My mid-week morning train WFH reads:

• Lumber Wipes Out 2021 Gain With Demand Ebbing After Record Boom Lumber, which at one point was among the world’s best-performing commodities as the pandemic sent construction demand soaring and stoked fears of inflation, has officially wiped out all of its staggering gains for the year. (Bloomberg) but see Chip Shortage’s Latest Toll: A Shortage of Work Trucks A bottleneck has left small businesses and municipalities competing over scarce supply of commercial vehicles as business rebounds (Wall Street Journal)

• How Did Ken Griffin Get to Be Such a Big Deal? His hedge fund firm, Citadel, has thrived for the past 30 years, thanks to his data-driven zeal—and an early start. Way early. (CIO)

• In Investing, Don’t Sweat the Small Stuff It is easy to obsess about the smallest parts of your portfolio, like the tiny amounts of interest spun off by money-market funds today. Don’t waste your time. (New York Times)

• Monty Python and the Search for the Ultimate Index Why is MSCI seeking something that was proved not to exist back in 1977 and then declared dead in 1992? (Bloomberg)

• On Chandler Bing’s Job Twenty-five years ago, Friends anticipated a time that would both romanticize and mistrust the culture of work. (The Atlantic)

• The U.S. didn’t start Cold War 2 A revisionist China smashes the global order at its own peril (Noahpinion)

• The Dream of Florida Is Dead The Miami condo collapse is a crisis for the entire state. (Slate)

• I’m Often Wide Awake at 3 A.M. What Do I Do to Get Back to Sleep? Sleep experts offer advice on sleeping soundly through the night. (New York Times)

• Their neighbors called covid-19 a hoax. Can these ICU nurses forgive them? For the nurses in the Appalachian highlands who risked their lives during the pandemic, it is as if they fought in a war no one acknowledges. (Washington Post)

• Is the Universe Open-Ended? An intriguing proposal about what makes reality tick under the surface. (Nautilus)

Be sure to check out our Masters in Business interview this weekend with Christine Hurtsellers, CEO of Voya Investment Management. The firm manages over $245 billion in assets. Hurtsellers was recently named to Barrons’s top 10 most influential women in wealth management.

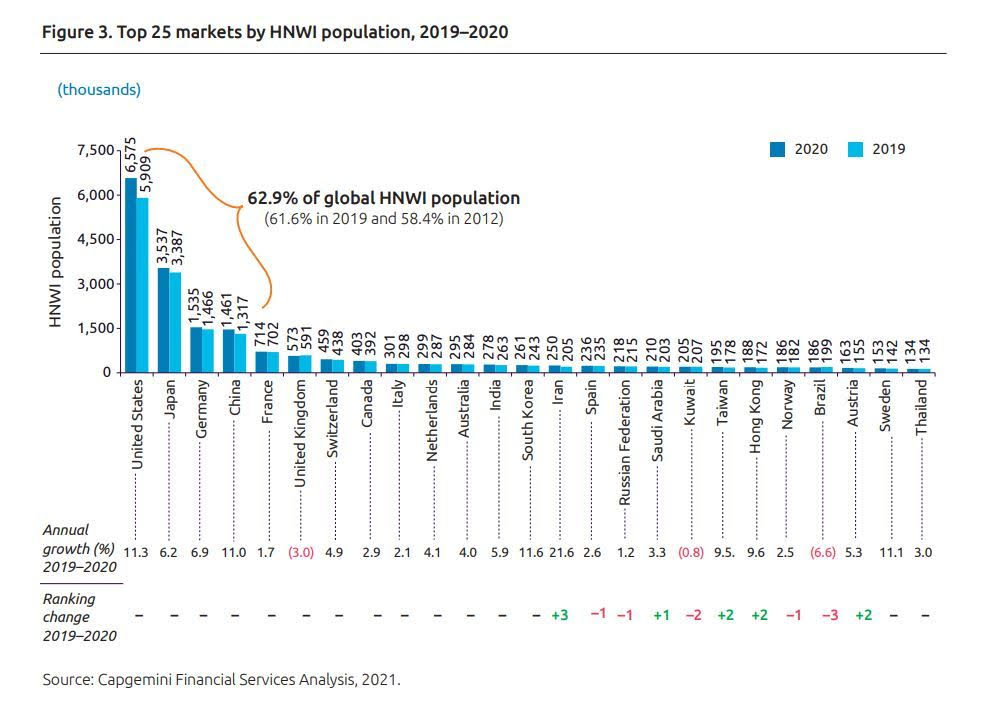

Where wealth is distributed in the world

Source: @RitholtzWealth

Sign up for our reads-only mailing list here.