The past week, I have been looking at some of the more interesting and unusual market charts. I started doing the same for a few of my favorite economic data series: NFP, Quits Rate, Wages, Housing Prices, Business Formation, Inflation, Retail Sales, Car sales, etc.

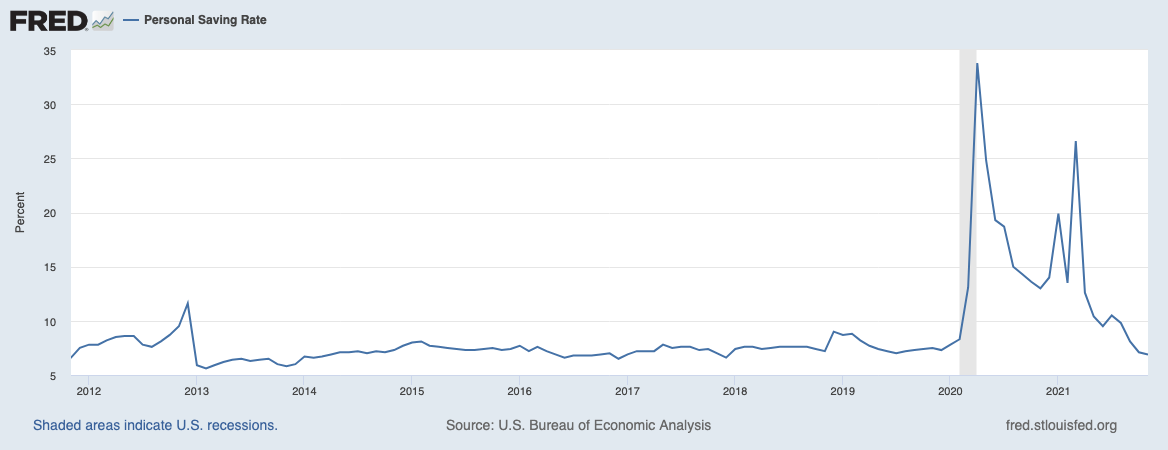

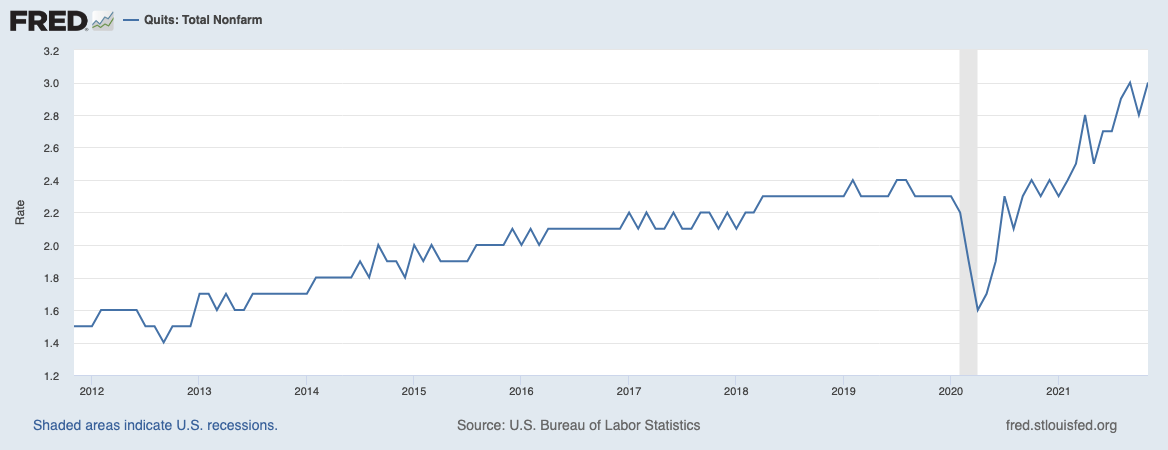

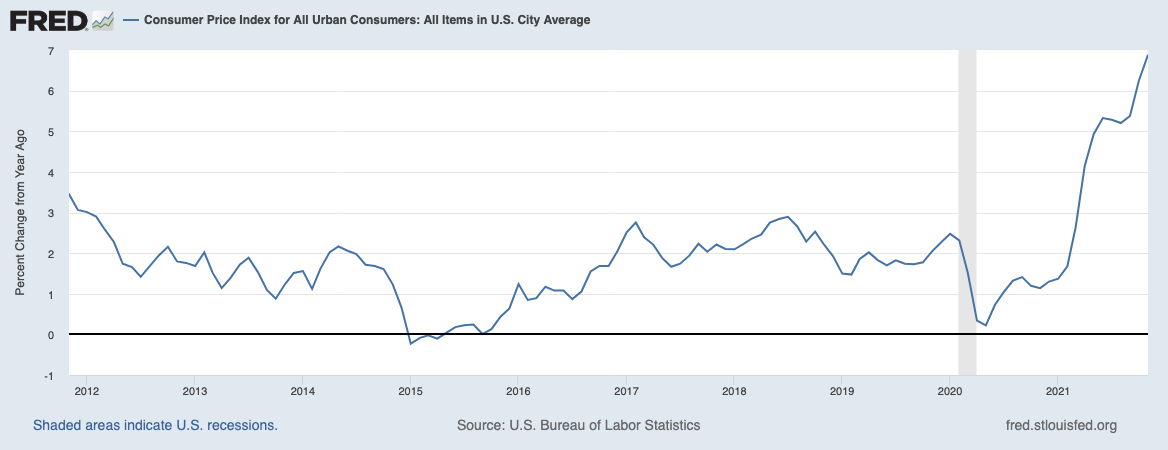

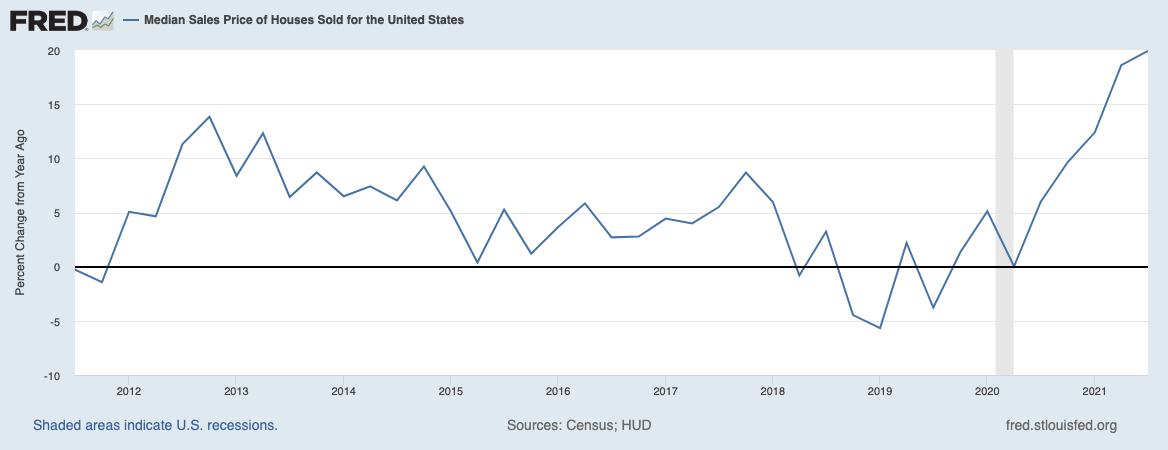

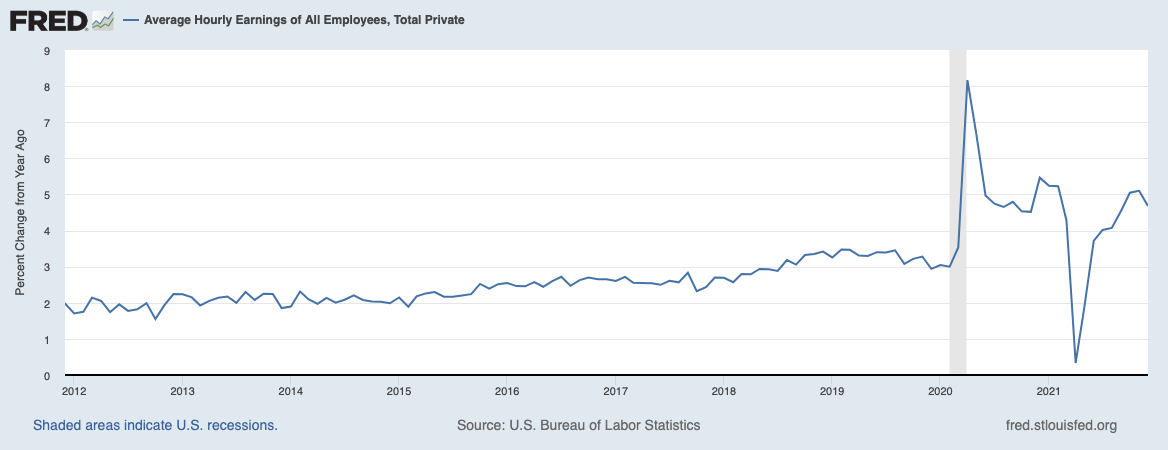

Pick any economic chart of your choosing; the simple truth is that nothing is “normal.” And by normal, I mean a traditional run-of-the-mill recession and recovery cycle. Everything today is aberrant and excessive, fast/strong/deep/record-breaking . . . Unprecedented.

This is no great insight — it is wildly obvious.

It began with the externality of the pandemic, followed by a massive fiscal stimulus to accompany the ongoing monetary stimulus. And yet, it hardly warrants the appropriate mention it deserves in the financial news media and economist community. These are massive, enormous, unusual inputs, and we have simply become accustomed to them.

