My end of week morning train WFH reads:

• Stock Pickers Watched the S&P 500 Pass Them by Again in 2021 More U.S. large-cap stock-picking mutual funds lagged behind the benchmark than in any year since 2014 (Wall Street Journal)

• Russia’s billionaires: Who they are, what they own — and can they influence Vladimir Putin? Targeting oligarchs is popular. It’s not clear it can help end a war. (Grid) see also How Putin’s Oligarchs Bought London: From banking to boarding schools, the British establishment has long been at their service, discretion guaranteed. (New Yorker)

• How to Prepare For a Recession So we could go into a recession this year or next year or four years from now. I honestly have no idea. All I know is we will have a recession at some point. Since World War II, we’ve had 13 recessions in the United States: This means that over the past 80 years or so, a recession has occurred once every 5.9 years on average. (Wealth of Common Sense)

• Michael Mauboussin Is Unshaken: The head of Consilient Research at Morgan Stanley explains the power of narratives, his approach to fundamental analysis, his faith in markets and multidisciplinary thinking, and what moved him to write his latest book. (RIA Intel)

• Inflation Isn’t Going Back to Normal This Year; So says the Federal Reserve. Our central bankers aren’t ready to do just anything to bring inflation down. They aren’t mentally gearing up to do their best impression of Paul Volcker, the Fed chair who plunged the U.S. into a painful double-dip recession in order to finally slay inflation early in Ronald Reagan’s presidency. Instead, they’re willing to tolerate moderate inflation for a while longer, with the hope that they can gently ease the economy toward a soft landing by the end of this year and beginning of next. (Slate)

• Many Introverts Dread the Office Return. Some Also Can’t Wait. Two years of remote work helped many self-described introverts realize what they liked and loathed about office social life—and what they plan to change. (Wall Street Journal) see also Covid-19 Taught Americans How to Let Go of Their Steady Paychecks Many decided they could make a living without being on someone else’s payroll. Some say the path has been rewarding but challenging. (Wall Street Journal)

• Against De-Materialization: Tom Wolfe in the Age of NFTs The idea that a blockchain inscription by a complete unknown could be worth so much money caused widespread cognitive dissonance. Within a week, the term “NFT” leapt from the esoteric realm of specialist discourse straight into the mainstream. As if in reference to Beeple’s title, NFTs became the stuff of everyday. Responses ranged from celebration to lamentation. Digital-art partisans hailed the sale as finally leveling the financial score with painting, sculpture, video, and installation. (Quillette)

• What Happened at the Stables? Elite equestrians are fighting a government nonprofit set up to tackle the long-standing problem of sexual abuse in U.S. Olympic sports. As prominent equestrians are banned for sexual abuse and even arrested, some traditionalists are taking aim at the Olympic watchdog created to protect young athletes. (Businessweek)

• My Father, the Fool: I’d run out of sympathy for COVID skeptics. Then I remembered my father’s stiff neck. A story about tribes, and empathy and why we need to better to each other despite the terrible things we all do. (The Atlantic)

• Michael Bublé Always Finds a Way Hustle, charm and a remarkable ability to slot himself into songs have made the musician a star — even though his style has never aligned with pop trends. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Darren Palmer, General Manager of Battery EVs at Ford. He has overseen the development and rollout of Ford’s Mustang Mach E, F150 Lightning, and the E-Transit van. The 30 year Ford veteran is part of their Team Edison skunkworks group and is overseeing Ford’s $50B shift to electrification, and will be driving the split into two firms, EV, and legacy business.

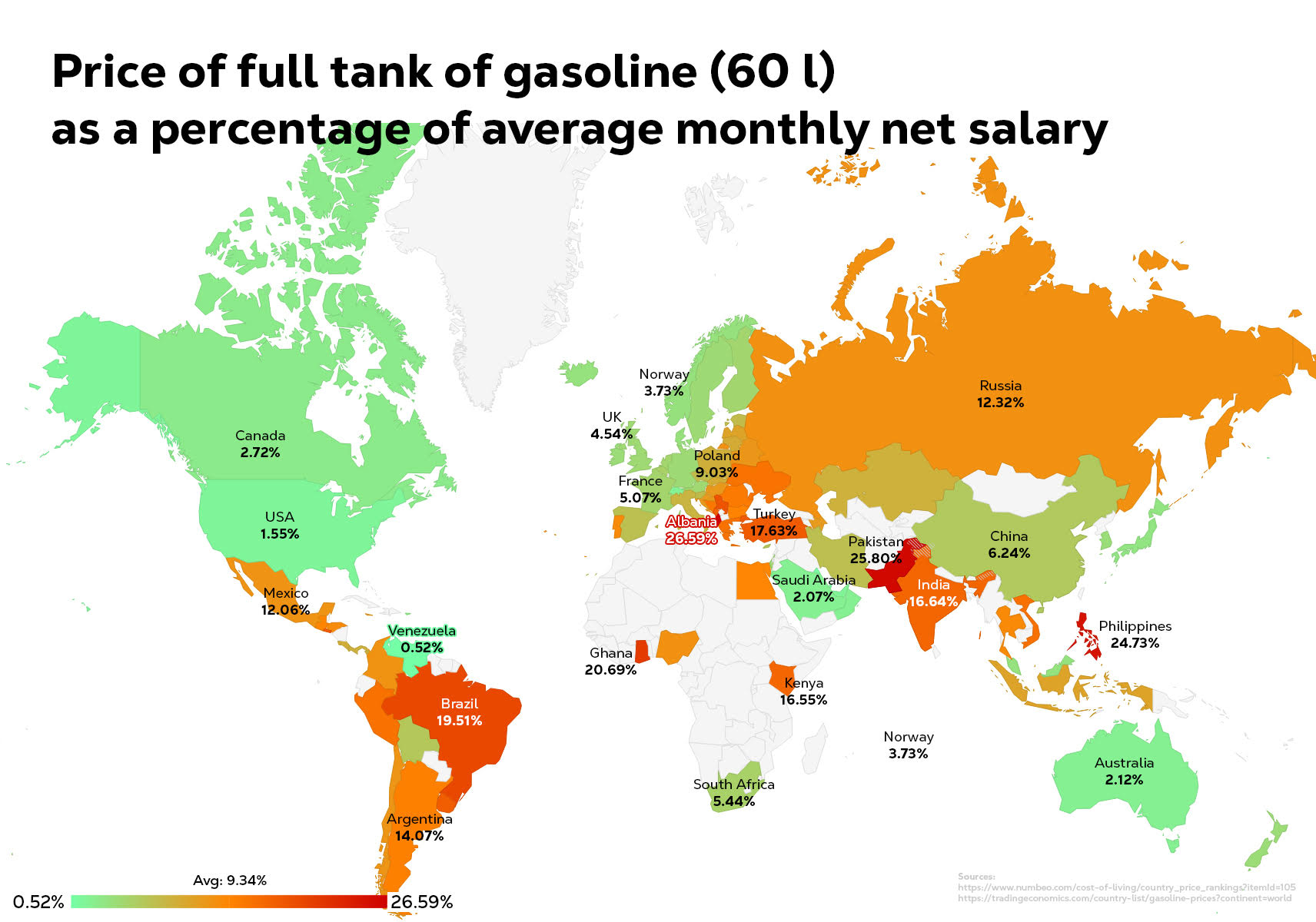

Price of full tank of gasoline (60 l) as a percentage of average monthly net salary across the world

Source: Reddit

Sign up for our reads-only mailing list here.