My Two-for-Tuesday morning train WFH reads:

• Why is everyone quitting, and how do I know whether it’s time to leave my job? Waves of Americans are leaving their jobs as part of the ‘Great Resignation.’ Here’s why: A record number of workers are quitting their jobs, empowered by new leverage (Washington Post) see also Elvis (Your Waiter) Has Left the Building Waitstaff, bartenders, hotel maids, busboys, dishwashers (and others) used the year of lockdown to level up, gain new skills, find not new jobs, but new careers. They have exited difficult, thankless, dead-end jobs for a chance at the American Dream. (The Big Picture)

• 10 truths about the stock market: A mental framework for investors The stock market can be an intimidating place: it’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions. (TKer by Sam Ro)

• We Need to Think Harder About Inflation The MMT lens keeps us focused on the things that matter. It’s not the headline dollar figure—$1.9 or $3.5 trillion—or the budgetary impacts of that spending that warrant our attention. What matters is the economy’s capacity to safely absorb those dollars as they begin to flow into people’s pockets.(The Lens) see also Don’t Blame Workers for Inflation It shouldn’t come as a surprise that labor productivity remains strong. The U.S. gross domestic product has bounced back to above its prepandemic peak, while the number of workers employed remains millions below the prepandemic level. That simply says that output per worker has grown. Which is great for employers. It means that they don’t need to raise prices to cover higher labor costs.(New York Times)

• Managers Have More Assets Under Management Than Ever Before — But Alternatives Are Driving the Business The largest 500 firms in the world manage $120 trillion. BlackRock is still at the top of list when measured by assets, but Blackstone has the most enviable market cap. (Institutional Investor)

• Soaring Home Prices Are Roiling Appraisals and Upending Sales An unusually high number of homes across the country are being appraised below their agreed-upon sales prices, causing a number of deals to collapse. (Wall Street Journal) see also What Happens When Airbnb Swallows Your Neighborhood The McMansions and large parties are possible because houses that used to be rented for a year by people who live in Austin are now rented for a weekend by people who just visit Austin (Slate)

• It Didn’t Have to Be This Way: Human History Gets A Rewrite: A brilliant new account upends bedrock assumptions about 30,000 years of change. (The Atlantic)

• How to Buy or Lease a New Car: Select the right vehicle, decide between leasing or buying, and prepare to negotiate with the dealer using this handy guide. (Car and Driver) see also Selling Cars in the Era of the Chip Shortage: Online Chats and No More Haggling Dealerships lean on fewer staff to sell used cars, handle new-car buyers online; ‘Haggling has gone out the window’ (Wall Street Journal)

• People talk about the cost of that big federal bill but don’t know what’s in it. So we’ll tell you What you may not know as much about is what’s actually in the act — in other words, what all that spending will pay for. That’s important because thanks to the way Washington is covered, Americans tend to turn negative about big legislative measures, even though they’re in favor of the individual provisions. (Los Angeles Times)

• Red Covid: Covid’s partisan pattern is growing more extreme. The political divide over vaccinations is so large that almost every reliably blue state now has a higher vaccination rate than almost every reliably red state: (New York Times) see also The Republican anti-vax delusion America’s vaccination programme is stalling. Populist conservatives are to blame (Economist)

• Paul McCartney Doesn’t Really Want to Stop the Show: Half a century after the Beatles broke up, he’s still correcting the record—and making new ones. (New Yorker)

Be sure to check out our Masters in Business interview this weekend with Soraya Darabi, co-founder and general partner of TMV. The firm has funded a broad cross-section of startups, 65% of which are led by women or people of color. Less than 5 years old, TMV has already had 10 exits.

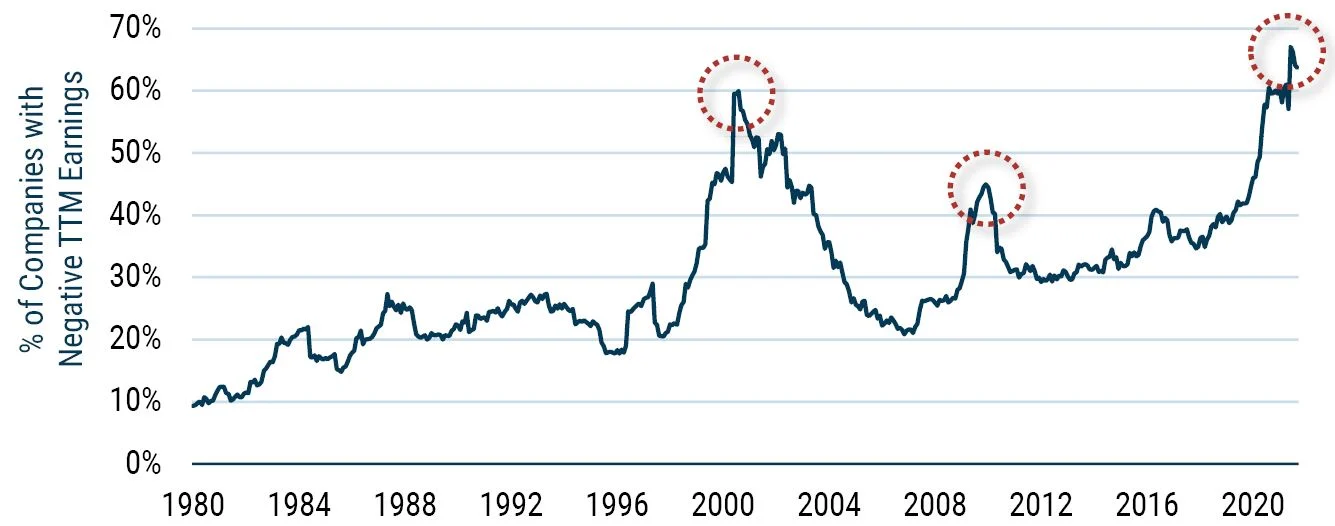

Growth Bubble: Making Money On Companies That Make No Money

Source: GMO