My mid-week morning train WFH reads:

• 5 Thanksgiving travel pitfalls — and how to deal with them Expect crowded airports and heavy traffic this holiday (Washington Post)

• The Age of Funcertainty! Funcertainty is everywhere. It’s in every S&P 500 rally on the heels of a race riot being broadcast on TV. It’s in every Nasdaq record high in the midst of mass arrests over the attack on our nation’s capital. You can see it in the prospectus of every money-losing unicorn raising billions of dollars from people who can’t even spell the word prospectus let alone read one. There’s funcertainty in every NFT launch, every airdrop of a mystery token, each and every SPAC transaction while the country burns – metaphorically and actually – on the screens of our televisions each night. Everything is getting scarier as the casino lurches into overdrive. What are you gonna do, not play? Funcertainty, motherf***ers. Get in the game or get out of my way. (Reformed Broker)

• The Conglomerate Paradox: As GE splinters You might call this the end of the conglomerate age. But, the truth is, that age ended decades ago in the United States. GE is just one of a few lumbering dinosaurs that survived the asteroid crash. But while the old American conglomerates are going extinct, a new breed is evolving to take their place at the top of the food chain: Techglomerates. Companies like Google, Facebook, and Amazon have been acquiring companies and entering into industries they’ve traditionally had no involvement in. (NPR)

• Here’s How Institutional Investors’ Bets on Crypto Are Performing Pension funds and others that have made the leap into cryptocurrencies are beating their peers — for now at least. (Institutional Investor)

• The Winds of Change The last 20 months have been a most unusual period, thanks primarily to the pandemic, yet many things feel like they haven’t changed over that time span. Each day seems like all the others. I mostly stay home and deal with email and Zoom calls – whether relating to work matters or not. Weekdays don’t feel that different from weekends (this was especially true pre-vaccine, when we rarely ate out or visited others). We’ve had only one one-week vacation in two years. The best way to sum it up is through a comparison to Groundhog Day: every day feels a lot like the day before. (Oaktree Capital)

• How to avoid the world’s second biggest economy in your portfolio The Chinese economy presents some unique challenges for investors. On one hand, China is home to several of the most dynamic and rapidly growing companies on the planet, such as electric car makers Xpeng and Nio (NIO) as well as privately held TikTok owner ByteDance. But China’s recent crackdown on the tech sector has slowed earnings momentum at big brand name firms including Baidu (BIDU), Alibaba (BABA) and WeChat owner Tencent (TCEHY). (CNN)

• To Bet on Inflation Is to Bet Against Human Ingenuity David Rosenberg, founder of Rosenberg Research, doesn’t expect a sustained surge in inflation. In an in-depth interview, he explains how investors can position themselves for a disinflationary market environment and which indicators he’s paying particular attention to. (The Market)

• How Music Created Silicon Valley The tech titans couldn’t have built their empires without songs—and now they are destroying the cultural ecosystem that made them rich (The Honest Broker)

• The Pigeon Puzzle: How Do They Figure Out Their Impossibly Long Routes Home? From around 2000 BCE, when it’s thought that ancient Sumerians discovered pigeons’ amazing homing abilities, to now, we still don’t quite know how these birds orient themselves in the sky. Scientists have various theories, but they have yet to fully understand the phenomenon. “It’s a mystery. It’s part of what makes the sport so interesting.” (The Walrus)

• Office holiday parties are back and smaller than ever People either love or hate office holiday parties. Pretty much everyone hates virtual office holiday parties. As we enter the second pandemic holiday season, both types of events — meant to celebrate employees and humanize bosses — are back. But they are probably different from what you remember. (Vox)

Be sure to check out our Masters in Business this week with Edwin Conway, Global Head of BlackRock Alternative Investors (BAI), which runs over $300 billion in total assets. BlackRock’s global alternatives business includes Real Estate, Infrastructure, Hedge Funds, Private Equity, and Credit, and is one of the fastest-growing divisions of the investment giant.

