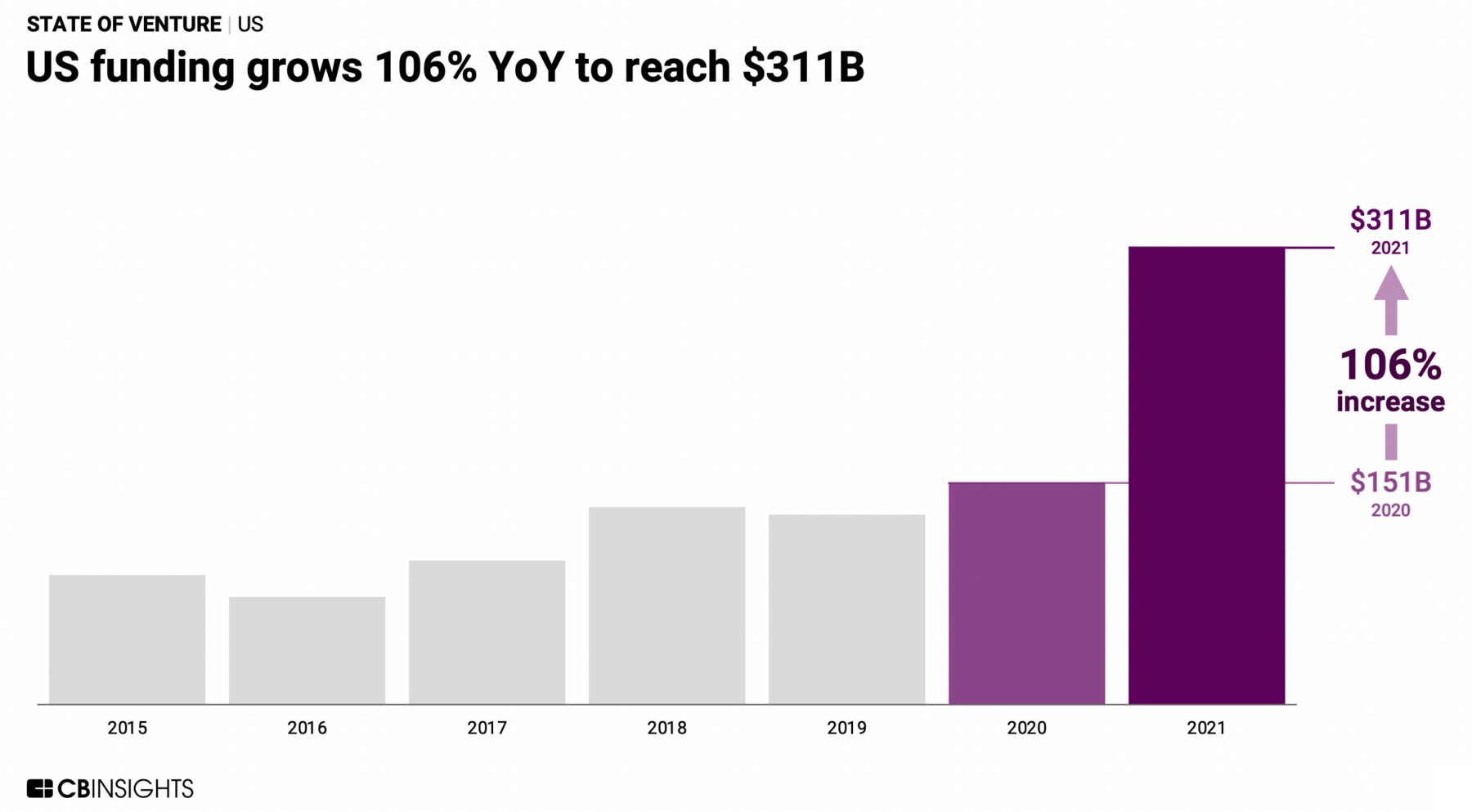

I have noted that it seemed like VC money was everywhere, and now we have the data to confirm that. According to CBI’s State Of Venture 2021 Report, global venture funding was up 111% in 2021 hitting $620.8B. As the chart above shows, the US accounted for more than half of that, growing 107% in 2021 to reach $311.2B in investments.

