We began this week looking at a broad question: “What is of greater import to investors, reopening post-pandemic, or war in Eastern Europe?” The next day, Vladimir Putin invaded Ukraine. When the US markets opened Thursday, they gapped down nearly 3% amidst 24/7 media coverage. It was reminiscent of the post-September 11th or the pre-2003 Iraq invasion. The danger today is the “uncertainty” over whether this spills into Eastern Europe, drawing NATO forces into a shooting war with Russia.

After 9/11, I found researching the market impact of geopolitics was a good way for me to cope with that attack.1

The exercise was a useful distraction: focus on the data while trying to compartmentalize the emotional aspects of that event. Working from the Pearl Harbor attack forward, and focusing on market data, we learn the overall impact on stocks and bonds is actually de minimus. There are in all but the most horrific2 instances (e.g., world wars) only a modest impact on corporate revenues and earnings. Those business measures are what drives markets over the long run. Over short time periods, however, markets do tend to react as events lead investors to suffer emotional spasms. And so markets stumble, they wobble a bit, before returning to their prior trends.

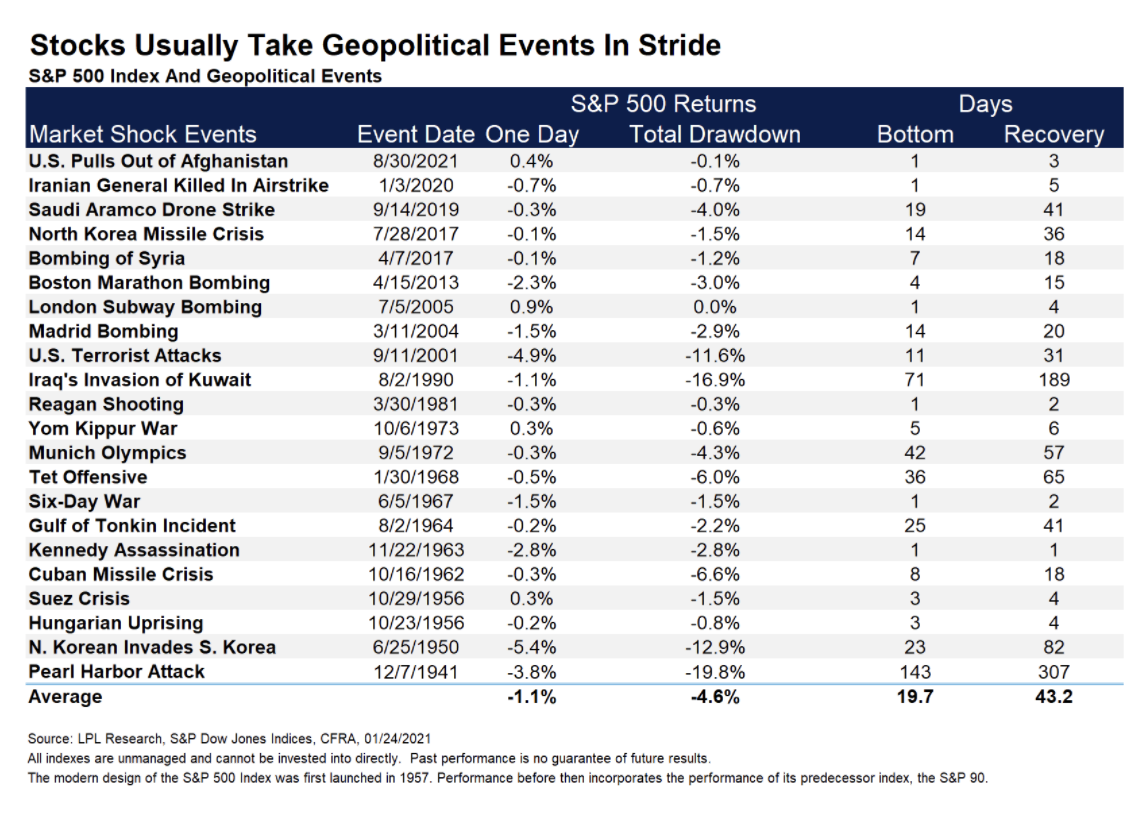

Consider the table nearby: On average, the impact of these events is a one-day loss of about 1.1%. The total drawdown from geopolitical events averages -4.8%; and it takes about 19.7 days to bottom and 43.2 days to recover.3

Consider the table nearby: On average, the impact of these events is a one-day loss of about 1.1%. The total drawdown from geopolitical events averages -4.8%; and it takes about 19.7 days to bottom and 43.2 days to recover.3