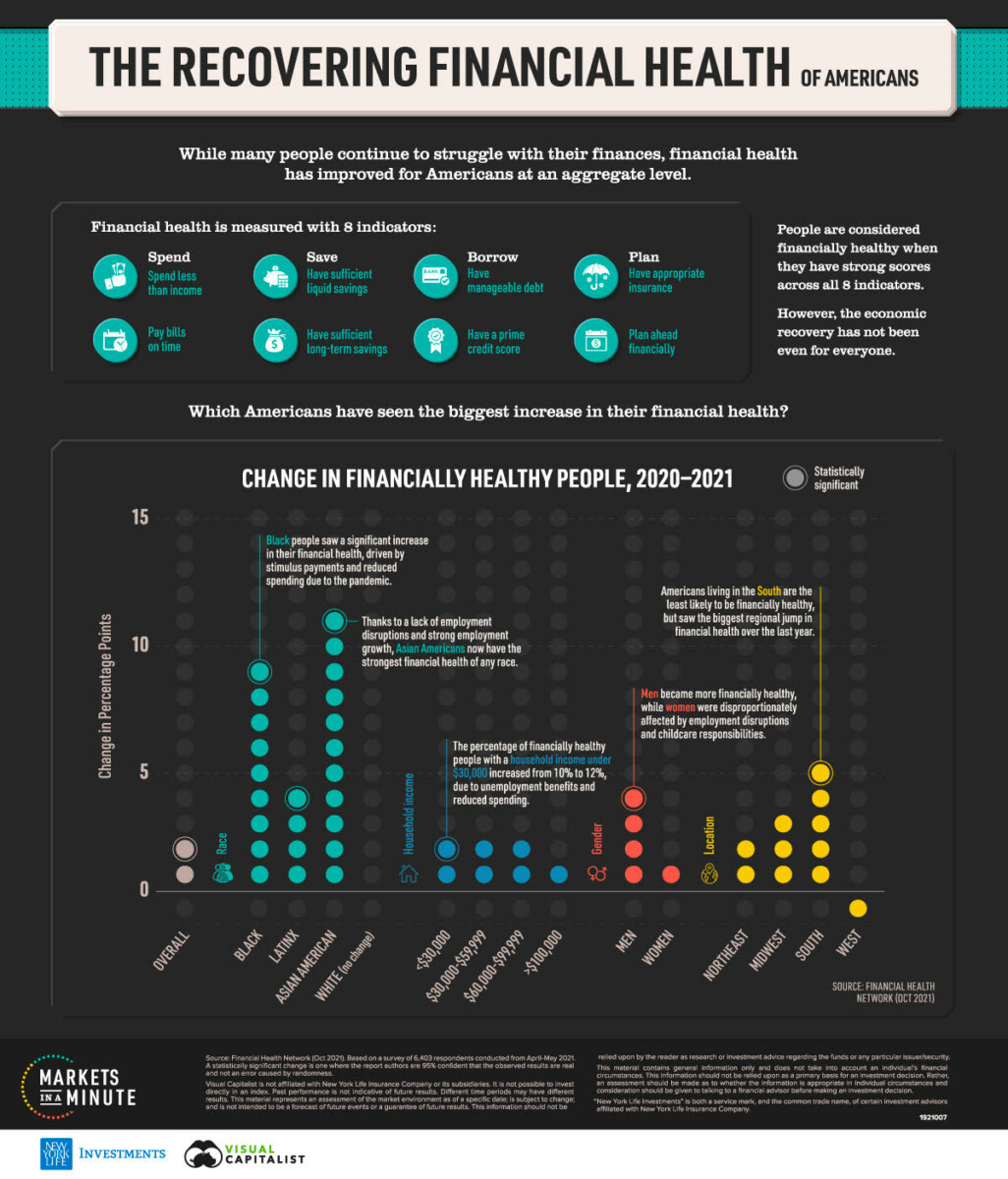

The Recovering Financial Health of Americans

Source: Visual Capitalist

Sign up for our reads-only mailing list here.