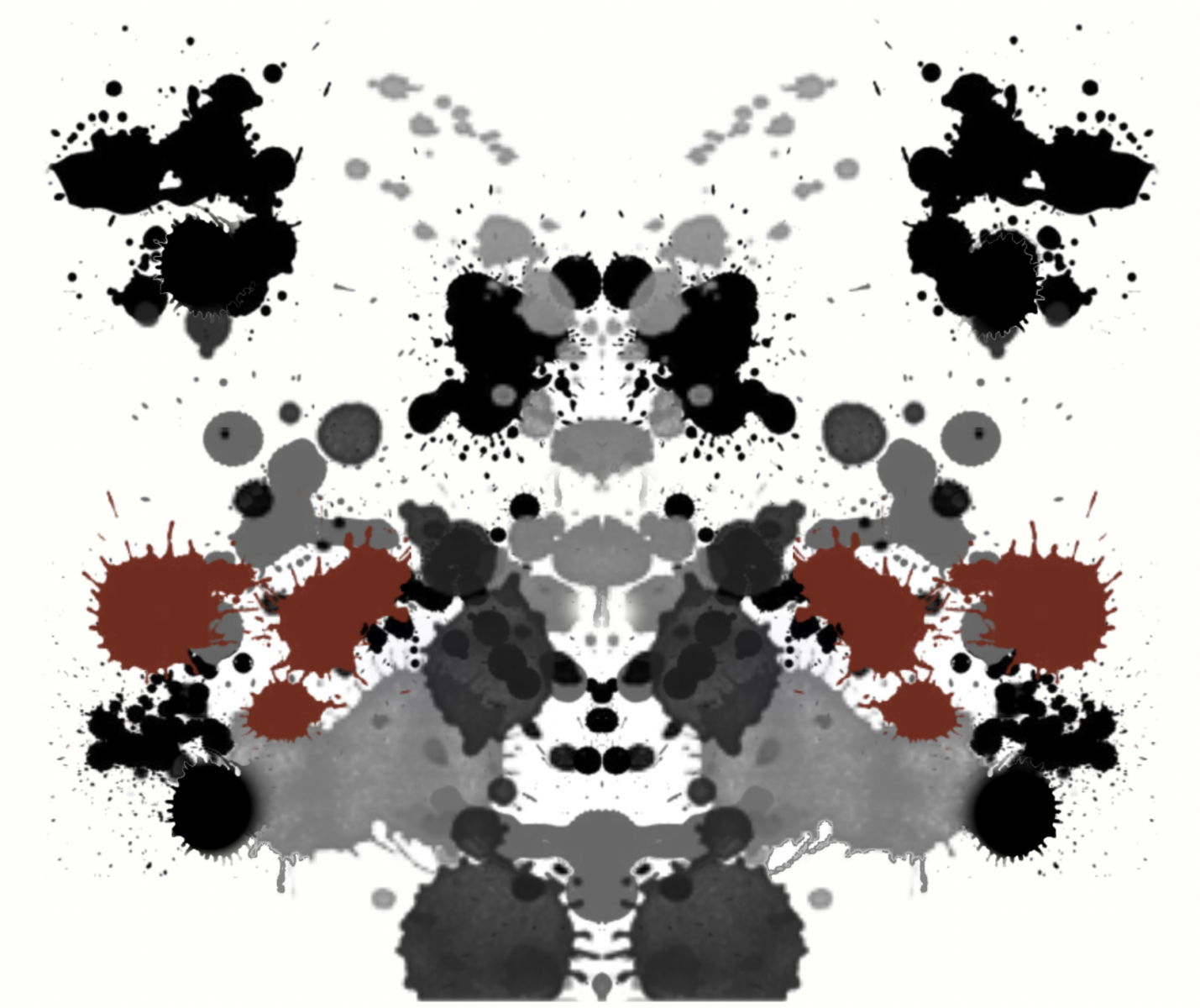

Intraday reversals like the one we witnessed yesterday, January 24 — down 4% before recovering to close up 1% — or its near mirror image last Wednesday, January 19 — up a few percent before reversing to close down a few percent — are always interesting from a behavioral perspective. The bi-polar nature of the market creates a confusing tableau; a blank canvas upon which we can project our own hopes and fears. All of our favorite behavioral foibles are out and on display, as market excitement leads us to do exactly what evolution has primed us to do for so long.

While you may or may not have experienced your own version of the Fight or Flight response, you certainly were witness to a number of emotional behaviors that are pre-programmed1 into our wetware. Here are a few most of us personally fought against yesterday:

Confirmation Bias: Around the same time that Kahenmann met Tversky, Simon met Garfunkle. They were in very different fields yet explored similar ideas: In The Boxer, the latter sang “Still, a man hears what he wants to hear And disregards the rest.“2 Chaotic, confusing market action is the perfect setting for our natural tendency to find evidence that confirms our pre-existing beliefs and expectations. Worse yet, we fail to seek “Disconfirming” evidence, and thereby miss the chance to avoid major errors.

Narrative Fallacy: Just after yesterday’s close I referenced the undue influence of storytelling as witnessed through television chyrons. We may laud Burton Malkiel’s thinking yet we hate to believe that much of what is happening is random. Thus, we find comfort in crafting narratives, with heroes and villains and tales of good versus evil, to explain the goings on in the world. These here’s journeys are more tolerable than the alternative: a random and indifferent universe. Narratives bring apparent order to chaos, create rationality where there is none, but allow us to function despite existential dread. (My own pet theory is that EVERYTHING is narrative, but that is another discussion).

Action Bias: We have a tendency to prefer to do something in the face of uncertainty or confusion, even when the overwhelming evidence suggests our actions on average tends to cause harm, and inaction is a more effective course. “First, do no harm,” said Hippocrates, except in finance, where he is both correct and widely ignored. This likely relates to the “Illusion of control,” that doing something, anything!, allows us to hold fast to our false beliefs that we are somehow in charge of our destinies.3 (Narrator: He was not).

Note I am not referring to a preplanned rebalance (When X occurs, then do Y) but rather, the tendency towards activity for activity’s sake.

Uncertainty Principle: My own pet concept which states that as markets (or war, politics, etc.) become increasingly challenging, we lose the ability to delude ourselves that we understand what is occurring presently or that we can predict what is likely to happen later. Hence, what we usually think of as “Uncertainty” is more akin philosophically to a moment of clarity. Once we can no longer lie to ourselves, we realize how little we actually understand, to our own great discomfit. This is both humbling, and on occasion, terrifying.

Our best hope for our portfolios (and our mental health) to survive these cognitive errors and behavioral biases is that we at least become self-aware about them. Perhaps with a little enlightenment and luck, we avoid the worst impacts these have on our long-term investment returns.

Previously:

Rorschach-Test Economics (October 30, 2019)

Lose the News (June 16, 2005)

“Unprecedented” Uncertainty (June 9, 2020)

Corrections, Retracements, Crashes & Dips (November 29, 2021)

Living Through a Crash (January 14, 2022)

What is the Market Up To? (January 24, 2022)

______

Images courtesy of Rorschach.org

1. For accuracy’s sake, I am trying to stop using the phrase “hard-wired” when I refer to the results of evolution and natural selection. Even “pre-programmed” is not as precise as I would prefer, but it seems less inaccurate than hard-wired.

2. The former duo would eventually explore write similar themes and issues, writing about bias and heuristics, and leading to the creation of the field of Behavioral Economics.

3. I would love to find out who is the original author said: “Just don’t do something, sit there!” The earliest reference I found was 1963 Jerry Lewis movie, The Nutty Professor.