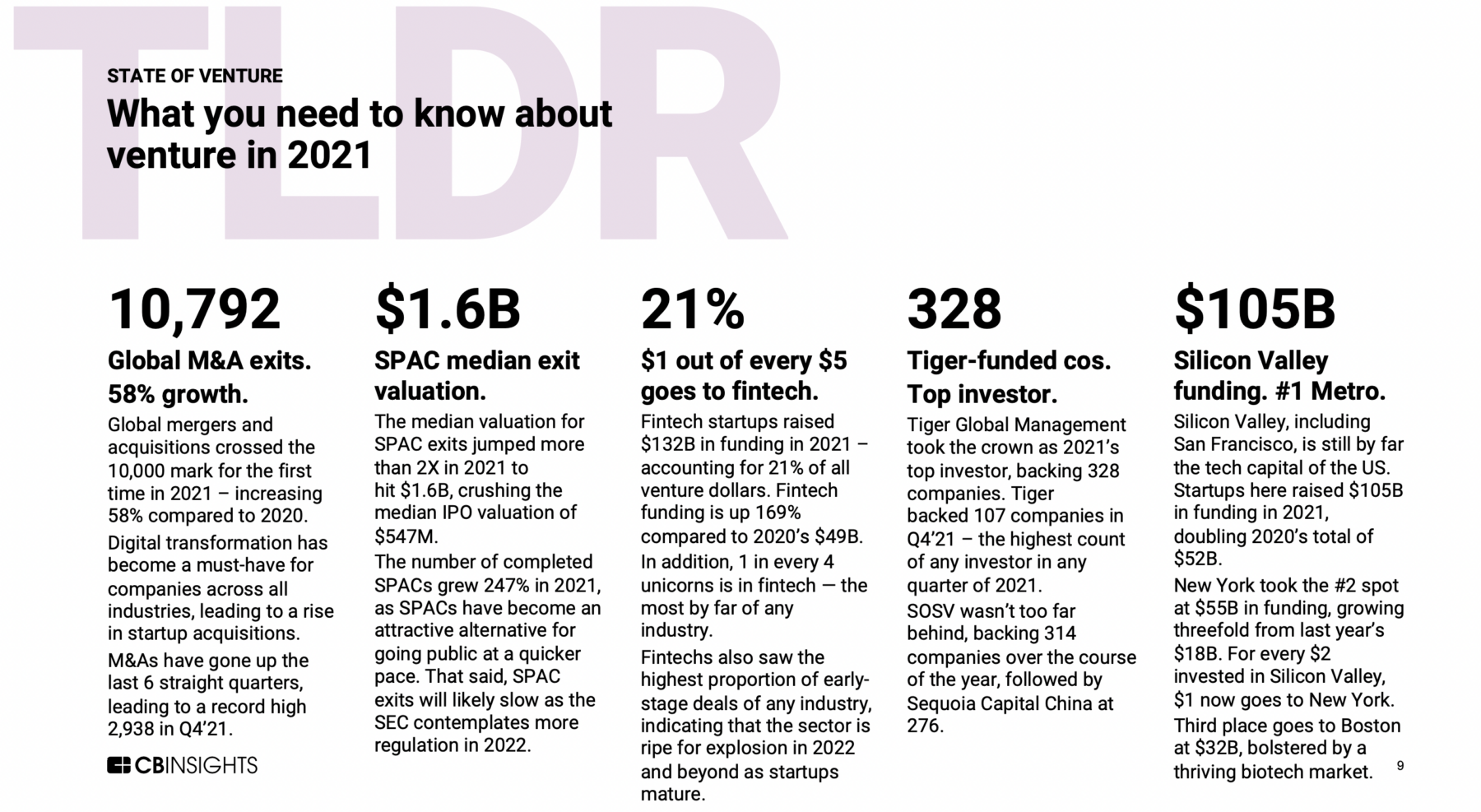

We looked at fintech companies in Faster / Better / Cheaper, and as it turns out, that sector accounted for the largest amount of those VC dollars globally at $132B, or 21% of total venture funding. (This is an all-time high).

Not surprisingly, Silicon Valley led the US in VC funding in 2021, with more than $100B invested (Q4’21 was a record $29.3B); New York was 2nd at $65 billion, followed by Boston ($31B), L.A. ($24B), Seattle (~$7B), D.C. (~$5B), and Denver (~$5B). The U.S. led in global exits in 2021, followed by Europe and Asia.

If you are interested in these sorts of things, the rest of the deck is worth checking out . . .

Source:

State Of Venture 2021 Report

Chris Bendtsen

CB Insights January 12, 2022

https://bit.ly/3npfVtg

Previously:

Faster / Better / Cheaper (November 11, 2021)

Venture Capital Money Everywhere (September 15, 2021)