My end of week morning train WFH reads:

• Robinhood’s Big Gamble: In eliminating barriers to investing in the stock market, is the app democratizing finance or encouraging risky behavior? (New Yorker)

• Medallion Fund: The Ultimate Counterexample? The performance of Renaissance Technologies’ Medallion fund provides the ultimate counterexample to the hypothesis of market efficiency. Over the period from the start of trading in 1988 to 2018, $100 invested in Medallion would have grown to $398.7 million, representing a compound return of 63.3%. (Cornell-capital) see also Why the Medallion Fund is the Greatest Money-Making Machine of All Time To put this performance in perspective, $1 invested in the Medallion Fund from 1988-2018 would have grown to over $20,000 (net of fees) while $1 invested in the S&P 500 would have only grown to $20 over the same time period. Even a $1 investment in Warren Buffett’s Berkshire Hathaway would have only grown to $100 during this time. (Of Dollars And Data)

• Investor Taxes and Stock Prices: Threading the Needle! In much of the world, income from investments (interest, dividends) is treated differently than earned income (salary, wages), by the tax code, and the reasons for the divergence are both practical and political: (Musings on Markets)

• Unplugged: Electric Vehicles Can EVs Last On America’s Rugged Roads? Not only are our current automobiles inefficient, their Rube Goldbergian complexity surpasses any contraption that cartoonists could imagine. A hot lump of a V-8 might easily comprise 640 parts, each mounting its own frictional war against its neighbor. Further, the engine remains useless until connected to a starter, a fuel system, a cooling system, an exhaust system, and a transmission that might offer eight forward gears with a computerized mapping brain more complicated than Temecula chili. (American Consequences)

• There’s an Exodus From the ‘Star Cities,’ and I Have Good News and Bad News When it comes to the fate of big cities in the wake of the Covid-19 pandemic, there are two sets of overlapping economic and political consequences, but they are not necessarily what you might expect. (New York Times)

• Why Start-ups Fail: It’s not always the horse or the jockey. If you’re launching a business, the odds are against you: Two-thirds of start-ups never show a positive return. Research findings buck the conventional wisdom that the cause of start-up failure is either the founding team or the business idea. Six patterns that doomed ventures. Two were especially common: (Harvard Business Review)

• The 60-Year-Old Scientific Screwup That Helped Covid Kill All pandemic long, scientists brawled over how the virus spreads. Droplets! No, aerosols! At the heart of the fight was a teensy error with huge consequences. (Wired)

• The real reason behind the misinformation epidemic in online moms’ groups Facebook group “Natural Parenting Mommas”: The slow cascade in online groups from alternative health to COVID misinformation is not easy to fix, especially since its very proliferation serves to normalize the content. It won’t go away if social media platforms simply label posts as misinformation. The moderators I’ve interviewed have told me that even their efforts to delete misinformation haven’t worked; the deleted posts just pop up in the comments section on seemingly unrelated posts. (Mother Jones)

• ‘An early red flag’: Mobile ad industry grapples with early uncertainties from Apple’s tracking crackdown “We see a trend of more non-IDFA users across our portfolio of games and the ratio goes up to 20% of users with an IDFA and around 80% of those without it depending on the ATT screen implementation and user acquisition strategy.” (DigiDay)

• When MTV Debuted 40 Years Ago, Everyone Thought It Would Fail. Here’s Why It Didn’t Scorned by adults, adored by kids, and built on other people’s content, the music video network was TikTok and the iPhone rolled into one totally ’80s package. (Vanity Fair)

Be sure to check out our Masters in Business interview this weekend with Danny Kahneman, winner of the 2002 Nobel Memorial Prize in Economic Sciences and author of Thinking, Fast and Slow. His empirical findings with Amos Tversky challenge the assumption of human rationality prevailing in modern economic theory, and established a cognitive basis for human error. His latest book is Noise: A flaw in human judgment cowritten with Oliver Sibony and Cass Sunstein.

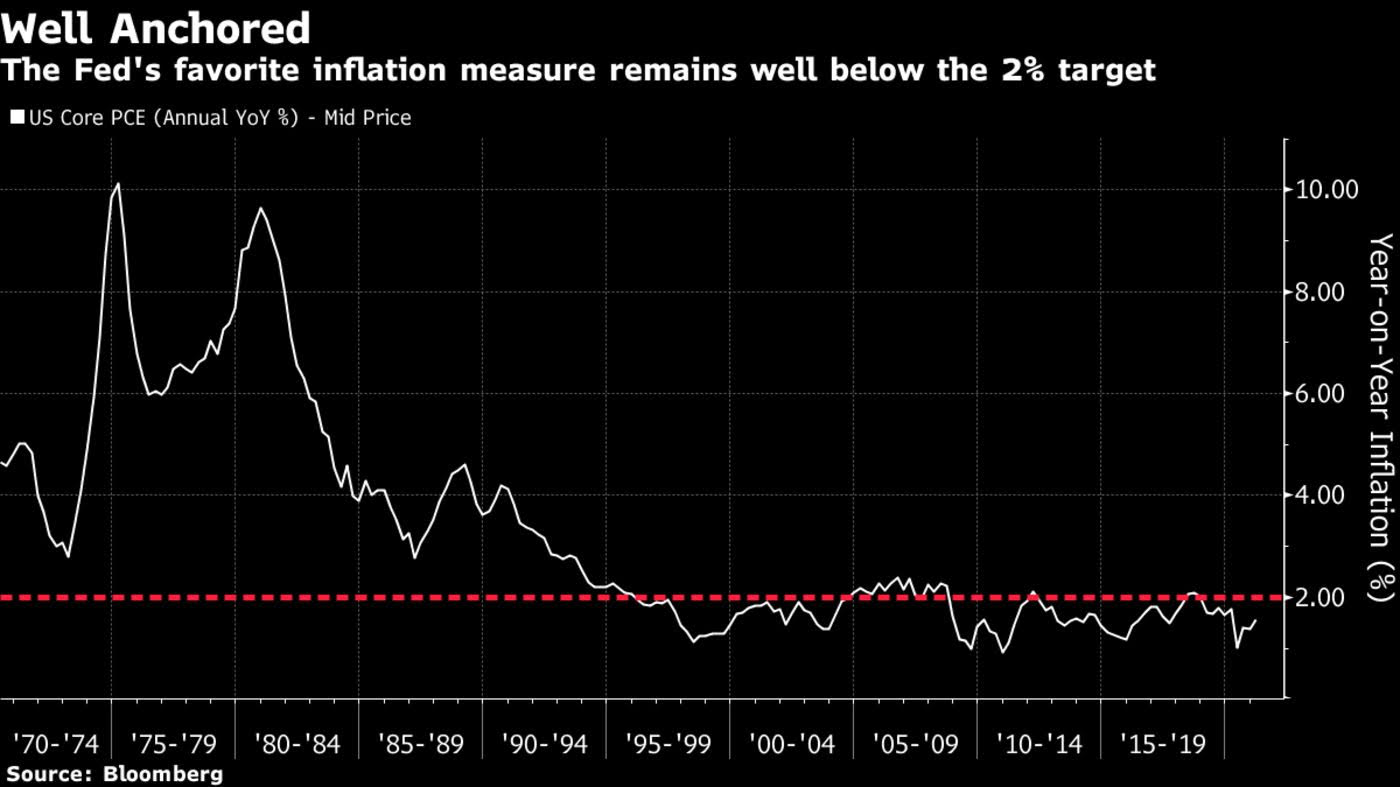

Core PCE deflator still shows inflation of comfortably less than 2%

Source: Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.