The Nonfarm payroll report today showed strength in hiring, modest wage increases, and a substantial decrease in unemployment. Employment rose by 678,000 in February, the unemployment rate fell to 3.8%, wages rose 1 cent to $31.58 per hour; its risen 5.1% over the past 12 months.

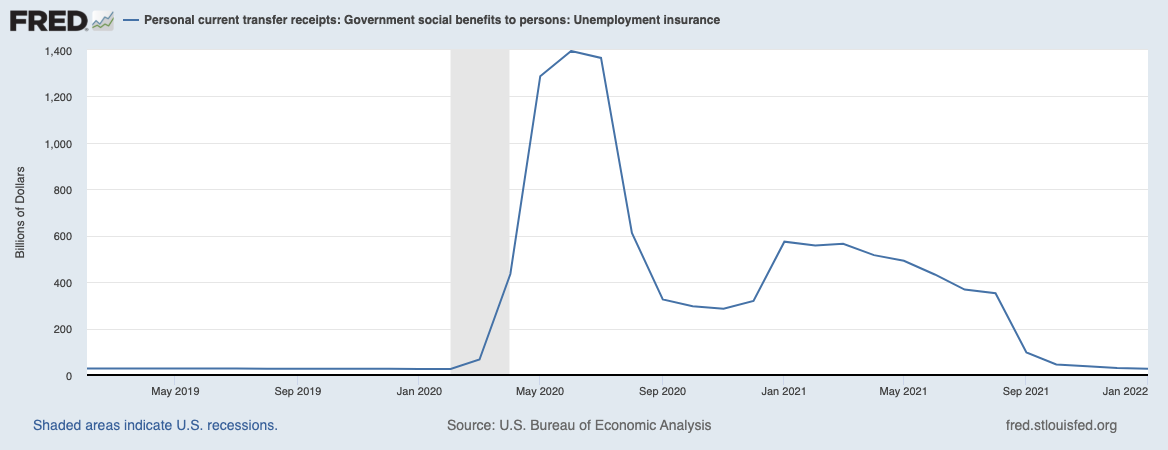

Of all the many perplexing aspects of the stimulus-assisted, post-pandemic, recovery, the one that seems to give economists the most difficulty is the labor market. There are many reasons for this which we will address in a future post; today, I want to direct your attention to a specific data point: Unemployment Insurance payments.

Unemployment levels hit a peak in April 2020 at 14.7%; today it is down to 3.8%. If you missed the peak 2020 dollar figures after that U3 peak, brace yourself: When unemployment benefits were at their peak in June 2020, the government paid $1.395 trillion dollars to the unemployed. Since then, those unemployment payments have dropped about 98% to a mere $26.7 billion. At the June 2020 peak, those government transfers had risen 4,903% from the year prior.

Those are astonishing numbers, a one-off fiscal stimulus of the first CARES Act courtesy of a panicked Congress.

To understand the complexities of the labor market, you need to comprehend where those nearly trillion and a half dollars went: from Uncle Sam to Mom & Pop to local stores and supermarkets and Walmart, Amazon, Target, and other necessities. But it also went to Netflix and Peleton, to online education and learning, to lots of services but to even more goods. The current transitory inflation is also due in some part to this trillion-dollar fiscal stimulus.

If we do a compare & contrast between the responses of the GFC and the pandemic, we see the impact of a fiscal stimulus versus that of a monetary one. The response to the pandemic is a reminder: Beyond the benefit, both kinds of government reactions to crises bring to all of society — and there are many — it is painfully obvious that monetary stimulus benefits the well off asset owners while fiscal stimulus benefits the bottom 50% of the country, primarily low-wage labor, the unemployed, and the middle class.

Have we been discussing the impact of this massive wealth transfer on society enough? A few people have: Claudia Sahm wants to make a more modest version of this automatic during recessions; Stephanie Kelton wants to bring the same sort of fiscal stimulus into the mainstream to tackle other issues.

I expect the discussion on fiscal stimulus and labor markets over the next few years to be quite fascinating . . .

Previously:

Transitory Is Taking Longer than Expected (February 10, 2022)

Finding it Hard to Hire? Try Raising Your Wages (May 6, 2021)

The Inflation Reset (June 1, 2021)

Wages are Table Stakes (June 10, 2021)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)