October! How did that happen? My end of week morning train WFH reads:

• Pass the damn infrastructure bill, dammit: Then pass the reconciliation bill, then pass another bill… I am annoyed at the way Democrats are handling the two spending bills now moving through Congress. When the bipartisan infrastructure deal passed the Senate, I assumed it was a done deal, and we could move on to the reconciliation bill. Instead, progressives in the House held up the bill, demanding that centrists vote on the reconciliation bill first. The idea here seems to be that since centrist Dems like Manchin and Sinema are opposed to lots of stuff on the reconciliation bill, the only way to force them to vote for it is to threaten to torpedo the bipartisan infrastructure bill. (Noahpinion)

• Are Rising Interest Rates Bad For Tech Stocks? Interest rates fell from 6.5% in the early-2000s to just over 3% a few short years later. In that time tech stocks got crushed, crashing 80%. From the summer of 2016 through the winter of 2018, interest rates more than doubled from 1.4% to 3.2%. Tech stocks rose around 60% over this time frame. Sometimes they move together. Sometimes they move in opposite directions. Sometimes they simply march to their own drummer. (A Wealth of Common Sense)

• Meet Ramzi Musallam, Wall Street’s Top-Secret Billionaire Investor Musallam produced his track record by focusing on technology companies that operate in sectors dominated by the United States’ federal government, particularly defense, health care and education. America’s $6.8 trillion worth of annual spending and sweeping regulatory power give it unparalleled sway in these markets. While many buyout firms try to avoid investing in areas affected by government interference, Musallam’s strategy hinges on understanding what the most influential player in the global economy will do next. (Forbes)

• Climate Change Is the New Dot-Com Bubble: There are good VCs being venturesome with their capital. There are funds that are investing in green things. There isn’t one carbon market; there isn’t one set of standards to follow; there are dozens of options, which means there isn’t really anything at all. The free market has plenty of grandiose ideas about how to fix our broken planet. There’s just one problem: We can’t afford another bust. (Wired)

• Few have quit their jobs over COVID-19 vaccine mandates, but thousands have gotten shots The bottom line is that the mandates may have provoked a few hundred workers to resign in protest here or there — but they’ve also prompted thousands to get their shots against COVID-19. (Los Angeles Times) see also Half of unvaccinated workers say they’d rather quit than get a shot – but real-world data suggest few are following through But while it is easy and cost-free to tell a pollster you’ll quit your job, actually doing so when it means losing a paycheck you and your family may depend upon is another matter. And based on a sample of companies that already have vaccine mandates in place, the actual number who do resign rather than get the vaccine is much smaller than the survey data suggest. (The Conversation)

• The problem with corporate “values” Despite the language of essentialism around them, though, corporate values don’t always track with company behavior. Some of this is due to a lack of specificity and accountability in their rollout — you can’t expect people to change their behavior if they don’t know why or how — but the primary reason is that, despite lip-service to the contrary, the long-term vision that values require is not rewarded. US corporate governance norms are based on the shareholder value model, which enshrines maximizing shareholder profits as a company’s raison d’être. When values are at odds with a company’s bottom line, all too often they won’t win out. (Vox)

• Why Britain and France Hate Each Other: The two countries are more similar than is often acknowledged. Not only in terms of population, wealth, imperial past, global reach, and democratic tradition, but the deeper stuff too: the sense of exceptionalism, fear of decline, instinct for national independence, desire for respect, and angst over the growing power of others, whether that be the United States, Germany, or China. London and Paris may have chosen different strategies—and there is nothing to say that both are equally meritorious—but the parallels between these two nations are obvious. (The Atlantic)

• When the Doctor Has to Make the Toughest Decision It hasn’t felt like all these people arrive and you choose between them. It’s this horrific situation where a lot of patients are not getting regular care. You’re being denied the type of care that would be most recommended. That’s what we call a “standard of care,” what would typically be given to you. And there can be more risk with missing out on that care, more chance that you won’t survive. We’ve seen that during surges, even survival from COVID has been lower in stressed hospitals. (Slate)

• Earth, Venus, and the Moon may all be victims of ancient hit-and-run planetary collisions After a grazing impact, between one- and two-thirds of impactors go on to orbit the Sun for a while before impacting Earth a second time. They also found that of the ones that don’t come back, most hit Venus. In fact Venus is about as likely to be the second target as Earth. (Syfy Wire)

• Why Is Every Young Person in America Watching ‘The Sopranos’? The show’s depiction of contemporary America as relentlessly banal and hollow is plainly at the core of the current interest in the show, which coincides with an era of crisis across just about every major institution in American life. “The Sopranos” has a persistent focus on the spiritual and moral vacuum at the center of this country, and is oddly prescient about its coming troubles: the opioid epidemic, the crisis of meritocracy, teenage depression and suicide, fights over the meaning of American history. The show’s new audience is also seeing something different in it: a parable about a country in terminal decline. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Jack Schwager, author of various Market Wizard books. He is also the founder of Fund Seeder, a platform designed to match undiscovered trading talent with capital worldwide. His latest book is “Unknown Market Wizards: The best traders you’ve never heard of.”

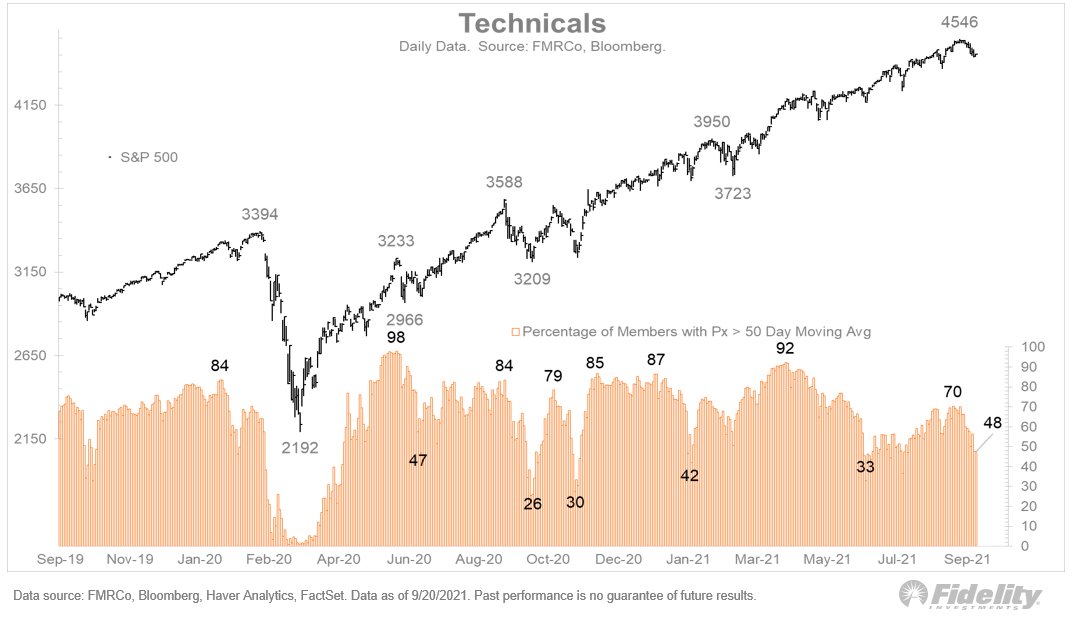

Stealth Correction: 44% of stocks are above their 50-day MA down from 92% in March

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.