I have been writing about these topics for (literally) decades. I try to bring some fresh insights into any thoughts I spill about the economy. Sometimes I discuss the flaws in the data assembly process, or why the recency effect means we should not get too excited about the latest news release. Most economic data is merely a continuation of prior trends and therefore not all that important.

But as I run through all of my market and economic charts, I am continually reminded just how abnormal this economic cycle is.

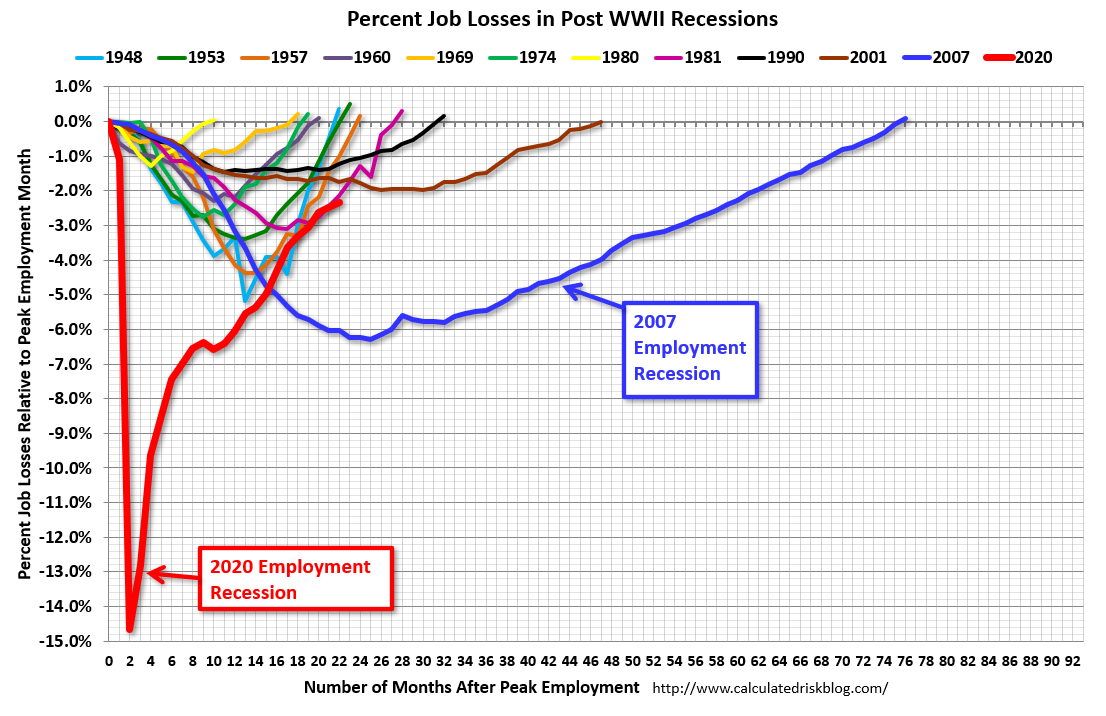

Look at the red line on the employment chart (top): We had the fastest, deepest payrolls collapse in the post-war period, followed by the strongest ever recovery.

¯\_(ツ)_/¯

Whatever part of the economy you want to review, you will be hard-pressed to find a data series that looks remotely normal:

What about Retail Sales?

I’ll stop there, but rest assured I could bore you with endless charts all demonstrating just how aberrant a period we are living in.

The economy is not in a “New Normal,” but rather is in a “Post-Normal” state.

What is the purpose of reminding you of something so obvious and well understood by everybody?

Spend a few hours watching FinTV or reading financial media. You might wonder where these pundits’ self-confidence comes from. How can they so self-assuredly discuss not only what is happening today, but then so very comfortably explain what comes next?

Pardon my skepticism, but I have a sneaking suspicion the pundits haven’t the slightest idea as to what is going to happen. Not about the markets or inflation or elections or pretty much anything else that will occur between today and when the ball drops again on New Year’s Eve.

I understand the game, the “fake it til you make it” aspect to all this bravado. But that does not mean I have to like it, or not remind you that much of what you hear is unadulterated bullshit (and I mean that in the technical, professor Frankfurt version of the word).

The bottom line is that consumers of financial media need to constantly remind ourselves as to what we actually know, and what is unknowable. If we do at least that we have a fighting chance to understand what is occurring around us. Or at least, not screw it up so badly as to hurt our own economic prospects and our portfolios . . .

Previously:

Nobody Knows Nuthin’ (May 5, 2016)

How Externalities Affect Systems (August 14, 2020)

“Unprecedented” Is 2020 Word of the Year (December 6, 2020)

There’s nothing new about uncertainty (July 14, 2012)

Kiss Your Assets Goodbye When Certainty Reigns (November 9, 2010)