My end of week morning train WFH reads:

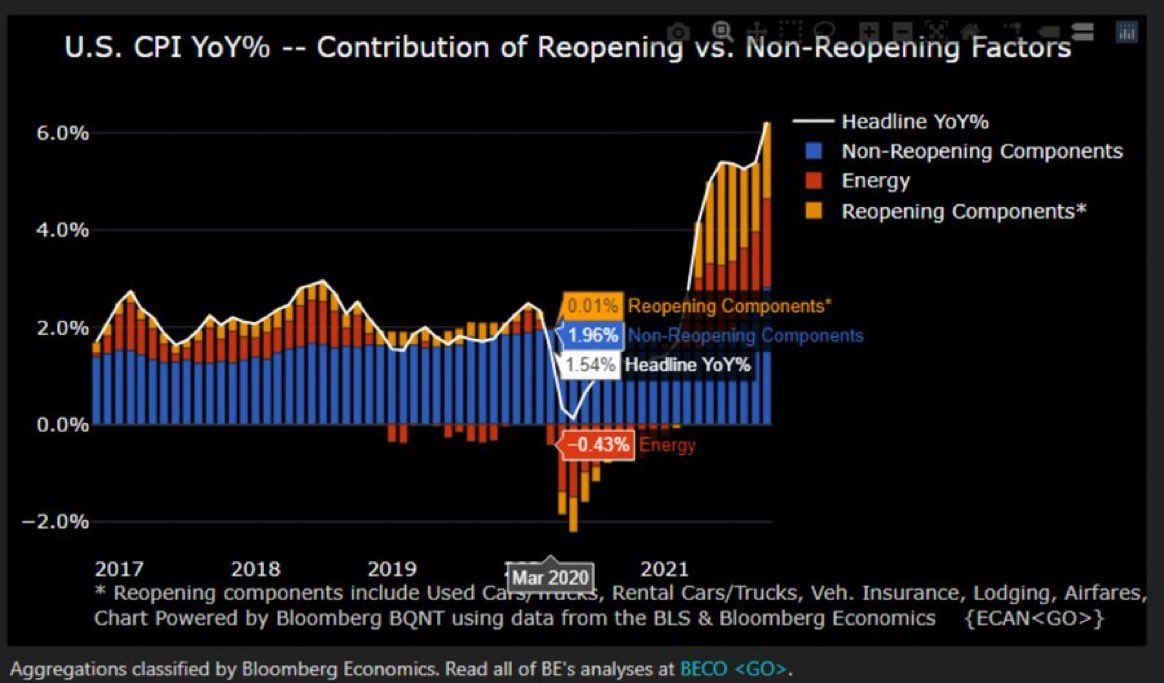

• Why All the Inflation Worries? Some respected economists are talking as if the US economy is in serious inflationary trouble. But the current uptick in price growth is highly likely to be a largely benign consequence of the post-pandemic recovery. (Project Syndicate) see also Which Asset Classes Perform Best During Inflation? To start, let’s look at the inflation-adjusted (“real”) annual returns of nine different asset classes from 1976-2019 (the data comes from BullionVault). Note that I capped all real returns at 20% (-20%) so that we could better visualize the performance behavior of these different asset classes: (Of Dollars And Data)

• Hunt for Hottest Tickers Creates a New Gray Market on Wall Street Strong fund names have been shown to boost trading in U.S. stocks, and the day-trader invasion is making them key to new ETF success (Bloomberg)

• $76 Billion a Day: How Binance Became the World’s Biggest Crypto Exchange The trading platform surged by operating from nowhere in particular—without offices, licenses or headquarters. Now governments are insisting on taking some control. (Wall Street Journal)

• Tesla Had 5 Founders. Why Did Only Two Get Really Rich? One is Elon Musk (duh), and the other is JB Straubel. But there were three more—and there’s a cautionary tale in why they aren’t billionaires too. (Forbes)

• The Internet’s Unkillable App: The noisier our digital lives get, the more popular the humble newsletter becomes. (The Atlantic)

• Minimally Extractive Meta: Why Zuck Might Have to Actually Contribute to the Open, Interoperable Metaverse The picture of the Metaverse that Zuck painted seems pretty fun, and the role he wants to carve out for Meta feels more than fair. I almost feel like we, the citizens of the internet, were taking advantage of poor Zuck. He’s willing to lose $10+ billion per year, all in the hope that his company might be able to take its small and hard-earned sliver of the Metaverse economy one day? Canonize this patron saint of the immersive internet! (Not Boring)

• You Don’t Live in the World You Were Born Into I’m not here saying to get levered long Rivian at the IPO. Or that stocks will continue to go up 20% a year. Or that the stock market can’t fall 50%. I’m saying that it’s too easy to make historical comparisons and think you’re being clever. The market is likely to be more right than you are and waiting for a return to what you think is normal is no way to invest. (Irrelevant Investor)

• Will the magic of psychedelics transform psychiatry? Psychedelics have come a long way since their hallucinogenic hippy heyday. Research shows that they could alleviate PTSD, depression and addiction. So will we all soon be treated with magic mushrooms and MDMA? (The Guardian)

• Our Worst Idea About “Safety” How individuals change their behavior in response to perceived risk has been of interest to psychologists, safety regulators, and economists for decades. A concept that took hold in the ’70s has haunted everything from seat belts to masks—and it’s going to keep putting us in danger. (Slate)

• After 14 Years, Robert Plant and Alison Krauss Finally Reunite The duo worked with T Bone Burnett on the million-selling triumph “Raising Sand,” in 2007. Its sequel is once again an alternative to nearly all of its pop contemporaries. (New York Times)

Be sure to check out our Masters in Business next week with Robin Wigglesworth, the FT’s global finance correspondent based in Oslo, Norway. He focuses on the trends reshaping markets and investing, from technological disruption to quantitative investing. His new book is Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever.

Visualization to frame the broader state of play in the inflation.

Source: @joebrusuelas

Sign up for our reads-only mailing list here.