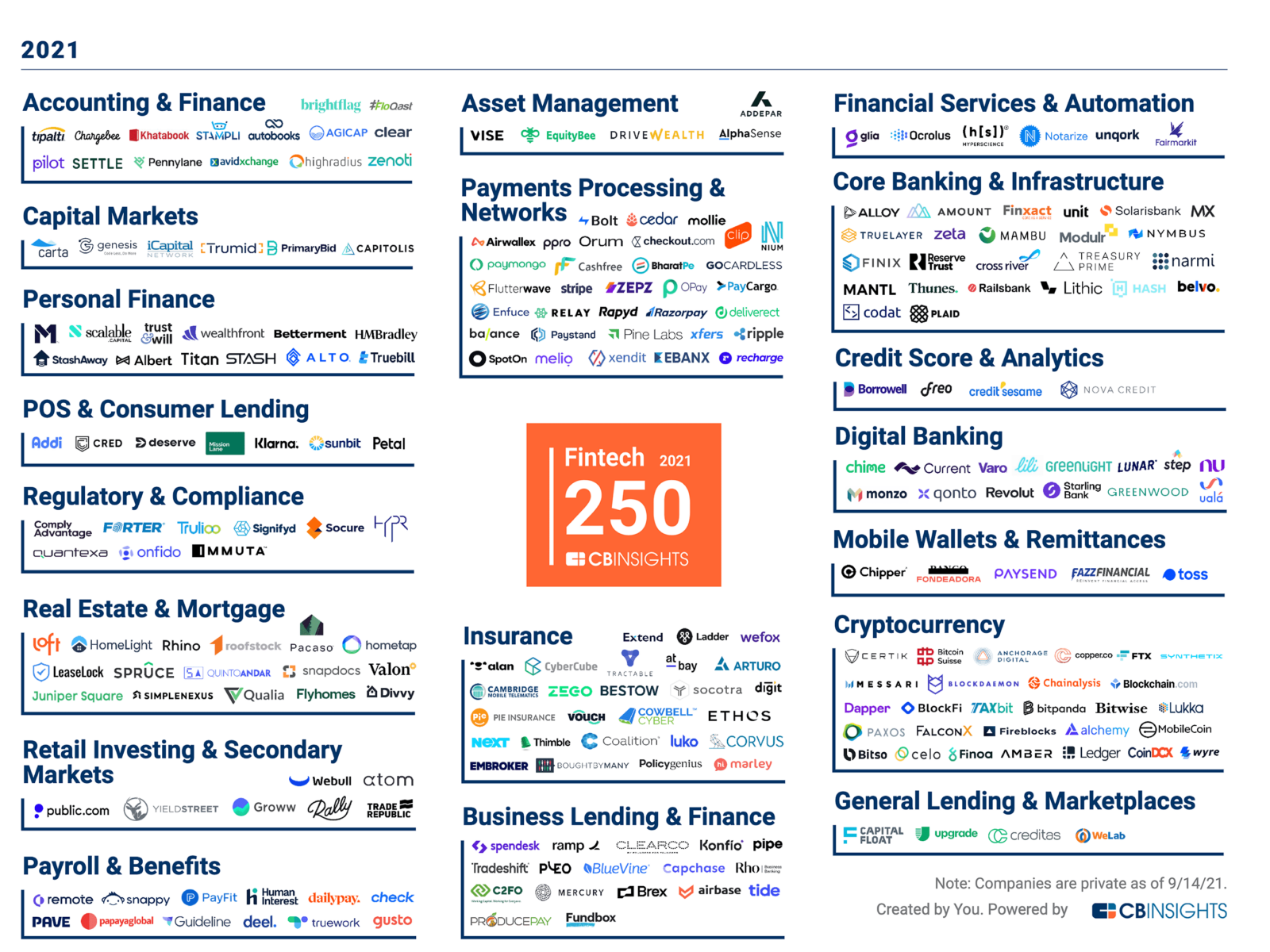

Source: CB Insights

I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And I will likely keep spilling 1,000 words at a time on the subject.

But not today.

Instead, see that graphic above. It is a deep dive into a shallow segment of the economy: VC-funded fintech start-ups.

I am intimately familiar with this space as Chair/CIO of RWM; I can tell you firsthand that the technology and tools we use in the office every day make us more efficient and more productive than we have ever been. These entrepreneurs are making the world of finance less expensive and more innovative. The pace of improvement is accelerating, limited by how quickly we can adopt the best technologies for doing our jobs for our clients.

And, it feels like it is Just. Getting. Started.

In 2009, former Fed Chair Paul Volcker lamented the lack of innovation in finance. He observed:

“The most important financial innovation that I have seen in the past 20 years is the automatic teller machine. That really helps people and prevents visits to the bank and is a real convenience. How many other innovations can you tell me that have been as important to the individual as the automatic teller machine?”

If that were true in 2009, it is no longer true today.

The reason the current price spikes are unlikely to persist beyond a few quarters is not just because they are driven by temporary phenomena, like supply chain disruptions or reopening demand surges. Rather, it is because they are up against all of the innovators and their companies.

Over the past 40 years, technology has been a regime-changer for inflation. Faster / Better / Cheaper has led to deeply deflationary outcomes.

If you believe the current bout of inflation is anything more than a mere blip, then you are on the other side of the trade from all of these entrepreneurs and innovators. You believe that the shipping snarls and port delays and chip shortages are more powerful than all of the brains and muscles and hard work of everyone in that group.

Now multiple that one group — FinTech– by 1,000 other sectors and industries. These are some of the most exciting and motivated people on the planet. Is that who you want to bet against?

I know which side of that trade I am taking…

Previously:

Productivity Is Offseting Wage Gains (November 9, 2021)

The Inflation Reset (June 1, 2021)

Did Covid Lockdown “Solve” Productivity Mystery? (December 9, 2020)

Productivity Puzzle Becomes More Complicated (November 2, 2016)