Clients reach out to us all the time with specific questions about, well, everything: Investing, markets, the economy, specific companies – pretty much whatever headlines might be causing that day’s confusion. We do our best to provide the necessary context to fully understand any of these concerns. This is why you see all of our blog posts, podcasts, media appearances, and books from the RWM team: We are trying to simplify the complicated and confusing world of investing.

Over the past few years, an increasing number of those questions have been about crypto: At first Bitcoin, then blockchain, then Ethereum, other coins, Web3.0, and now the metaverse.

The most asked question: “Should I invest in this?”

Our conservative response: “Feel free to put a couple of percent of your liquid assets into whatever coins or technology appeals to you. The caveat: If it works out, great, but if it does not, it should not meaningfully affect your standard of living.”

The frequent and surprising follow-up: “Great! Can you guys do this for us?”

Our answer over the past few years has been “No, we are sorry, but it is too difficult, too expensive, and too complicated for any RIA to intelligently manage this; the institutional grade technology just isn’t there yet.”

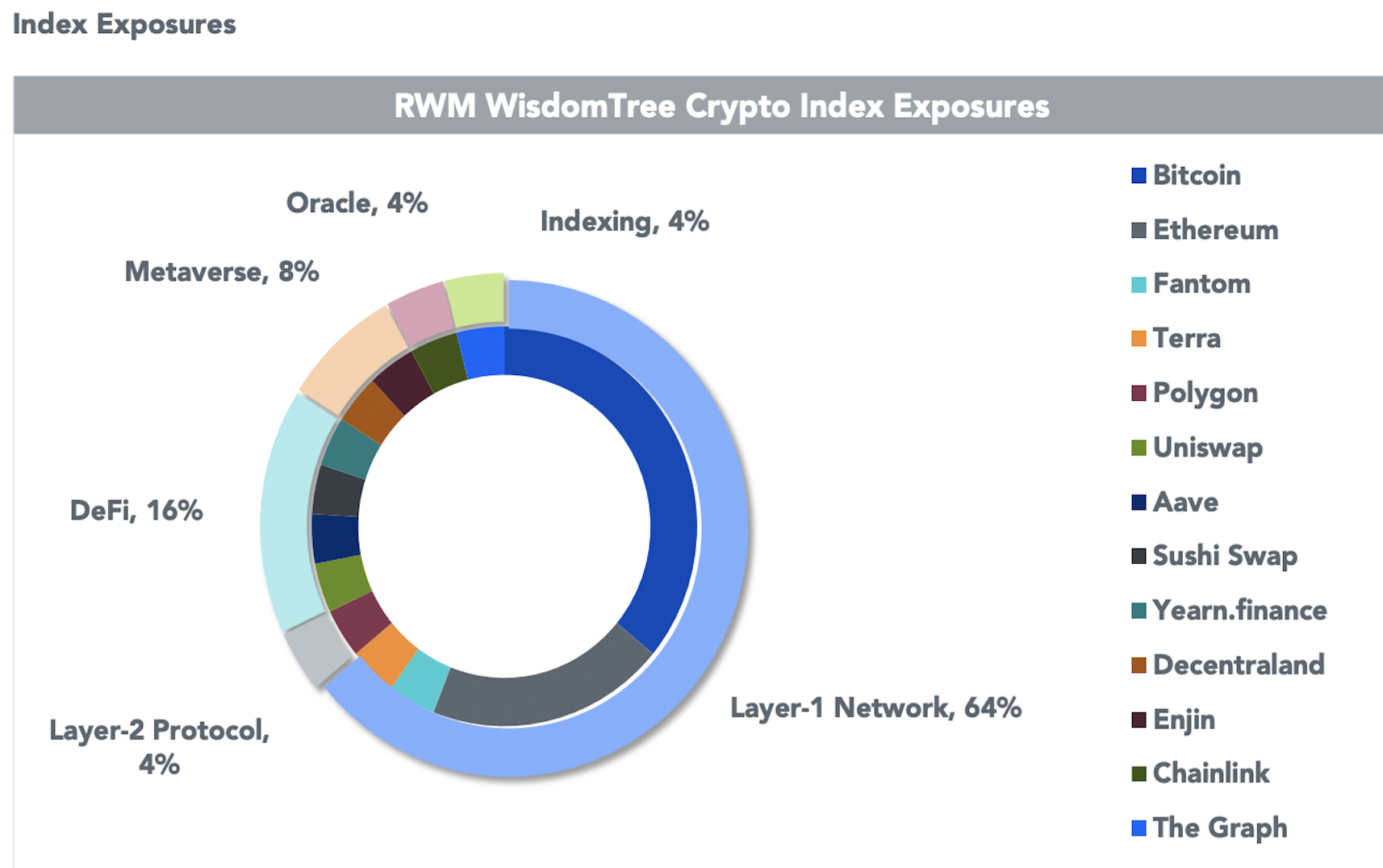

But as of today, our answer changes: “Sure! Speak to your advisor, it will take a few minutes to set up an account, you can purchase the RWM Wisdom Tree Crypto Index in a separately managed account (SMA). It’s a modified market cap-weighted index that consists of 36% Bitcoin, 20% Ethereum, and 4% of each of 11 other assets that provide broad crypto exposure. We will handle everything else for you.”

~~~

There is a much longer and more interesting story behind this:

Michael Batnick is head of research at RWM. He seeks out interesting ideas on behalf of RWM clients. As the crypto question kept coming up more often, Michael undertook a deep dive into the entire crypto complex to see what was available for advisors.

What he learned was a surprise to all of us:

First, there was no easy, inexpensive RIA-specific diversified crypto solution available.

Second, given our general preference for an indexing approach over stock picking or coin selection, we were stymied by the lack of choice for RIAs. There were not many good options: From the clients’ point of view, Wallets were a non-starter.

