will not get and trying to trick them into believing in and spreading something that will not do them any good. Examine the actual arguments for using cryptocurrencies as currency, rather than just being wowed by the complex underlying system and words like “autonomy,” “global,” and “seamless,” the case for their use by most people collapses utterly. Many believe in it because they have swallowed libertarian dogmas that do not reflect how the world actually works. Speculators might make money on it, but the arguments for its usefulness fail completely. (Current Affairs)

• Cities Are Our Best Hope for Surviving Climate Change: Whatever Climate Change Does to the World, Cities Will Be Hit Hardest: Cities currently consume two-thirds of the global energy supply and generate three-quarters of the world’s greenhouse-gas emissions. Luckily for human civilization, they’re also extraordinarily motivated to minimize their cost to the climate—and quickly. Because cities are uniquely vulnerable to climate change, they’re also likely to be remade the fastest by the human need to survive and eventually thrive on a warmer planet. Cities are made of cement, glass, and steel. They absorb heat and repel water. That’s a big problem as the world warms and seas rise (CityLab)

• They Hacked McDonald’s Ice Cream Machines—and Started a Cold War Secret codes. Legal threats. Betrayal. How one couple built a device to fix McDonald’s notoriously broken soft-serve machines—and how the fast-food giant froze them out. Plenty of companies have fought against their own customers’ right-to-repair movements, from John Deere’s efforts to prevent farmers from accessing their own tractors’ software to Apple’s efforts to limit who can fix an iPhone. But few of those companies’ products need to be repaired quite so often as McDonald’s ice cream machines. (Wired)

• When Blackness Is a Superpower A common theme threaded throughout all these Black superhero narratives is the way that society questions the worthiness of African-Americans. What the creators and characters you’ll read about in this package underscore is that the arc of Black superheroes is anchored by a continuing need to portray the humanity of Black people in an ongoing quest for justice and equality. (New York Times)

• The Girl in the Kent State Photo In 1970, an image of a dead protester immediately became iconic. But what happened to the 14-year-old kneeling next to him? When Mary Ann Vecchio watched the video of George Floyd’s dying moments, she felt herself plummet through time and space — to a day almost exactly 50 years earlier. On that afternoon in 1970, the world was just as riveted by an image that showed the life draining out of a young man on the ground, this one a black-and-white still photo. Mary Ann was at the center of that photo, her arms raised in anguish, begging for help. (Washington Post)

• Bodies and Souls, Sophisticated Ladies, and Plucked Strings: Jimmy Blanton was the man who freed the Duke Ellington sound, who made all future sounds attainable. No one in jazz history has played an instrument better than Blanton played the bass, but I almost hesitate to term what he did bass playing. When you listen to someone like Robert Johnson on guitar, it takes some settling in on your part, because you need to suspend belief, do away with a lot of what you already knew, and be open that someone is redrafting and rearranging the principles of how sound can be ordered, sourced, constructed, what one human can do that another has not done previously. This is how Blanton revolutionized the bass in popular music. (The Smart Set)

Be sure to check out our Masters in Business next week with Jack Brennan, former CEO and Chairman of the Vanguard Group. When Vanguard founder and investment legend John Bogle decided to step down as CEO, Brennan was his hand-picked successor for the job, and ran the firm from 1996-2008.

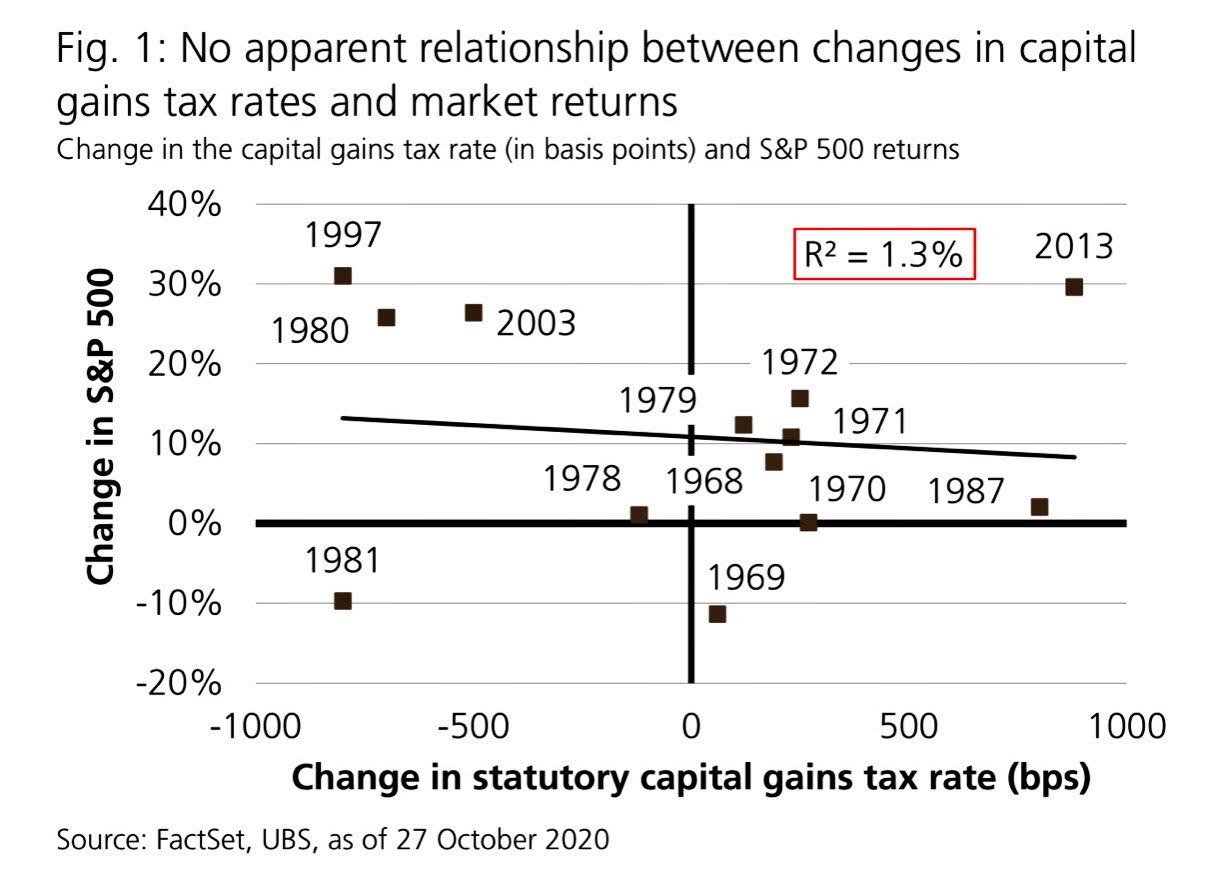

Virtually no relationship between changes in capital gains tax rate & S&P 500 returns in year of change … last time cap gains went up (in 2013), S&P 500 had stellar year (up 30%)

Source: @LizAnnSonders

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.