My Two-for-Tuesday morning train WFH reads:

• This Is Jerome Powell’s Shot at a Volcker Moment—in Reverse It took courage to lift rates in 1979 to kill inflation. The gutsy move for today may be to stand fast until we have more jobs. (BusinessWeek) see also 179 Reasons You Probably Don’t Need to Panic About Inflation It is spurring calls for the Federal Reserve to “cool off” the economy by raising interest rates. But doing so could cause a lot of collateral damage by stalling the still-nascent economic recovery. (New York Times)

• How Asset Owners Are Solving the Emerging Manager Problem CIOs weigh in on some of the biggest challenges they face when seeding diverse and emerging investment firms. (Institutional Investor)

• Gemini Raises $400 Million To Build A Metaverse Outside Facebook’s Walled Garden Last month dozens of blockchain startups raised a total of more than $4 billion to chip away at the exterior defenses of these Walled Gardens by building a virtual, holographic, augmented reality version of the internet, called the metaverse, that anyone can build on (and monetize) while Facebook, Epic Games and other Big Tech giants prepare a counterattack. (Forbes) see also Want to Bet on Bitcoin Without Owning Any? Try These Mining Stocks. Mining stocks have gained an average of 291% this year as Bitcoin has doubled, far ahead of the Nasdaq Composite’s 25% return. But they are highly sensitive to movements in Bitcoin prices and investor sentiment. (Barron’s)

• Two Things That Are Both True: (1) The U.S. consumer is in excellent shape considering we went through the worst quarterly GDP contraction on record last year. Wages are rising, net worth is at all-time highs, credit card debt is down, home equity has skyrocketed and 401k balances are as high as they’ve ever been. (2) Inflation is higher than it’s been in more than 30 years. (A Wealth of Common Sense)

• The Great Resignation Is Great for Low-Paid Workers Despite all the talk about burnout and reevaluating priorities, the soaring quits rate has little to do with white-collar jobs. It’s more about lower-income people getting the chance to move up. (Bloomberg) see also Who Is Quitting and Why? The “Great Resignation” is a backward-looking phrase. Lower paid labor has upskilled, gotten certified, degreed, leveled up, found new fields to work in. A better descriptor of what is going on now: The Great Disruption. (The Big Picture)

• Modern Monetary Theory Isn’t the Future. It’s Here Now. Important elements of MMT are accepted by much of the financial establishment, but markets aren’t pricing it in. (Wall Street Journal)

• How to Troll an NFT Owner Welcome to the weird world of NFT “etiquette.” In a rapidly growing community of NFT enthusiasts, where rules can be hard to define and harder to enforce, a lot of what happens is a matter of emerging social norms and, well, yelling at people. (Slate) see also Why I didn’t bid on the US Constitution This week, we witnessed one of the greatest Internet rabbit holes since the 28.8k modem came to the scene in the early 90s. For a few bucks, you could buy a slice of the US constitution. Yup, we the people could be owned by the people. (Rad Reads)

• How Twitter got research right: While other tech giants hide from their researchers It’s always of note when a tech platform takes one of those unflattering findings and publishes it for the world to see. At the end of October, Twitter did just that. (The Verge)

• U.S. Covid Deaths Get Even Redder: The partisan gap in Covid’s death toll has grown faster over the past month than at any previous point. (New York Times) see also As G.O.P. Fights Mask and Vaccine Mandates, Florida Takes the Lead Florida lawmakers, at the request of Gov. Ron DeSantis, passed new laws sharply curtailing mask and vaccine mandates. Fringe anti-vaccination views met with little pushback. (New York Times)

• Are AirPods Out? Why Cool Kids Are Wearing Wired Headphones Humble ‘retro’ corded headphones are making an unexpected return, for both aesthetic and practical reasons. (Wall Street Journal)

Be sure to check out our Masters in Business this week with Edwin Conway, Global Head of BlackRock Alternative Investors (BAI), which runs over $300 billion in total assets. BlackRock’s global alternatives business includes Real Estate, Infrastructure, Hedge Funds, Private Equity, and Credit, and is one of the fastest-growing divisions of the investment giant.