Third, what we did see was a DIY nightmare. One company managed your wallet, a different one did the trading, a different one was responsible for giving you regular updates. It was neither simple nor inexpensive for busy clients who were running their own businesses nor had time-consuming jobs.

“Find a simple, inexpensive, secure solution” became the driver here, and I believe we have accomplished just that. The solution that Batnick created had three key requirements:

- Safe, secure, and reliable for financial advisors and their clients. If this did not happen, the entire project was a non-starter.

- Simple, no more complex than opening an RIA account; easy to do, easy to execute a purchase (or sale); easy to add more money to the account.

- Index-based: meaning, inexpensive, with low turnover and no coin selection required by the investor to complicate things.

To make this happen, we partnered with three firms with demonstrated domain expertise:

• Wisdom Tree has been a leader in Indexing for decades. We have always admired their leadership and expertise. The firm has committed itself towards crypto, and their CEO recently explained why I am all in on DeFi.

• Gemini is our custody infrastructure and crypto-native exchange partner. The Winklevoss (founders of Gemini) have built a best-in-class exchange that is both secure and compliant for wealth managers who want to offer crypto investments to their clients.

• OnRamp offers a comprehensive integration platform for crypto assets. They make all of the many moving parts here come together easily and seamlessly. They are the technology layer that makes all of this work (We were seed investors in OnRamp, as was Wisdom Tree).

No single company we looked at had expertise in all of these things, and putting together a consortium to get this done was the best route to make something worthwhile occur. I believe the results validate this approach.

~~~

Over the years, I have called Batnick one of our “secret weapons;” he is the chief architect of this project, the person who let nothing stop this from going forward. Between his blog, book, and podcast, I guess it’s time for me to stop calling him that — the secret is out…

See also:

The RWM Wisdom Tree Index

Sign up to be informed about the Index

The Gang Launches a Crypto Index

Ritholtz Wealth Management and WisdomTree Collaborate to Launch Innovative and Diversified Crypto Index (Press release)

Smart Tickets: Creators Capturing Secondary Market Sales (April 7, 2021)