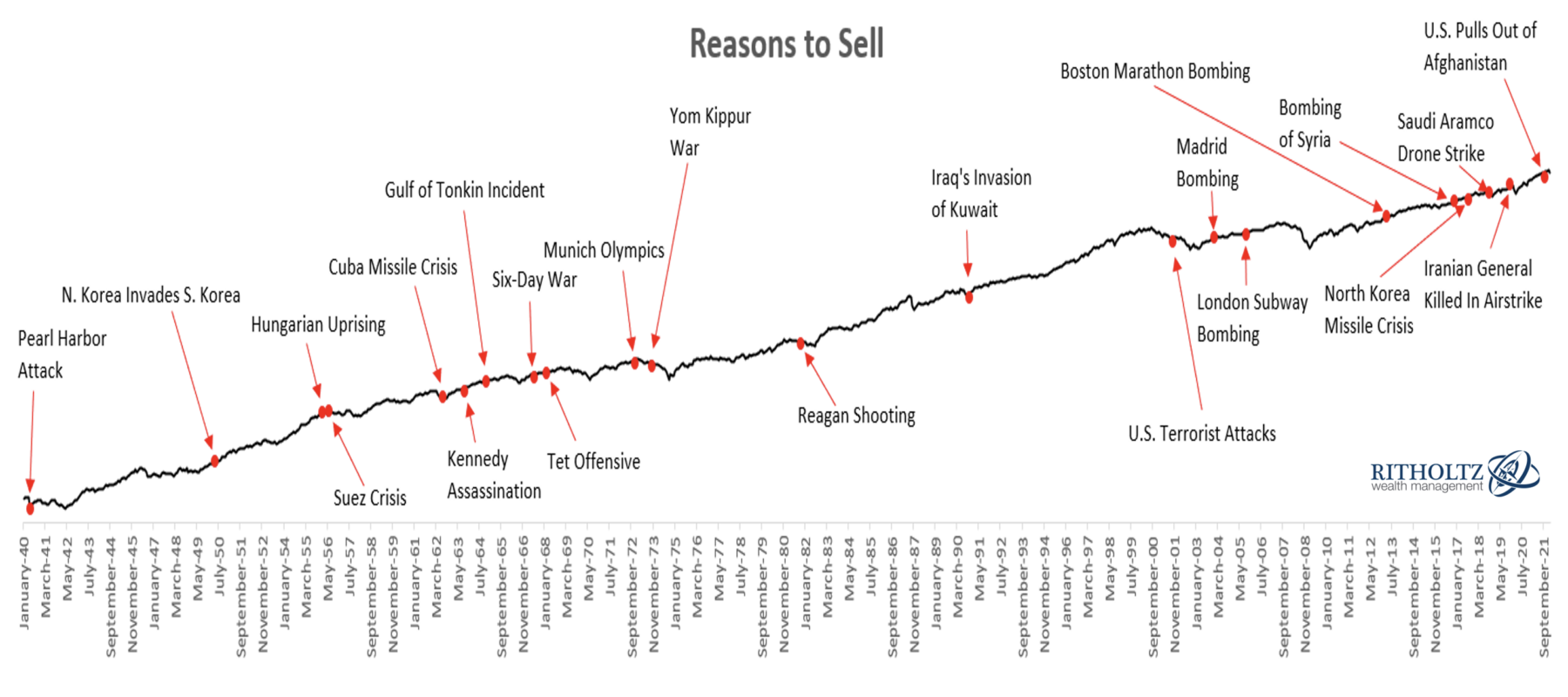

Those numbers may seem a bit abstract, lacking in emotional resonance and immediacy. To create something more resonant, I applied those to Batnick’s framework of “Reasons to sell.”

The result is the instructive chart you see above. Most of the time, markets are hardly affected by these sorts of terrible events. Even the US entry into World War 2 after the Pearl Harbor attack took a little more than one year to recover. The worst war in human history and markets were higher in 307 days (it did take 143 days to bottom).

The lesson here is to never bet against human ingenuity, creativity, or progress. In the face of horrific existential threats, while the headlines are terrible, gradual improvements are always taking place beneath the surface. Morgan Housel likes to say that “Progress happens too slowly for people to notice, while setbacks happen too fast for people to ignore.”

To get to those long-term returns, you must survive the short-term. It’s not always easy amidst all of the noise, but the data can help you navigate the path more objectively.

Previously:

Living Through a Crash (January 14, 2022)

A Personal Recollection From a Day of Horror (September 12, 2001)

See also:

Looking to the Past for Guidance (TheStreet.com, 09/15/2001)

Five Lessons from History (Morgan Housel, May 29, 2019)

There Are Always Reasons to Sell (The Irrelevant Investor, June 10, 2020)

Talk less, read more (Reformed Broker, February 23, 2022)

_____

1. My office was headquartered in Two World Trade; I was in the Long Island office on September 11th.

2. These events exact a terrible human toll. But the point of the exercise was to separate yourself from your emotions and instead focus on the data.

3. That February 24, 2022 gap down to -3% was eventually met with a powerful intra-day reversal; markets closed up a percent or more, and the Nasdaq had a ~6% swing.