To hear an audio spoken word version of this post, click here.

It may be a simple question, but it is one that is quite difficult to calculate:

The United States is a “Rule of Law” jurisdiction that places very high values on the sanctity of contracts, respect for private property, and (as a structure) a government of laws, not men. This has made the nation an attractive place to do business, with enormous amounts of capital ready to be put to work productively in various ventures.

How much is that worth?

It is very challenging to put a number on that, as it is difficult to assess such an inherently soft and squishy quality. There are not a lot of metrics that directly quantify what the Rule of Law is worth. We can look at GDP, income, wealth, equity P/E, etc, but no one figure captures all of this value.

We can, however, see the direct effects in countries when these values are ignored. I believe these three comparisons might help put this into context:

1. China’s current crackdown on its own tech stocks;

2. Russia as a organized crime syndicate, (albeit one with a standing army)

3. January 6th insurrection in the United States

Let’s stay with China today since it is both timely and lends itself more towards quantifying the impact of recent actions.

Consider the market capitalization of US equities is (as of June 30th, 2021) at ~$47 trillion dollars. That is a substantial increase from about $27 trillion five years ago. But despite its size and economic footprint, the market capitalization of China’s equities hit a peak of $13.4 trillion in May 2021. That was before the government decided it wanted more control over who could own shares in its companies, who could run them, and what they could say and do.

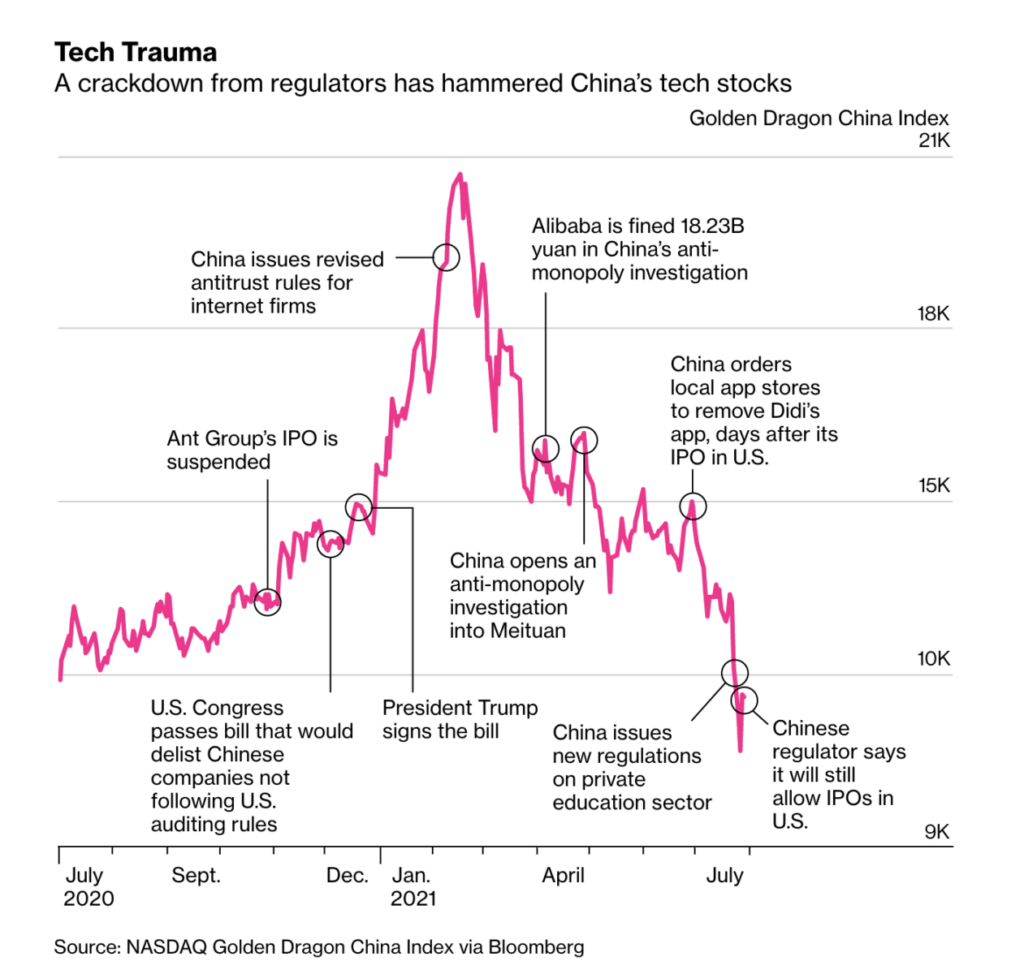

As of last week, about $150 billion in U.S.-Listed Chinese tech stocks has been wiped out. The Nasdaq Golden Dragon China Index (^HXC) is off its 2021 highs by 42.97%.

The crackdown began with China’s President Xi’s aggressive actions towards Jack Ma of Alibaba last year. Here is Bloomberg News:

“Following the logic of the prison yard, Beijing signaled the start of the new era for entrepreneurs and investors by taking a swing at the biggest inmate: Alibaba Group Holding Ltd. founder Jack Ma. On Nov. 3, the initial public offering of Ant Group Co. — the finance arm of Ma’s empire, which was set to surpass Saudi Aramco as the biggest public listing of all time — was unceremoniously squashed.”

Afterward, Jack Ma, one of the wealthiest people in China, disappeared from view for months. He was “laying low. ” The BBC wrote: “It is believed Mr. Ma’s criticism of the Chinese financial sector in October prompted the move.” Can you imagine if POTUS was going to quash the biggest US IPO of all time — not with a tweet, but with the full force of the Federal Government? It’s hard to see that even with the Grifter-in-Chief, who clearly had no fucks to give about the Rule of Law.

Is this a risk factor from China, or the actual plan? I do not know, but the latter would not surprise me. China has a long history of insularity, and they probably have gotten all they need from the West. They have plenty of capital, they just need to sell into our markets.

There is a real possibility that China will soon be uninvestable to outsiders.

For those who ranted about YouTube, Twitter, and Facebook kicking off bad actors from their platform for spreading misinformation about Covid, voting, or the election: THIS is what actual Tyranny looks like. Corporate control by the government — not the shareholders or management or Board of Directors — for political, not business reasons.

If you want to see what it looks like when a nation allows the government to dictate how companies can operate — not setting up guardrails and rational regulations for a level playing field, but full-on control — look at China…

Previously:

Silicon Valley De-Platforming: Freedom & Censorship (January 13, 2021)

Tyranny & Terms of Service (January 18, 2021)

Click to listen to audio