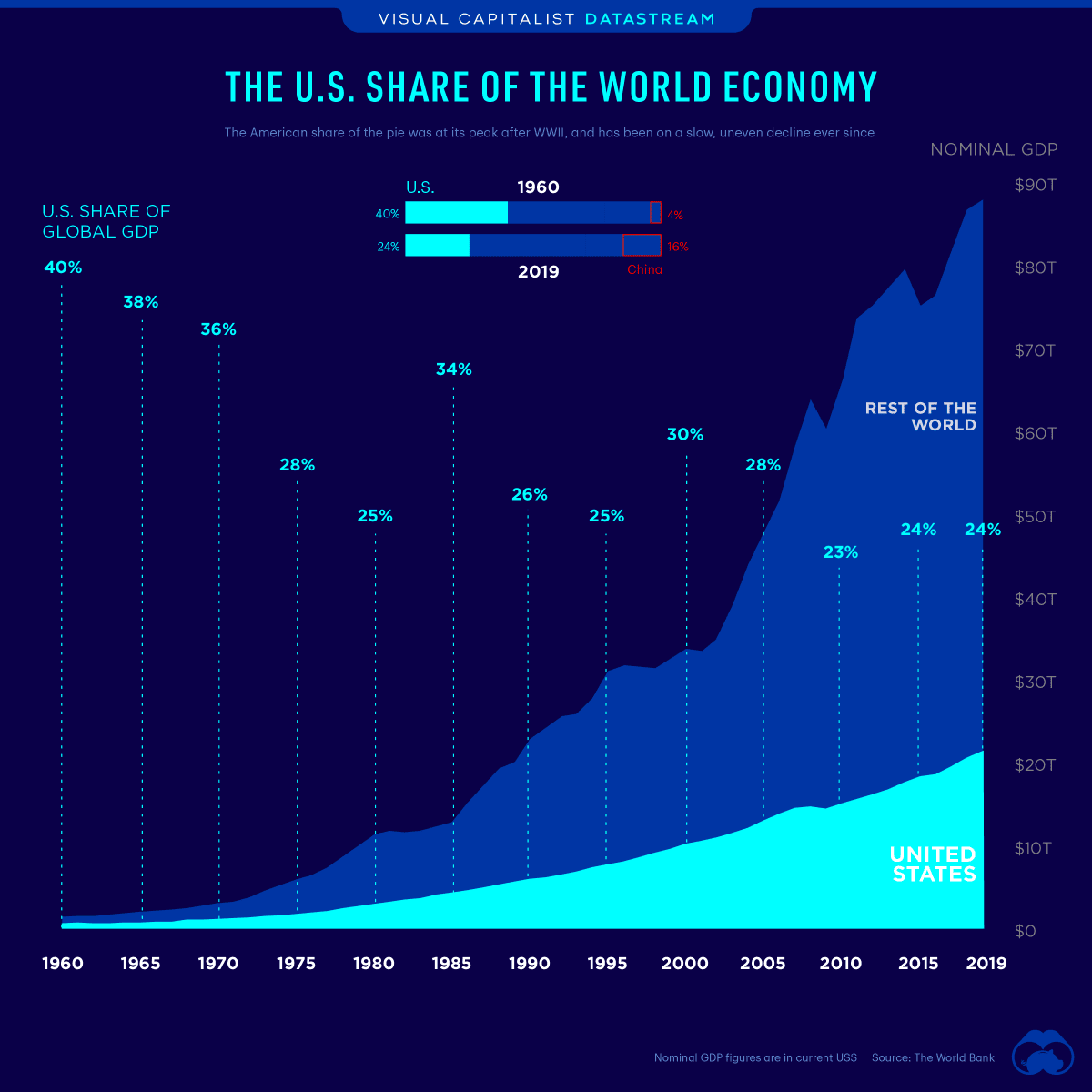

The US Share of the World Economy

Source: Visual Capitalist